At one time, the New Business Rule generally prevented an injured party from obtaining a damages award for lost profits due to the opposing party if the injured party was a newly established business (R. Dunn, Recovery of Damages for Lost Profits, 3d ed.,1987). Absent a history of past profits, future profits seemed too “uncertain and speculative,” particularly in the progress-oriented atmosphere of the late 1800s when rules defining damages first developed (Hickman v. Coshocton Real Estate Co., 58 Ohio App. 38 (Ohio ct. App. 1936)). In addition to their desire to limit excessive damages, courts often distrusted jurors with the discretion necessary to evaluate the reasonableness of future profit estimates (B. Bollas, New Business Rule and the Denial of Lost Profits, 48 Ohio State L.J. (1987)).

Changing attitudes towards jurors, a consensus focused on the inherent injustice to new businesses, and recognition of the economically nonoptimal allocation of resources that the New Business Rule encouraged may have all played a role in the shift in the interpretation of the rule away from a finding of law to a finding of fact, as pointed out by Bollas in the Ohio State Law Journal, and by Everett Gee Warner and Mark Adam Nelson in “Recovering Lost Profits,” 39 Mercer L. Rev. (1988). In most cases, says Michael L. Roberts in his article, “Recovery for the New or Unestablished Business” (The Alabama Law. (Mar. 1987)), the emphasis focuses on the fact that profits were lost, not on an absolute measure of those profits. As a result, calculation of lost profits need no longer conform to “absolute certainty” requirements; the “reasonable certainty” standard as applied to existing businesses with a history of profits has been applied to new enterprises as well (Michael G. Stewart, The Evolution of the New Business Rule, 17 Cumberland L. Rev. (1986)). However, as evidenced in Schonfel v. Hilliard, 62F. Supp. 2d 1062 (S.D.N.Y 1999) and Tipton v. Mill Creek Gravel, Inc., 373 F.3d 913 (2004) courts still give lost-profits claims heightened scrutiny when the party has no financial history. Clearly, when a business can show a history of profitability, both in the long-term and recent past, this profitability can often be reasonably projected into the future (with all other variables held constant). Additionally, if the contractual agreement between two parties makes mention of expected profits, quantification of those profits lost in the event of a breach proceeds without difficulty.

When faced with quantifying lost profits for new businesses with little or no history of earnings prior to the breach, quantification of lost profits becomes more of a challenge. Fortunately, the widespread application of the “reasonable certainty” standard allows several methods of quantifying damages without the requirement of complete and absolute certainty as to amount. The specific approach taken depends upon the operational effect the breach has upon the new business. An enterprise that fails because of the breach necessitates slightly different analysis than does one which continues operations at a reduced or at a level capacity. Regardless of the approach taken, however, an overriding concern focuses on the individuality of the case.

1. Business Enterprise Continues

If the business enterprise survives the breach, post-breach income figures, either for the injured party or for another who continues the enterprise at the same location, may be used to approximate profits lost due to the breach.

Post-Breach Profits, Injured Party

In some cases, the harmed business may be able to resume business along the same growth curve as existed prior to the breach. Although no permanent harm has occurred, the business has experienced a shortfall in income from the time of breach until production returns to normal. Profits will always lag as a result of the breach.

Notice that this method does not rely upon profitability at the time of breach. Rather, it focuses on the timing of profits. In limited circumstances, it may be possible to utilize post-breach income numbers as a proxy for expected income during the shortfall period. Additionally, use of this method depends heavily upon the continuation of existing market and production factors after the breach.

McDermott v. Middle East Carpet Co. Associated, 811 F.2d 1422, (11th cir.1987) (MECCA) applied this concept in determining a damage award for lost profits. Plaintiffs McDermott and his corporation Criterion Mills served as co-consultants to the royal family of Kuwait during construction of a carpet factory in the Middle East. As a result of McDermott’s inability to perform his contractual duties, production of the facility fell behind schedule. Additionally, McDermott ordered raw materials that were incompatible with production equipment installed earlier. In combination, these factors caused an eight-month delay in the production of carpets. MECCA suffered diminishing losses for 1979, 1980, and 1981 before a fire destroyed the factory in 1982. A new carpet plant completed in late 1982 was profitable.

