This article draws from the introduction to Missing the Target: Why Stock Market Short-Termism Is Not the Problem (Oxford University Press, 2022). More on this book can be found here.

Look at the ten largest US firms by stock value in 2020, shown in this table:

Rank | Company Name | Total stock market value |

1 | Microsoft | 1,200 |

2 | Apple | 1,113 |

3 | Amazon | 971 |

4 | Alphabet (Google) | 799 |

5 | 475 | |

6 | Johnson & Johnson | 346 |

7 | Walmart | 322 |

8 | Proctor & Gamble | 272 |

9 | United Health | 237 |

10 | Intel | 232 |

Source: Fortune 500, https://fortune.com/fortune500/2020/search/?f500_mktval=desc (last visited July 9, 2020).

A stock market that accords a value of several trillion dollars to Amazon, Apple, Google, Facebook, and Microsoft is not one that we should worry about being too short-term oriented. These five are quintessentially longer-term companies that do much research and development—anemic R&D is seen as a core cost of a short-term stock market, but it’s not shortchanged at these companies. Because their current money making cannot justify their stocks’ high prices, the stock market is paying for their future earnings and growth—as it has right from when they first sold their stock decades ago. Yes, their power, political influence, and market share are legitimate concerns, but their time horizons are not. These companies’ longstanding sky-high value contradicts the widespread idea that the stock market is unable to look beyond the next quarter’s financial statements.

Yet fear that stock-market-driven short-termism is seriously harming the US economy is pervasive. A widely-held view among Washington policymakers, corporate executives, the media, and the public is that frenzied, short-term stock market trading has coupled with Wall Street’s unquenchable thirst for immediate results to disrupt US firms and badly hurt the economy. Something must be done to reverse short-termism’s impact. Jobs are destroyed and technological progress is stunted, while solutions seem, in the public view, so easy to implement that one is angered at their absence. Corporate executives and their allies castigate stock market short-termism for inducing poor economic performance, which, they say, could be improved if executives and boards had more autonomy from stock markets.

But I show in this book, first, that the evidence for stock-market-driven short-termism is much weaker than is usually thought and, second, that working to lengthen corporate time horizons will not bring us closer to the fairer and environmentally stronger society that policy leaders seek. The two issues—the corporation’s time horizon and its purpose—are largely separate issues that public discourse often conflates. A long-term factory could keep workers employed and be good for stockholders too over the long run but still degrade the environment. And so, this book also provides friendly advice on why to avoid this policy path.

* * *

Stock-market-driven short-termism is the rare corporate structural issue that both resonates with the public and has a place in political rhetoric. Most corporate law issues are technical—for experts, for lawyers, and for corporate interests. But especially when businesses are threatened with closure, political leaders react and often justify their response as not just seeking to save a local business with loyal employees who did nothing wrong but also as fighting Wall Street short-termism.

Consider how senators reacted to the shutdown of a major paper mill in Wisconsin. Hedge fund activists were said to have forced the Wausau Paper Company to close its paper mill—throwing lifetime employees out of work and devastating the mill town. In response, Wisconsin’s Democratic senator, Tammy Baldwin, joined with Georgia’s Republican senator, David Perdue (Georgia also has major paper mills) to sponsor a major anti-hedge-fund bill aiming to reduce the influence of hedge funds on businesses. The sponsors described it as a “bipartisan reform to protect Main St from Wall St hedge funds” so as to “fight against increasing short-termism in our economy.”[1] Senators who had proposed a prior version of the bill castigated predatory activists who “demand[] short-term returns and buybacks at the expense of the company’s long-term future.” This short-termism, they said, must end:

[T]here is [a] growing chorus who believe short-termism is holding America back . . . . [S]hort-termism . . . is the focus on short time horizons by both corporate managers and financial markets. It results in corporate funds being used for payouts to shareholders in the form of dividends and buybacks rather than investment in workers, R&D, infrastructure, and long-term success.[2]

