The Risk Allocation Landscape

Historically, escrows have served as a classic deal protection mechanism in mergers and acquisitions (M&A) transactions. Recently, however, representations and warranties (R&W) insurance has emerged as an escrow alternative, offering seller-friendly terms and competitive premiums. Is there room for two products on the market? Is one better than the other? Bottom line, it all depends. In this article, we will explore some areas to consider when evaluating the optimal deal protection mechanism for your transaction.

ESCROWS: A primer

Holdback escrows are generally used by Buyers to segregate a portion of the purchase price for various reasons, with the most common reasons being to:

- Provide a means for the Buyer to claim back a portion of the purchase price for breaches of representations and warranties from the Seller.

- Secure post-close purchase price adjustments until finalization of such amounts.

Escrows can also be used for other M&A purposes:

- Good Faith Deposit: can demonstrate serious interest and/or comply with regulations (e.g., if government approval is needed); can also be used to hold potential termination fees.

- Closing Agent / Paying Agent: can centralize funding sources and enable funds to be on hand prior to close; can also facilitate exchange of company stock from Seller for payment of cash from Buyer.

R&W INSURANCE

While there are Seller and Buyer R&W policies, the latter is more common. Under a buy-side R&W policy, the Buyer in an M&A transaction recovers directly from an insurer for losses arising from certain breaches of the Seller’s representations and warranties in the purchase agreement. By shifting the risk of such losses from the Seller to an insurer, a policy can limit the Seller’s liability for certain representation breaches. The Buyer retains the risk of receiving payment from the insurer for any claims submitted.