Expert testimony utilizing a hypothetical economic model incorporating market variables established that a “delay in commencing production will cause a corresponding delay in reaching full profitability.” Significantly, profits were awarded based on MECCA’s profit and loss statement for 1983, more than four years subsequent to the breach and with a reconstructed facility. Post-fire income figures were sufficient because the relevant variables remained constant. The new facility produced the same kind of carpet, used similar machinery, and operated within the same market as the destroyed facility. The pattern of diminishing losses just prior to the fire, consistent with the expert’s economic model, suggested that MECCA would have soon reached profitability.

Expert testimony convincingly quantified lost profits because the economic model supported the substitution of the new facility’s performance for that of the old. Additionally, the model properly accounted for variables such as changes in management, labor, capital, and raw materials. Finally, the existence of a “stable and monopolistic” Egyptian market and protection from foreign competition simplified the analysis by eliminating many variables associated with a free-market system.

Post-Breach Profits, Successor Business

It is possible that the injured party may vacate the premises of former activity, only to be replaced by another company in the same business. In this case, assuming that market variables have remained constant, an extrapolation can be calculated based on comparing the replacement business entity with the original. Care should be taken here to ensure that the replacement business is actually comparable to the original. Calculating lost profits in these circumstances approaches quantification using benchmarking techniques.

2. Business Enterprise Ceases

Using post-breach income figures makes sense when a business merely experiences a temporary shortfall in production of income or is continued by a different entity. However, in the event that the new business is unable to recover from the breach, it will have neither a significant history nor a future of recorded profits. Although this complicates matters, lost profits may still be quantified with reasonable certainty.

In all cases, the most important step involves the identification of critical success factors. Critical success factors, as the name implies, are those elements that are absolutely necessary for a particular business to succeed. Although most businesses share a common core of essential skills and attributes that promote economic viability, the mix of these skills can vary widely among individual businesses. Elements that are important for the success of a service-oriented business may differ substantially from that of a capital-intensive business. For example, the critical success factors for a health spa may include location, marketing strength, employee reputation, management expertise, and start-up capital. On the other hand, the critical success factors for a computer manufacturer may be sufficient capital, patented technology, distribution channels, supplier relationships, and advantageous labor relationships.

Short-Term, Prebreach Operations

Prior to the breach, the new business may have experienced some level of short-term operations. Even if the business operated for less than one year, sufficient information may exist to extrapolate lost profits as a result of the breach. So long as some information is available, it can serve as the starting point for a comparison to industry statistics. Key industry statistics to examine, among others, include financial ratios such as profit margins, debt-to-equity ratios, and receivable and inventory turnover. Other vital information includes trends in sales, cost of sales, general and administrative expenses, customer profiles, and potential regulatory impacts. Furthermore, a thorough analysis of contracts such as sales contracts, lease agreements, and employee contracts can provide a valuable source of information regarding projected future revenue and expenses.

It is not even necessary in all cases to demonstrate the existence of profits during that abbreviated period (Brookridge Party Center v. Fisher Foods, Inc.,12 Ohio App. 3d 130 (1983)). For example, most new businesses experience an initial period of diminishing losses followed by a gradual progression to profitability as the business moves up the learning curve. Losses in the initial stages of the business’ life cycle are to be expected, particularly if they remain in line with industry averages. If the business possesses the critical success factors specific to its particular enterprise, it can be reasonably expected to perform at least as well as the industry average, implying that it would “turn the corner” at some point in the future (along the industry average growth curve).