The senators’ statement shows why stock market short-termism is not just a specialists’ issue but also a political one: it’s blamed for the Wausau mill closing and other setbacks, and for widespread US economic degradation. That’s what I examine in this book: Does stock market short-termism really worm its way in to do major damage to the economy? Was the Wausau closing really the result of a pernicious short-term stock market? Even if it was, does the problem scale up to the economy-wide level to cripple US R&D, investment, and long-term business focus, as the senators argue? Or is the Wausau closing better seen as a local misfortune that’s mistakenly categorized as due to a dysfunctional time horizon and then exaggerated as indicating an economy-wide problem?

Political convenience can lead politicians to blame the stock market’s purportedly faulty time horizon for economic setbacks for which its responsibility is minor or nil. Faulting Wall Street is politically satisfying and looks like forward-moving action both to voters and to senators trying to do their best. But the evidence is that doing so avoids the hard political effort to address the disruption’s root causes and effects. True, many shortcomings could be pinned on large corporations. But excessively truncated time horizons and a crippling inability to bring forward good new technologies and products or to stick with tried-and-true good ones, to do the underlying R&D when needed, and to adapt to new markets and political realities are not among the large corporation’s major faults. The evidence, we shall see, does not support the idea that the stock market’s time horizon is damaging the economy in any major way.

Dislocations and closings are real problems for those thrown out of work, yes, but lengthening Wall Street’s time horizons to more highly value good results years down the road will do little or nothing for the US worker, for greater equality, or for the environment and climate degradation. It’s not the best target if there’s a major R&D shortfall. Aiming at purportedly truncated time horizons to fix these problems is aiming at the wrong target.

Even the Wausau paper mill result in Wisconsin deserves further thought. Paper manufacturing had been in a long-term decline in the United States when Wausau closed its Wisconsin mill, government data tells us.[3] The company was slow to adjust to the country’s declining use of print paper. The cause was obvious: computerization changed how businesspeople communicated, emails meant fewer letters and fewer office memos, and online media and ebooks meant fewer printed newspapers, magazines, and books.[4] The senators and their supporters viewed the Wausau paper mill as a victim of stock market short-termism, but the workers’ and their families’ pain was more likely due to the company’s excessive long-termism. It clung for too long to an outmoded business plan, leading to the company having to abruptly pivot to the realities of declining paper use.

But the political impact is clear: a mill closes, workers lose jobs, and senators blame Wall Street short-termism, extol legislation to diminish Wall Street influence, and paint vivid imagery of Wall Street “wolf packs” hunting down companies to close and jobs to eliminate. If stock market short-termism wasn’t central—and it wasn’t—to the Wausau paper mill shutdown, other policies are in order.

The senators blamed the financial market messenger bringing an unwanted message. Accelerating technological change, not the stock market, was the real culprit. The senators’ action was a symbolic gesture of sympathy for affected constituents. But they were not helping long-term adjustment—and their plans would maybe even slow it down.

They found a scapegoat, not a solution.

* * *

By corporate short-termism I mean overvaluing current corporate results at the expense of future profits and well-being. In recent years, stock market short-termism has also become intertwined in public rhetoric with conceptualizations of corporate social responsibility, corporate purpose, and the need to emphasize corporate attention to the environment, stakeholders, and the risk of climate catastrophe, the so-called ESG issues. There is a widely held view that shifting the large US corporation from its supposed short-term orientation to a longer one is needed to ameliorate a raft of social and economic problems, such as employment, equality, and R&D. According to this thinking, lengthening the stock market’s time horizon will release a dammed up investment tide, while also doing much to save the planet from climate catastrophe. It’s satisfying to think so, because if the stock market’s time horizon is the main culprit and long-term companies are inherently environmentally friendly, then there is less need to do the hard political and economic work to more directly handle these problems. But we’ll see in Chapter 3 that these corporate responsibility considerations are for the most part not time horizon issues; making the large firm more long-term focused will have little or no impact here.

