I. INTRODUCTION

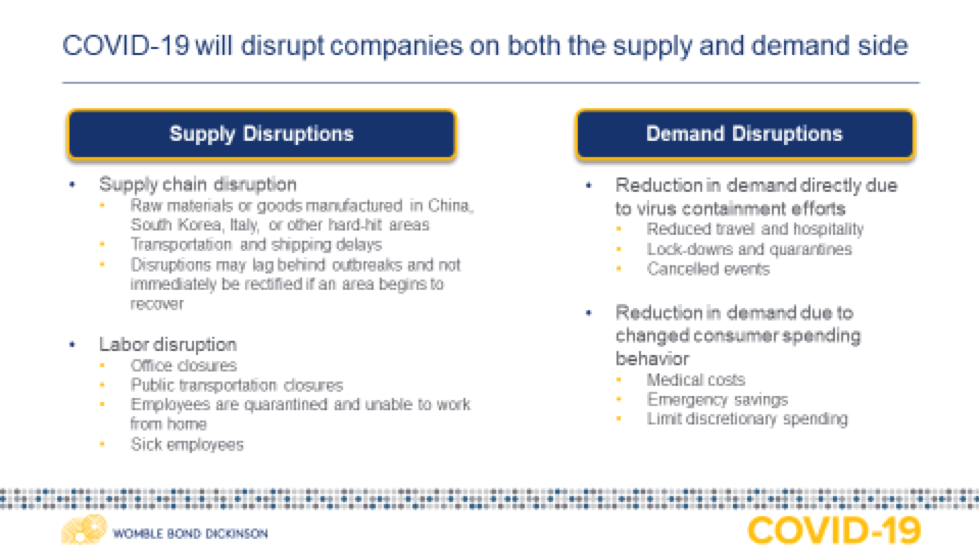

COVID-19 is having a dramatic effect on everyone’s lives. Our thoughts go out to all those who have been infected and their loved ones. While health has to be the first priority for everyone, this situation also raises significant economic and business issues. Businesses are seeing interruptions in supply, and many contracts can no longer be performed. Businesses are trying to decide whether and how to “push the pause button.” Others are unable to perform their contractual obligations and are trying to determine their legal rights. This article discusses some of the legal issues that inform the decision-making process.

II. Governmental Actions Are Restricting Business Activity

A. State of Emergency

As of March 20, 2020, there have been state of emergency declarations from the federal government in all 50 states and in all populated American territories because of the COVID-19 pandemic. Many of these emergency declarations have closed schools, limited public gatherings, and limited restaurant activities to takeout or delivery.

B. Shelter-in-Place Orders

Many states, including California, New York and Illinois, have also initiated shelter-in-place orders. Hundreds of cities and counties have also entered such orders. In the event of a shelter-in-place order or a state’s COVID-19 mitigation initiative, the distinction between “essential” and “nonessential” is crucial in assessing whether a business may have to reduce operations (to a state known as “minimum basic operations”) or close for a period of time.

There is uncertainty as to what is a “nonessential” business state-to-state, and authorities may not approach this consistently. California has referenced the Memorandum on Identification of Essential Critical Infrastructure Workers During COVID-19 Response from the US Department of Homeland Security, Cybersecurity & Infrastructure Security Agency (CISA). CISA identifies 16 sectors considered to be “essential,” and is part of the National Infrastructure Protection Plan (NIPP). This listing is advisory by CISA, but the California Order implements it as is in its listing of “essential businesses.”

However, some orders have listed different definitions of “essential business”—for example, the Alameda County order that affected San Francisco differs from the state-wide California Order. Pennsylvania and New York have each taken different paths on defining “essential business,” so there will be no “one size fits all” solution. Determining whether a particular business is required to close requires case-by-case analysis.

III. Contractual Defenses

It is basic contract law that a party that fails to perform is liable to pay damages for breach of contract. “Non-performance of a valid contract is a breach thereof … unless the person charged … shows some valid reason which may excuse the non-performance…” Cater v. Barker, 172 N.C. App. 441, 447, 617 S.E.2d 113, 117 (2005); see also Tejas Power Corp. v. Amerada Hess Corp., No. 14-98-00346-CV, 1999 WL 605550, at *2 (Tex. App.-Houston [14th Dist.], Aug. 12, 1999) (noting that while “a seller is bound to deliver the thing to the buyer… and, as a necessary consequence of this obligation, to do so at his own expense…” but also noting “extraordinary circumstances…may excuse the seller’s breach”); In re Appraisal of Metromedia Intern. Group, Inc., 971 A.2d 893, 900 (Del. Ch. 2009) (noting that a valid contract will be enforced “unless a party’s non-performance is excused.”)