Example

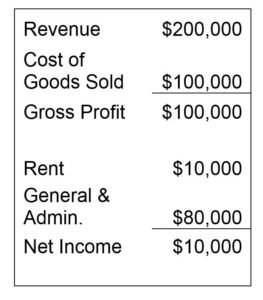

Assume a retail business commences operations on January 1, 20X0 and ceases business on October 31, 20X0 due to a contract breach. Furthermore, assume it is now January 20X5 and the case is going to trial. Actual net income for the ten months ending 10/31/20X0 is as follows:

Step 1

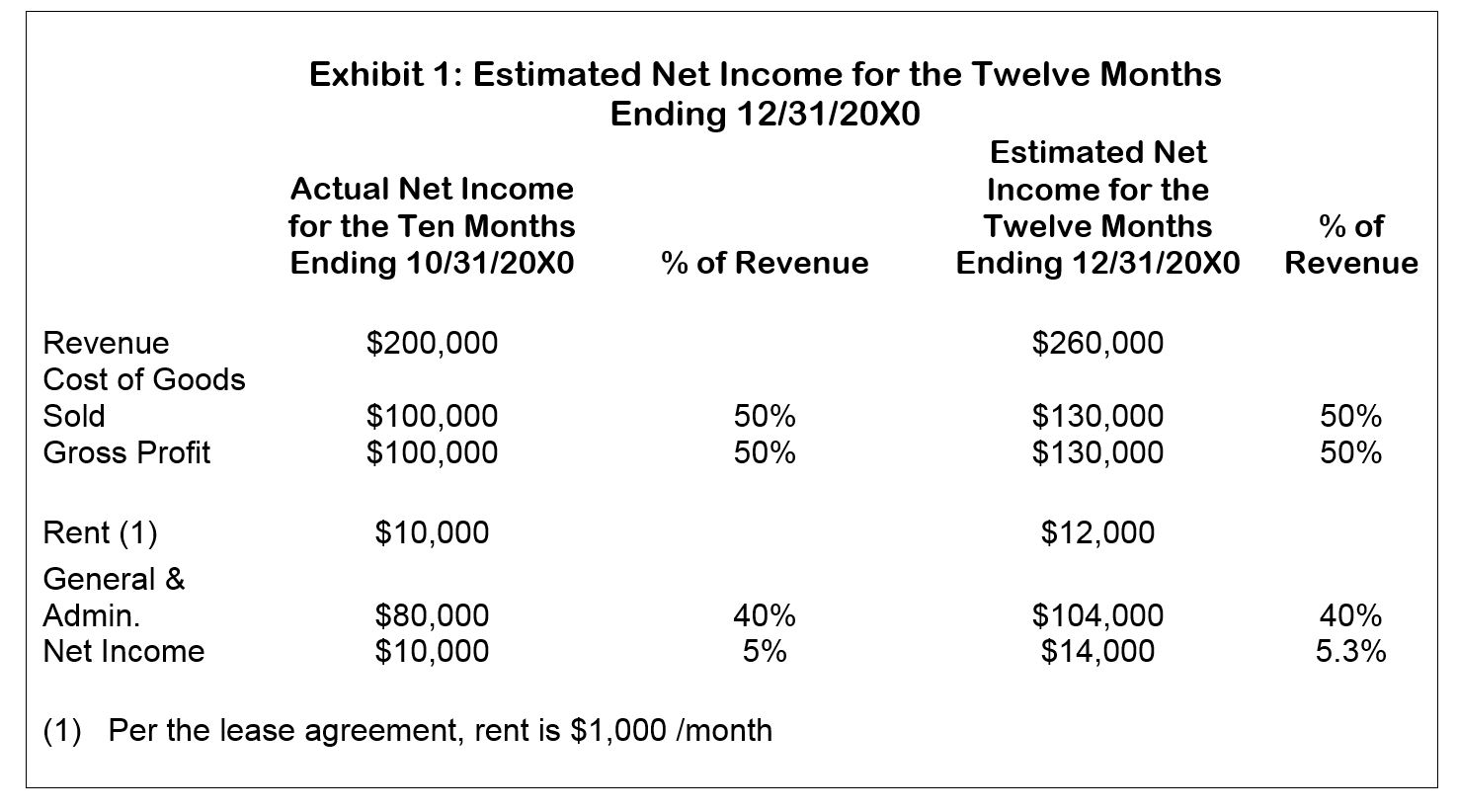

The first step involves projecting financial results achieved in the first 10 months over a 12-month period. Where possible, contracts or agreements should be used to determine future activity.