Stock market short-termism and lawmaking ideas on how to handle it are also prominent in part because they implicate interests. Employees with good jobs, along with their policy supporters, see stock market short-termism as degrading employees’ well-being and as fostering risky, economically costly policies throughout corporate America. Much of the public rhetoric on short-termism aims to help employees and advance social well-being, but the beneficiaries often end up being executives seeking autonomy. Liberal-minded judges, policymakers, and political leaders are more likely to accord executives more autonomy from the stock market when these leaders see themselves as helping the economy, employees, and the environment; they support corporate structure outcomes—more power and more autonomy for executives—that if presented to them directly and starkly, would induce them to be more skeptical.

In corporate policymaking circles, executives and their allies often see stock market short-termism as hurting the economy. Many insist that insulating management from the stock market’s purported short-termism would bolster the economy. That many executives genuinely believe that the stock market hurts the economy does not undermine the fact that these beliefs align with their interests. Misdiagnosis—attributing too many societal problems to a stock market time horizon problem—leads to stock market rules that insulate executives and boards from feedback, allowing some strategic mistakes to persist unnecessarily.

* * *

Getting this right is important because misdiagnosis leads us to policies that fail to cure real problems. The real target is a better-performing, more equitable economy. Aiming at the purported damage emanating from a purportedly excessively short-term stock market will miss that bigger and better target for something small and not particularly problematic.

Consider government support for R&D and for better climate and environmental policy.

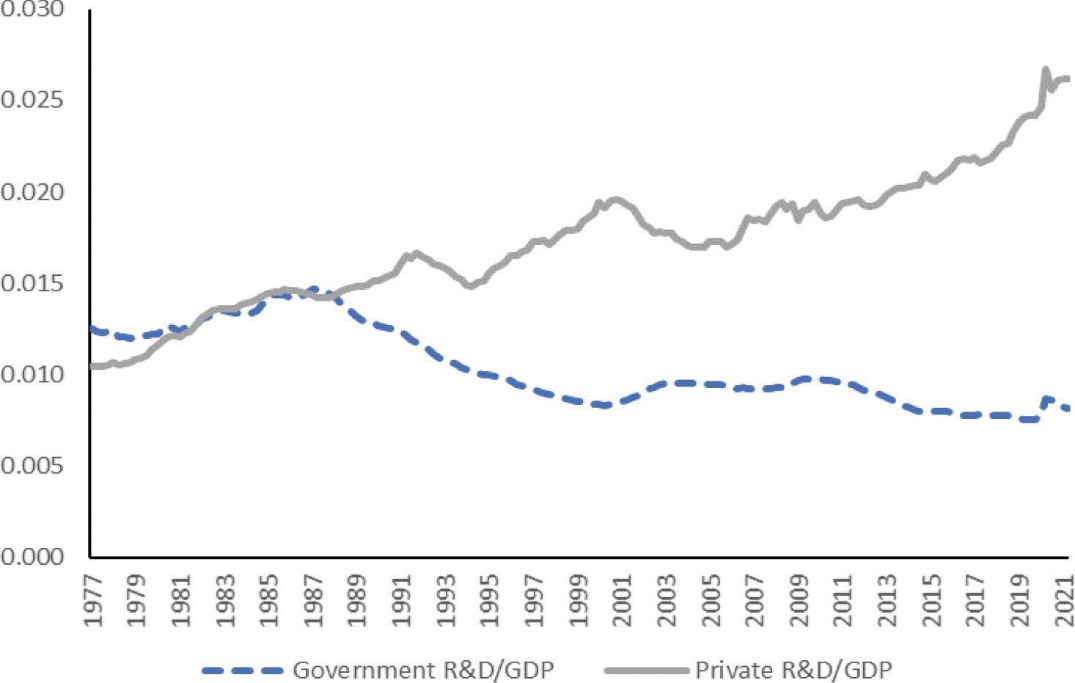

Government’s declining support for research and development. R&D is weakening in the United States, the critics say, and stock market short-termism is to blame. Stock buybacks, exacerbated by short-termism, starve large firms of the cash they need to invest and to do more R&D. If those diagnoses were correct, a policy of insulating firms and their executives from stock market pressure could have cogency.