Contractual defenses fall into three primary categories: (a) impossibility/impracticality; (b) frustration of purpose; and (c) force majeure.

A. Impossibility/Impracticability

The common law often recognizes a defense of impossibility. A party should not be held liable for breaching a contract that they could not perform. For example, laryngitis may make a singer’s concert performance impossible. Death and disability make personal service contracts impossible.

Some of the government orders surrounding COVID-19 may in fact render performance impossible. A contract committing to put on a theater show on March 30 is now impossible in locations where theaters have been ordered to shut down.

Some courts also recognize a defense of impracticability. Here, a party must show that performance has been made excessively burdensome by a supervening event. Generally, the supervening event must be: 1) unforeseeable (but not inconceivable); 2) not the fault of the excused party’s; 3) inconsistent with the basic assumption of the parties at the time of contract; and 4) something that a reasonable party would not have guarded against in the contract.

B. Frustration of Purpose

Some courts also recognize a separate doctrine called “frustration of purpose,” which is similar to the impracticality defense. Under this doctrine, performance is excused when a supervening event fundamentally changes the nature of a contract and makes one party’s performance worthless to the other. Unlike the other defenses, this doctrine has nothing to do with inability to perform. For example, if a contract called for cleaning a theater after a performance, the cancellation of the performance frustrated the purpose of the contract. The contract can still be performed (i.e., the cleaning personnel are available and the theater is available for cleaning), but the purpose (cleaning up after a performance) has been frustrated, making cleaning a wasted effort.

IV. Force Majeure Clauses

Unlike the preceding defenses, which arise under common law and potentially apply without regard to the language of the contract, the defense of force majeure is based on a contractual provision. Accordingly, companies should check their contracts, and those with their suppliers, for force majeure clauses. The clauses generally take two forms. The most general form excuses performance under the contract when it is due to any circumstance outside the party’s control, which presumably would include performances prevented by coronavirus. The second type of force majeure clause lists specific events that trigger the clause.

In most cases, force majeure events are contemplated to cover acts of God, extreme weather events, riot, war or invasion, government or regulatory action including strikes, terrorism, or the imposition of an embargo. It is less common to see force majeure clauses that expressly contemplate a global health emergency, pandemic, or epidemic as a force majeure event.

In addition to the force majeure event, many courts also require that the party shows an attempt to perform the contract regardless of the triggering event (here the epidemic), perhaps by finding an alternative source of supply.[1]

A. Practical Considerations

Contracting parties must be cautious in declaring a force majeure event on the basis of the recent coronavirus outbreak and ceasing performance of their obligations. Incorrectly declaring a force majeure event may result in a contracting party repudiating the contract; it may also provide the other party with a right to damages.

The China Council for the Promotion of International Trade has apparently already issued over 3,000 force majeure certificates. However, these certificates are not dispositive. Instead companies, and ultimately arbitrators and courts, will have to examine each contract and the specific circumstances to determine if a force majeure clause applies and performance under the contract is excused.

Some states in the U.S. have specific rules regarding notice of force majeure claims, including when notice must be given. Companies should check with counsel about the proper timing and format of the notice, based on the jurisdiction, choice of law provisions in the contract, and specific notice language in the contract.

Finally, companies asserting these defenses, suffering damages from breach, or generally impacted by COVID-19, should keep good records regarding the factual circumstances and damages incurred because these documents will be central to any later legal proceedings. Counsel should also consider whether litigation is “reasonably foreseeable” such that it triggers an obligation to implement a litigation hold.

V. Insurance Coverage Issues

A. Business Interruption Insurance

Business interruption insurance can be purchased as part of a commercial property insurance policy or as a stand-alone policy or provided through a captive insurer. General business interruption insurance is intended to protect a business against profits that are lost as a result of unintended interruptions to the business or its supply chain. Typically, business interruption policies are triggered when the company suffers some sort of direct physical damage, and that physical damage leads to the interruption of its business operations.

If your policy contains a requirement of physical damage, as most do, a determination will have to be made regarding whether the COVID-19 virus is deemed to be physical damage. However, some policies do not have a requirement of physical damage if the loss arises from certain diseases. A determination will have to be made whether the virus rendered a facility totally or partially unusable or required additional costs such as testing or cleaning. COVID-19 is not a disease that has ever been mentioned in any policies.