For example, let us assume that rent expense is fixed at $1,000 per month as stipulated by the lease agreement. Therefore, we would expect rent expense of $12,000 for the 12-month period ending 12/31/20X0 ($10,000 plus $2,000 rent for November and December). Where contracts and agreements cannot be used to project financial results, other techniques must be employed. Assume that an interview of similar retailers at the same location reveals that January to November sales are relatively constant, with December averaging twice that of any other single month. Multiplying actual financial results for the 10-month period ending 10/31/20X0 by a multiple of 13/10 provides a reasonable estimate of results for the year ended 12/31/20X0 (see Exhibit 1).

Step 2

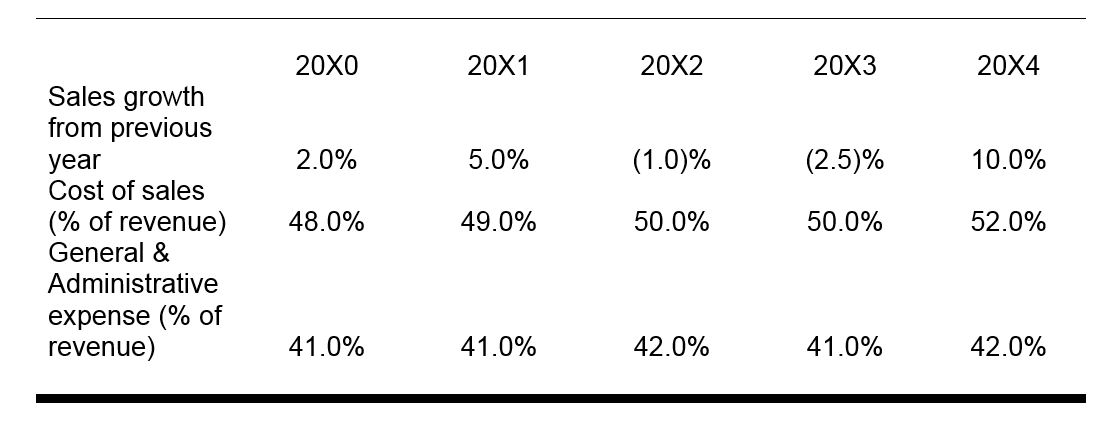

The next step involves accumulating industry data (statistics and financial ratios) for companies operating in the same industry as the injured company. This information can be accumulated by conducting database searches. For example, the SIC (standard industry code supplied by the IRS) for the injured company can be used to search databases such as Dunn & Bradstreet, NEXIS, and the SEC for financial data specific to that industry. Let us assume that the following information regarding financial results was uncovered thorough a database search for our example (see below).