But corporate R&D spending is rising, not falling. Perhaps R&D should be rising more, yes. But a more obvious R&D weakness, as I show in Chapter 4, is the spectacular fall in US government R&D spending. Government-backed R&D often leads to breakthroughs in basic technology that greatly boost prosperity. If the decline-in-R&D culprit is mostly the sharply shrinking government support for basic research, then no amount of new time-horizon-focused stock market rules will fix the problem.

Figure 1: R&D spending in the United States rising as a proportion of GDP, 1977–2021. Source: Federal Reserve Bank of St. Louis, FRED https://fred.stlouisfed.org/tags/series?t=r%26d (accessed Jan. 4, 2022). The underlying data is from U.S. Dep’t of Commerce, Bureau of Econ. Analysis, National Income and Product Accounts, U.S. Dep’t of Commerce, Table 5.6.5, lines 2 & 6, http://www.bea.gov/itable/ [https://perma.cc/HM9A-7XM3].

Thinking that stock market short-termism’s truncating of corporate time horizons is the primary cause of weakened US R&D leads policymakers astray—to aim at the wrong target.

Weakened environmental and climate change rules. Critics complain that corporations contribute gravely to climate change and environmental degradation, with stock market short-termism particularly to blame. But weak corporate respect for the environment is not due to individual firms’ shortened time horizons but to the ability of firms to push the costs of environmental and climate damage away from themselves and onto others. They can do this in the short-term and the long-term, and can profit from offloading environmental costs while others pay. Indeed, maintaining a factory with toxic emissions into the future may look long-term to some and could save jobs but be bad for the environment. The right focus is not on when the damage is done—the time horizon problem—but rather on who suffers from the damage.

In too much public discourse, the stock market’s time horizon is mixed up with what the corporation aims for—profits instead of doing good in and of itself. But these two are largely separate: a firm can be long-term and profit-focused, or it can be short-term and generous. Thinking that time horizons and purpose are one and the same, or that changing the firm’s time horizon will make it less profit-focused, weakens our resolve for implementing better environmental regulation and climate solutions. What we need are better rules that prevent players—corporate and individual—from externalizing environmental costs to society while keeping the profits and convenience for themselves. No amount of tinkering with stock market time horizons will fix that problem. Thinking that tinkering with time horizons can fix it misses the real targets—the corporation’s (and our own) warped incentives—and prevents us from reaching the best solution.

Or any solution.

* * *

Consider the following when you think about how plausible it is that the stock market’s time horizon is persistently and perniciously too short: Tech companies that had their initial stock offerings in 2018 and 2019 before the Covid-19 slowdown included Dropbox, Survey Monkey, Cloudflare, and Spotify. Not one was profitable;[5] the stock market bought them on a future-oriented view. Similarly, a slew of money-losing biotech companies made their initial stock offerings in 2018. In 2019 seven of the top ten biotech IPOs had no approved drug—hence, the market valued those companies for their long-term prospects not their immediate marketing capabilities—and still they collectively raised more than $1.95 billion from the stock market.[6] Future possibilities, not current profits, drove investors, who were betting on the firms’ potential successes in drugs that would treat maladies such as autoimmune disorders and cancer.[7]

This is not an accidental or one-time event. Recall the companies that were the largest by stock market capitalization in 2020—listed in Table 1. Years ago, when Amazon first sold its stock to the public, it had no earnings but still was accorded a half-billion-dollar value by the stock market, while Apple, Facebook and Google obtained a stock price about one hundred times their earnings when they first sold their stock—more than five times the stock market’s overall ratio of stock price to earnings.[8]

All this indicates the stock market does value the distant future and has been doing so for decades.