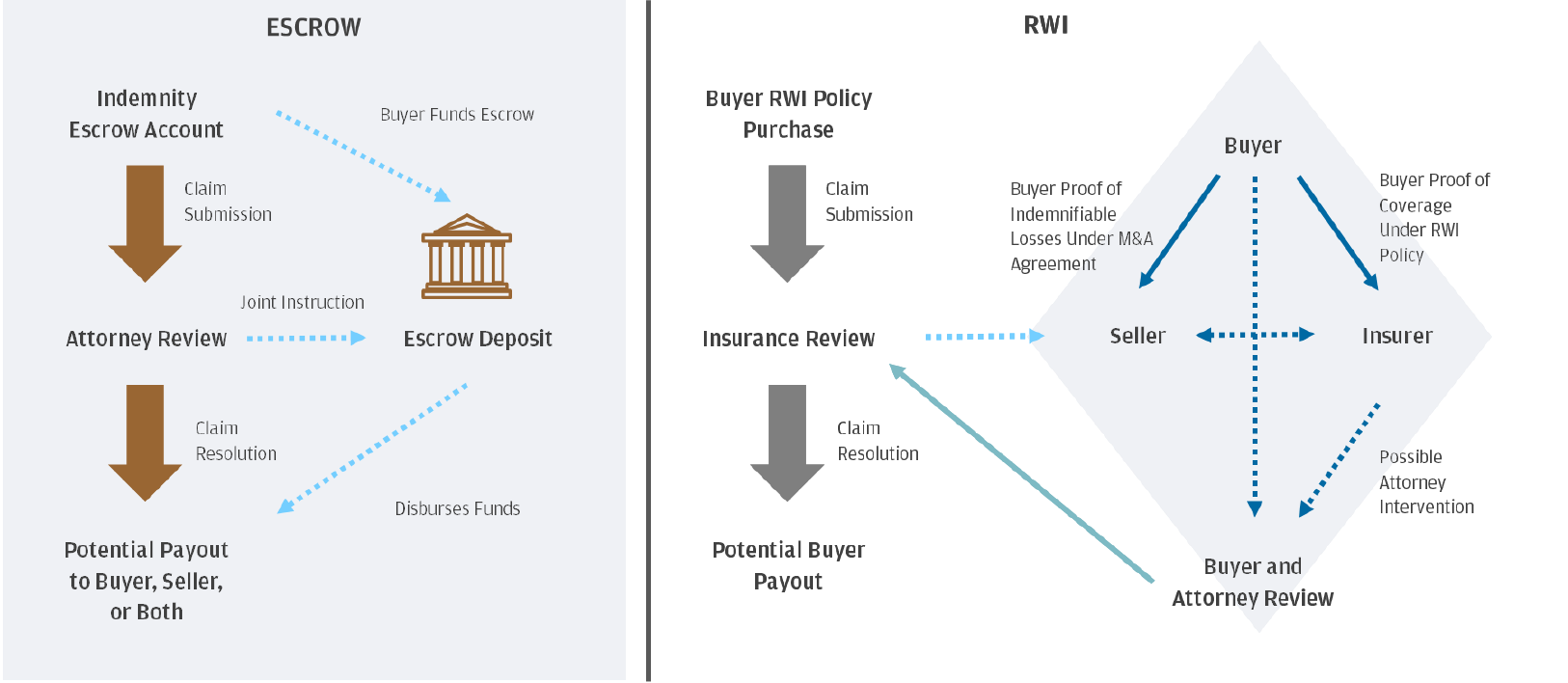

Claim Event Comparison (Escrow agent not involved in claim resolution)

Vital Parameters to Consider

CLAIM COVERAGE

For both escrows and R&W policies, claim coverage is particularly important for a Buyer seeking to mitigate risk in its acquisition. In general, an escrow can provide a clear solution to resolve risks between the parties and may be customized to facilitate a comprehensive coverage model. Conversely, many R&W policies cover only specific, targeted areas.

Currently, in a typical R&W policy, known issues may be excluded, whether or not reported to the insurer or included in a due diligence memo. In addition, in many instances R&W policies will not cover breaches of covenants, forward-looking statements, or purchase price adjustments. Depending on the specific policy, common indemnity claim types such as tax, litigation / product liability, collectability of accounts receivable, pension underfunding issues and environmental liabilities may require separate policies or increased premiums.

CLAIM PAYOUTS

Traditionally, claim payouts are not influenced by the escrow agent, as it serves as a neutral third party, acting generally on joint instructions to release funds. Existing R&W insurance studies provide limited visibility on claim payouts and timing. This calls into question whether or not certain R&W providers will face increased pressure to pay on claims and potentially to increase premium fees to ensure claim payouts.

COST

R&W premiums vary based on the level of coverage but are generally a certain percentage of required coverage. On the other hand, escrow fees are nominal, and larger escrow deposits generally do not result in higher fees. Additionally, in the current low-interest-rate environment, the opportunity costs of having funds on deposit in escrow are relatively low. Escrow will likely continue to be a less expensive risk mitigation tool regardless of whether claims increase over time.

DUE DILIGENCE

When circumstances change, escrow does not require a separate due diligence work stream like R&W insurance does, and it will typically be quicker and simpler to execute a new escrow agreement vs. an R&W policy. As a result, escrow can provide much-needed flexibility when quick turnaround is needed or to resolve last-minute negotiation issues that come up between the Buyer and Seller.

Choosing a Mechanism for Your Deal

Despite their recent emergence, most R&W policies only cover certain types of breaches for representations and warranties, though added coverage may be available, potentially for an additional cost. Claims may be paid but sometimes at the expense of increased legal fees and the extent of recovery. The ability to close within timeframes desired by Buyers can also be impacted. On the other hand, many transactions, even those with R&W policies, involve some form of escrow to help cover and protect the gaps left by R&W policies.

Escrow can offer flexibility, low cost and broad security, such as extending coverage through the “interim period” (time between signing and closing) via a good faith deposit.

Bottom Line

Each transaction and its requirements are unique, and understanding the needs of your transaction — including what it will cost, how long it will take, the extent of its coverage provided, the user experience and quality of digital offerings and certainty of enforceability — will drive towards a coverage model that makes the most sense for you.

* Nicholas Scarabino and John Thomas contributed to this article.

Nicholas Scarabino, Managing Director, Wholesale Payments, Global Escrow Services Sales at J.P. Morgan. Nick has been with J.P. Morgan for over 31 years in Sales and Marketing.

He is currently the Global Sales Manager for the Escrow Services department within the Corporate and Investment Bank’s Wholesale Payments division. The 25+ member team focuses on building relationships and delivering innovative escrow, depositary and agency solutions to corporations, investment banks, law firms and other financial intermediaries.

John Thomas, Executive Director, Wholesale Payments, Global Escrow Services Product Management. John has been with J.P. Morgan for over 13 years in Product Management.

He is currently the North America Product Management lead for the Escrow Services department within the Corporate and Investment Bank’s Wholesale Payments division. The Product Management team focuses on supporting, developing, and expanding escrow solutions and digital escrow applications for institutional clients and law firms.