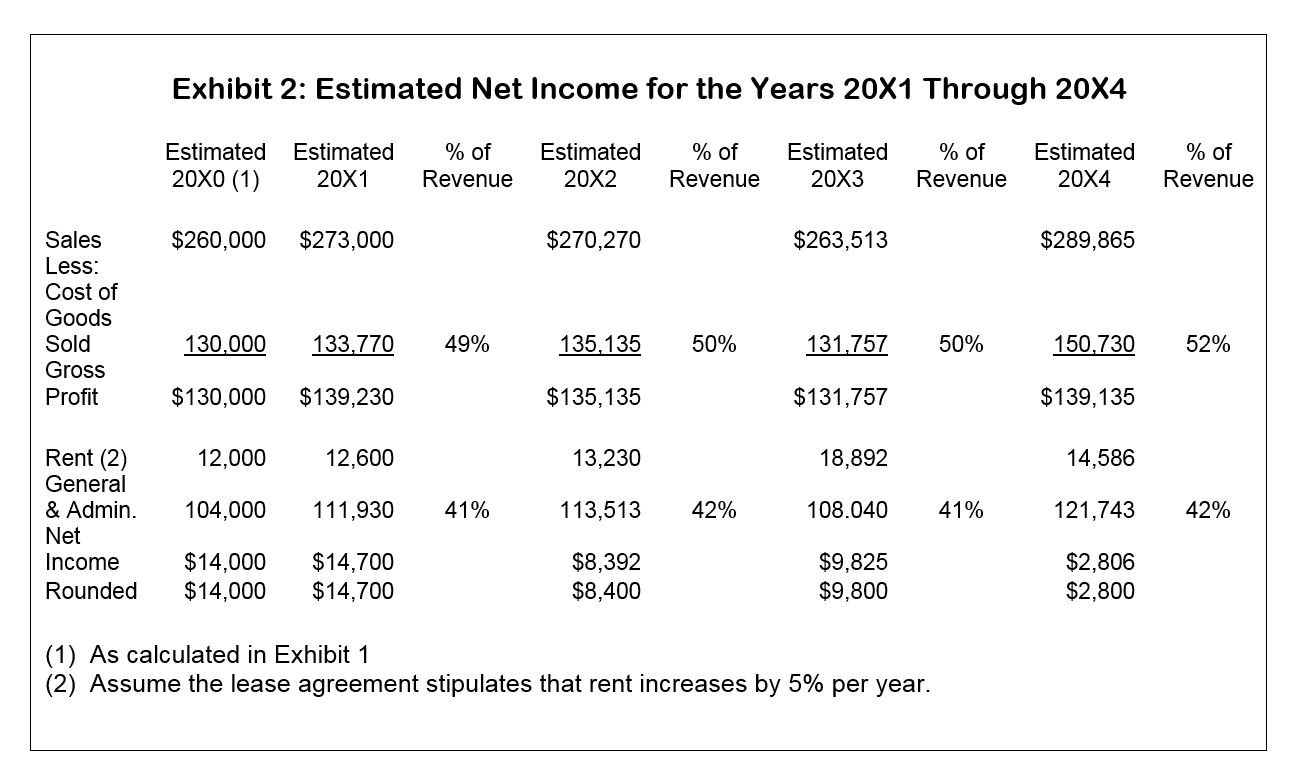

These ratios can then be applied to the injured company to estimate financial results in the years 20X1 to 20X4 (see Exhibit 2).

Note that the estimated financial results in 20X0 do not exactly match industry ratios in that same year. One would expect a start-up company to operate with less efficiency than industry averages (which include companies with significant experience). However, given that actual financial results in the first 10 months ending 10/31/20X0 approximate industry ratios in 20X0, actual results for that 10-month period are used to project earnings in future years.

Losses suffered during initial operations do not necessarily preclude projection of profits in future years. For example, if the injured company in the example below suffered an actual loss in the first 10 months of 20X0, one could argue that industry ratios should be applied to actual revenue in 20X0 to estimate net income or net loss in 20X0. After all, as a start-up company, the injured company can expect losses in its initial period of growth. By utilizing industry ratios, we nullify the “start-up effect” by assuming performance of an established company.

Bear in mind that industry averages are meant merely as guidelines; they should not be taken verbatim. Industry average statistics and specific company statistics commonly differ, particularly when the specific company is a brand-new enterprise.

This means merely that industry statistics and ratios should be used as a starting point, with adjustments made to approximate the specific circumstances of the injured company. For example, if you know that the injured company utilizes a greater proportion of debt financing than the industry average, estimated interest expense should be increased accordingly. Additionally, if the injured company is more labor intensive than that of the industry average, salary expense should be adjusted accordingly.