Moreover, the logic behind the theory that there is pervasive economy-wide short-termism is not strong. For stock-market-driven short-termism to deeply afflict the US economy—as opposed to damaging only some firms, here and there—normal market processes must fail. When one big firm is too short-term and gives up long-term profit, others can jump in to profit from the short-termers’ neglect. The United States’ dynamic venture capital and private equity sectors make money from opportunities big firms don’t take. Or another big public firm that isn’t tied up by the stock market can pick up the slack. They all have the profit incentive to do so.

The Covid-19 crisis opened another window into short-termism. The consensus view among short-term critics is that the stock market overreacts to quarterly earnings changes. A few pennies up in quarterly profit and the stock soars. A few pennies down and the stock price plummets. Surely there’s some truth to this; but how seriously detrimental is it? In the first months of 2020, the Covid-19 lockdown froze more and more economic activity and gross domestic product plummeted, with forecasters then expecting a severe 2020 GDP decline of 5.8%. Unemployment rose to post–World War II highs. The Covid-19 lockdown and resulting decline in much economic activity crushed corporate earnings. By early June 2020, second quarter earnings were estimated to be down by more than 40% compared to the prior year—a swift and steep drop.[9]

Yet during that time the stock market, after a modest decline, recovered strongly. The 40% estimated earnings decline was not matched by a 40% stock market fall, and the stock market reached an all-time high at the end of 2020. The critics who see the stock market as excessively short-run and obsessively quarterly focused need to explain why we did not see Covid-19-induced stock market declines as steep as the Covid-19-induced fall in earnings.

The easiest explanation is that the stock market is nowhere nearly as short-run oriented as critics say it is. The stock market’s long-run expectation was that the economy would recover in a year or two, when a good-enough vaccine or a cure became available, and it priced stocks for the long-run, not the immediate short-run. Yes, there is a coldness to a stock market assessing long-term economic value as a medical tragedy unfolded, but the stock market’s reaction to the Covid-19 crisis was hardly a short-term stock market at work.[10]

* * *

Broader social and economic reasons help to explain why stock market short-termism is seen as seriously pernicious, as opposed to a small issue that might be better handled. These reasons are rooted in part in rapid economic change and in hard-to-resolve, perhaps irresolvable, conflict.

Economic change is accelerating. New technologies rise, dominate, and then are superseded. Markets open and close. Companies with high-flying stocks find themselves after several years with outmoded technologies, and their stock price falls. Long-established papermakers find people buy less paper than before. Retailers sell books one year and VCR tapes the next until DVD mailers put the VCR rental firms out of business and then online streaming forces the DVD distributors to recede. Newspapers are read on tablets; books are ordered, delivered, and read online; banks become virtual. Physical capital assets become obsolete before they have worn out. All these make the stock market jump, as new technologies change old ways.

The pace of economic change quickens and disrupts more jobs. Both those who are affected and their political protectors react, blaming the stock market for inducing the changes and being too short-term. Even if new technologies make many people better off, those who do not benefit—the employees and executives whose working lives, personal lives, and sense of self are diminished—do not sit still. They act and constitute a sympathetic audience for leaders who blame financial market short-termism for the disruption. And executives who want more autonomy from financial markets applaud and seek more autonomy from stock markets. Corporate lawmakers give them a sympathetic hearing.

We have more than a simple problem of technical data interpretation at hand. We are not just examining whether the stock market is too slow or too fast, but whether it is the conduit for disrupting too many people’s lives and livelihoods. Instead of a pure time horizon problem, we have serious underlying conflict and social dislocation, with the rhetoric of short-termism having become a means for criticizing the economy and the corporation. The rhetoric of stock market short-termism has become a manifestation of political, policy, and social combat as much as it is an economic problem for data inquiry, analysis, and a weighing of the evidence.