Other policies contain contingent business interruption coverage. Rather than requiring the policyholder to suffer a direct physical loss, contingent business interruption coverage responds to some losses that impact a company’s supply chain. To the extent that a supply chain is impacted by slow-downs or stoppages in the United States, China, Europe, or within the NAFTA free trade area, a company may see more benefit from contingent business interruption coverage than from traditional business interruption coverage. However, this coverage ordinarily requires physical damages to a supplier or customer’s property by a peril covered under the company’s policy.

Another type of business interruption insurance which may have broader applicability is civil authority coverage. The coverage applies when you are unable to operate your business due to the order of local, state, or federal authorities. Several months ago, some insurers began writing limited and optional coverage for COVID-19, particularly for “civil authority” orders, where governments or health officials issue orders restricting the use of businesses or properties. If you purchased this coverage, it is likely to have certain sub-limits (which may be relatively low), but it will need to be closely reviewed. This supplemental coverage may also apply without the physical presence of COVID-19 on your premises.

B. Commercial General Liability/Professional Liability

A company’s commercial general liability (“CGL”) insurance is typically the first thought when people ask general questions about insurance. CGL coverage responds to claims that the policyholder acted in a way that caused personal injury or bodily harm to a claimant. The typical example is a slip and fall of a patron in a public building, a products liability claim, or other physical injury caused by the policyholder that resulted in injury to another.

If businesses are sued by customers or patrons for causing, spreading, or failing to take adequate steps to prevent COVID-19 transmission, the CGL policy will be the first line of defense. However, many CGL policies contain exclusions for viral and bacterial-related bodily injury. On the other hand, CGL policies for certain industries that are more susceptible to contagious disease outbreaks (including restaurants, event centers, and hotels) are more likely to be sold with optional coverage that may include bacterial and viral infection, as these industries have historically demanded optional coverage for contagious disease.

C. Workers’ Compensation

Workers’ compensation insurance is required of most employers; either explicitly by statute or implicitly by business contracts. Workers’ compensation insurance generally covers jobsite injuries, as well as occupational diseases that are peculiar to a trade, occupation, or employment. For example, the hallmark occupational diseases include asbestosis and mesothelioma for those who worked with asbestos and black lung disease for underground coal miners.

Individual state law will control whether an “ordinary disease”—i.e., one which the general public is exposed to outside of employment—will be covered by workers’ compensation. Typically, an employee who contracts an “ordinary disease” will not be covered under worker’s compensation insurance. Some states apply the “peculiar risk” approach to determine whether the risk was increased because it was related to the employment. To the extent that your employees are hospital workers, nursing home workers, or other front-line healthcare workers who may be exposed to COVID-19 on a heightened basis, your business workers’ compensation insurance may cover those employees. Law enforcement, firefighters, and other emergency responders may also have similar claims. Employees of grocery stores, or those providing childcare to medical professionals would potentially be covered, but they would be a step further down the chain. The farther your particular employees are from the “peculiar risk” of being exposed to COVID-19 in the workplace, the less likely it would fall within your workers’ compensation insurance. Employees bringing workers compensation claims for COVID-19 will also have to prove that they were exposed at the workplace, rather than as members of the general public, which could be difficult in areas where community spread is apparent.

D. Directors & Officers Liability Insurance

Directors & Officers (“D&O”) liability insurance almost always contains exclusions for bodily injury. However, as the COVID-19 pandemic begins to negatively impact financial markets, credit markets, and share prices, shareholders may bring claims that a company’s executive leadership grossly mismanaged the company. Against the background of the turmoil currently roiling the financial markets, these claims may be specious at best, but the D&O policy may respond to such claims that are based on the drop of a public company’s stock prices.

Regardless of what you see, hear, or read about insurance coverage for COVID-19, you still need to have your policy read by an attorney experienced in the area of insurance coverage. And if you believe you have a claim, you need to notify all of your insurance companies as soon as possible.

VI. CONCLUSION

Due to the broad impact, companies need to evaluate whether their contractual performance, or that of their suppliers, has been impacted by COVID-19 and the governmental response to the pandemic. If the parties cannot negotiate a mutually acceptable “pause button” postponing performance, then companies should evaluate whether there are defenses to performance which will reduce or eliminate liability for breach.

[1] See, e.g. Gulf Oil Corp. v. F.E.R.C., 706 F.2d 444, 452 (3d Cir. 1983)