Benchmarking

Another effective method often utilized to quantify lost profits when a business ceases operations is benchmarking (see Lehrman v. Gulf Oil Corp.,464 F.2d 26 (5th Cir. 1969). As the term suggests, benchmarking calculates likely anticipated earnings based on a relative comparison of the defunct business to a similar company in the same industry. Theoretically, a company that is comparable in size, location, management, product lines, and market position could experience the same approximate earnings stream. Earnings for a similar company can be used as a proxy for earnings of the defunct business provided that relevant factors are identified and determined roughly equivalent.

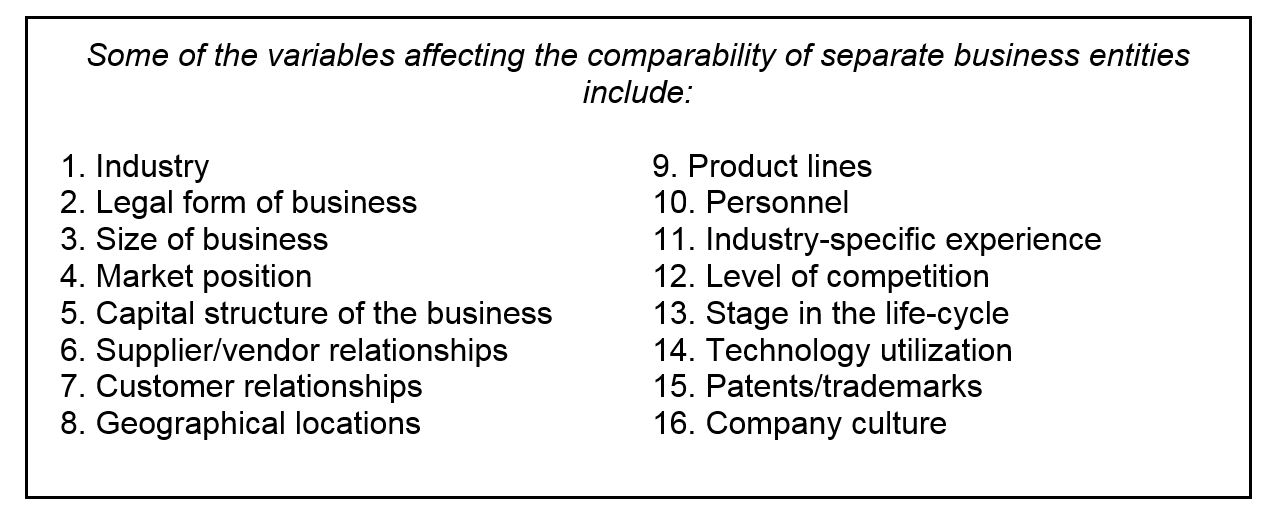

Although benchmarking makes intuitive sense, it can be difficult to implement. In practice, no two companies are equivalent, even in general terms. Differences in just one of the variables in the following box can make a tremendous difference in performance between two otherwise similar firms. For example, two publishing companies in the same city with similarly sized staffs may have vastly different earnings potential simply because they market their services to different clients.

Another potential difficulty with using benchmarking as a means for estimating lost earnings lies in the availability of information. Because of regulatory requirements, publicly traded companies must make selected financial and accounting information available to stakeholders and potential investors. Thus, benchmarking can usually be used on a general level for publicly traded companies. However, comparison of privately held and nonregulated companies becomes more difficult simply because information cannot be readily obtained.