Senators Tammy Baldwin (Wisconsin) and David Perdue (Georgia), Brokaw Act: Bipartisan Reform to Protect Main St from Wall St Hedge Funds, www.baldwin.senate.gov/imo/media/doc/Brokaw%20Act%20OnePager.pdf. ↑

Senators Tammy Baldwin (Wisconsin) and Jeff Merkley (Oregon), The Brokaw Act: Strengthening Oversight of Activist Hedge Funds, www.baldwin.senate.gov/imo/media/doc/3.7.16%20-%20Brokaw%20Act%201.pdf. ↑

Jeffrey P. Prestemon et al., U.S. Dep’t of Agric., The Global Position of the U.S. Forest Products Industry 3, fig. 2 (E-Gen. Tech. Rep. SRS-204, 2015). ↑

Alon Brav, J.B. Heaton & Jonathan Zandberg, Failed Anti-Activist Legislation: The Curious Case of the Brokaw Act, 11 J. Bus. Entrepreneurship & L. 329 (2018). ↑

Ben Eisen, No Profit? No Problem! Loss-Making Companies Flood the IPO Market, Wall St. J., Mar. 16, 2018; Alex Wilhelm, Over 80% of 2018 IPOs Are Unprofitable Setting New Record, Crunchbase News, Oct. 2, 2018, https://news.crunchbase.com/news/over-80-of-2018-ipos-are-unprofitable-setting-new-record/; Cloudflare S-1 filing, Aug. 15, 2019, www.sec.gov/Archives/edgar/data/1477333/000119312519222176/d735023ds1.htm. Much of the data on these IPO issues originates with Jay Ritter’s IPO database, to be further discussed later in chapters 2 and 6. ↑

Melanie Senior, The Biopharmaceutical Anomaly, 38 Nature Biotechnology 798 (2020); Eisen, supra note 9. ↑

Kate Rooney, More Money-losing Companies Than Ever Are Going Public, Even Compared with the Dotcom Bubble, CNBC News, Oct. 1, 2018; Joanna Glasner, While Tech Waffles on Going Public, Biotech IPOs Boom, TechCrunch, July 2018. ↑

More specifically, the S&P 500’s price to earnings ratio was 9, 15, and 19, when the three went public. Microsoft was, comparatively speaking, the laggard, with a price-to-earnings ratio of 25 when the stock market overall was selling at about 16 times its prior year’s earnings. ↑

Factset, Earnings Insights, July 10, 2020, www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_071020.pdf (last visited July 13, 2020). ↑

Matt Levine, the Bloomberg columnist, sharply analyzes this Covid-19 short-term versus long-term contradiction. Matt Levine, Stocks Are Trying to Forget 2020, Bloomberg Opinion—Money Stuff, June 1, 2020. A New York Times story on the stock market’s strength despite the Covid-19 hit to the economy reflects the forward-looking nature of the stock market, where—in theory—investors buy stock based on long-term expectation for profits and dividends they expect companies to generate, rather than on how they’re faring when the shares are purchased. Matt Phillips, “This Market Is Nuts”: Stocks Defy a Recession, N.Y. Times, Aug. 19, 2020, at A1, A10. The Federal Reserve’s low interest policy during the Covid-19 economic setback—which buoys the stock market—cannot be ignored here. ↑

For further reading, in addition to Missing the Target: Why Stock Market Short-Termism Is Not the Problem, please see author Mark J. Roe’s related work in The Business Lawyer:

Mark J. Roe & Federico Cenzi Venezze, Will Loyalty Shares Do Much for Corporate Short-Termism?, 76 Bus. Law. 467 (2021).

Mark J. Roe, Corporate Short-Termism—In the Boardroom and in the Courtroom, 68 Bus. Law. 977 (2013). (This article is also presented in The Best of The Business Lawyer: 75 Years of Corporate Law, edited by Karl John Ege and John F . Olson.)