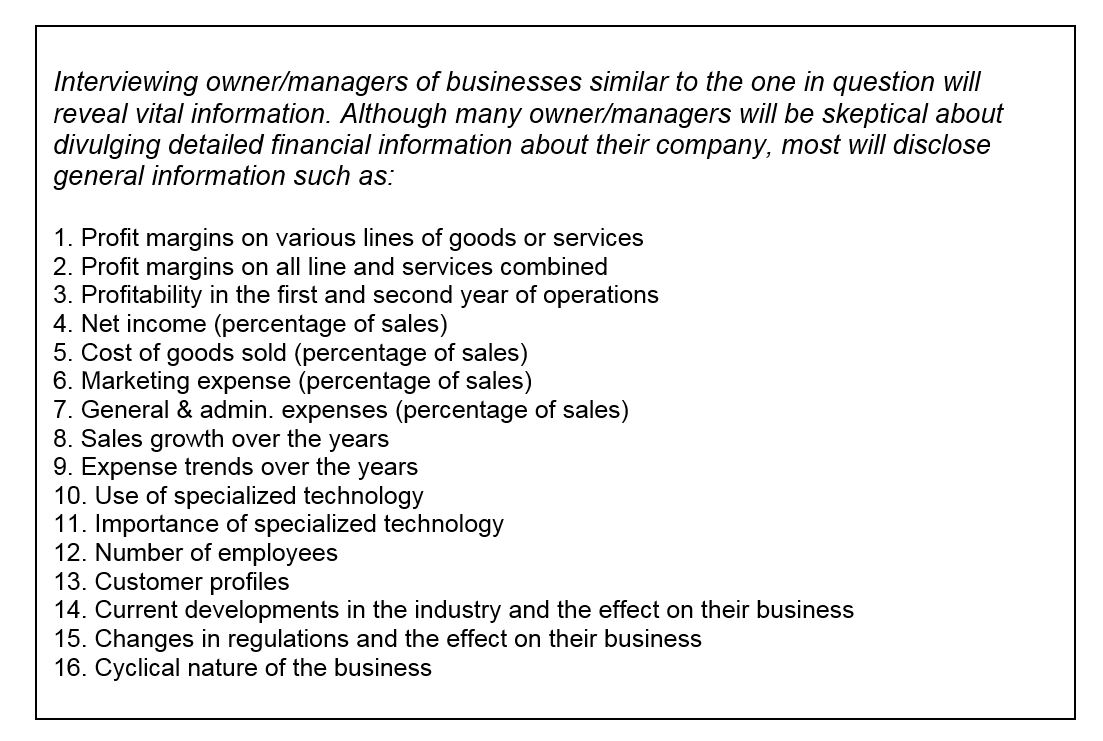

An effective method of overcoming the limitations in the availability of detailed information for privately held or nonregulated companies is through the use of interviews.

The key to using benchmarking as a means of quantifying lost profits is the realization that it can provide a general estimate of profits when little else is available. If a sufficiently similar business enterprise can be identified, benchmarking can be a powerful tool for demonstrating likely lost profits. Because of the assumptions made, however, benchmarking must be used carefully, with particular attention given to assumptions made about what constitutes a “mirror” company. As with other methods, critical success factors should be identified, both for the defunct business and potential “mirror” businesses. Furthermore, differences in facts between the injured company and the benchmarked company should be taken into consideration, and adjustments to financial results should be made accordingly.

Past Experiences, Injured Party

If the injured party has prior experience with a similar business, financial and operational information from that business may translate roughly into projections for the new, injured business. As is the case with benchmarking, the previous business should be examined carefully to ensure that it compares sufficiently to the new business. If the prior business passes the test of comparability, using past experience has the added benefit of intuitively including hard-to-quantify variables such as industry-specific experience (presumably the same with the same business owner/manager).

Conclusion

In determining lost profits for start-up companies with little or no prior earnings history, several methods can be utilized to arrive at an estimate backed by reasonable certainty. Crucial in selecting the method of projecting or applying those profits is the recognition of the individual characteristics of the business in question in relation to the industry and market as a whole. Numbers alone are not enough; qualitative as well as quantitative factors must be taken into account. In the final analysis, assumptions made and calculations performed must make sense from a general business perspective and must be supportable. Through an understanding of the strengths and weaknesses of common techniques for determining lost profits, an appropriate mix of approaches can be utilized to produce reasonably certain, supportable results.