This article is related to a Showcase CLE program that took place at the American Bar Association Business Law Section’s Fall Meeting on September 8, 2023. All Showcase CLE programs were recorded live and will be available for on-demand credit, free for Business Law Section members.

In March 2023 the United States experienced two of the largest bank failures in its history, Silicon Valley Bank (“SVB”) and Signature Bank, with the failure of First Republic Bank following shortly thereafter.[1] This article reviews aspects of these failures (mostly of SVB’s failure)—in particular, the effect of rising interest rates, including on longer-duration securities; some of the precipitating events; and whether the failures provide lessons about the regulatory tools that might have led to a different outcome. This article seeks to expand the dialogue away from a binary debate centered around questions of whether the 2023 turmoil means that policymakers should raise (or not) capital requirements and unwind (or not) tailoring of the prudential framework that was undertaken in 2018–2019—largely in response to Congress passing the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018.[2] In an era when questions about the politicization of the federal banking agencies abound, it is worth asking whether there are some policy approaches that can be pursued that avoid, and indeed are more targeted than, some of the policy questions that have become the center of political debates.[3] If achieving that perhaps aspirational goal is possible, it should allow for durable policy and redound to the benefit of finding the right balance between financial stability and economic growth and innovation.

One way to undertake this exercise is by taking a fresh look at aspects of the Dodd-Frank Act (“DFA”) that were never implemented (particularly, section 166); reviewing what the banking agencies previously said about how to capitalize unrealized losses on investment securities; and examining particular attributes of SVB’s failure. These points then can be considered through the lens of what regulators have said about how to respond to the March 2023 banking sector turmoil. Evaluations of this nature are useful because they can help inform how to design regulatory and policy responses that are targeted to address the particular lessons learned from these events.

Accordingly, this article reviews a series of approaches that could be considered to address the attributes of the March 2023 banking sector turmoil and would be less drastic and disruptive than wholesale changes to the prudential regulatory framework, including the regulatory capital standards that apply to large banking organizations. These approaches are revisiting early remediation requirements; revising how unrealized losses on investment securities are capitalized; and designing new triggers to better prepare for the resolution of large banking organizations and, in turn, to develop a more effective resolution paradigm.

By no means are these approaches intended to be presented as the exclusive or best policy approaches that may be pursued in response to the March 2023 banking sector turmoil. Instead, this article seeks to illustrate two main points: one, it is hard to say that the March 2023 turmoil demonstrates the DFA was structurally flawed, given that the agencies have not implemented key provisions of that law; and, two, it is worth considering whether there are targeted responses that would be able to address the problems that were revealed with relative efficiency.

Looking Back at Proposed, but Unadopted, Regulatory Measures

2010: Dodd-Frank Act

In response to the 2008 financial crisis, Congress passed the Dodd-Frank Act “[t]o promote the financial stability of the United States.”[4] This section discusses two of the DFA’s directives to help frame the remainder of the article: first, a study commissioned to understand the effectiveness of prompt corrective actions (“PCA”); and second, a mandate for regulations providing for the early remediation of large, interconnected financial companies facing financial distress.[5]

The PCA regime was adopted in 1992 and “implement[ed] a statutory requirement that banking regulators take specified ‘prompt corrective action’ when an insured institution’s capital falls to certain levels.”[6] As was evidenced by the crisis in 2008, however, there were fundamental weaknesses in the tools used by regulators to deal promptly with emerging issues at the time.[7] These observed weaknesses prompted a study commissioned under the DFA that, among other findings, “recommend[ed] that the bank regulators consider additional triggers that would require early and forceful regulatory action to address unsafe banking practices as well as the other options identified in the report to improve PCA.”[8] Furthermore, section 166 of the DFA was designed to address these same types of concerns.

In particular, section 166 of the DFA requires that, among other things, the Federal Reserve Board (“FRB”) prescribe regulations establishing standards for the early remediation of large, interconnected bank holding companies under financial distress.[9] In 2012, the FRB proposed a rule to implement this provision. At the time, the FRB said:

The recent financial crisis revealed that the condition of large banking organizations can deteriorate rapidly even during periods when their reported capital ratios are well above minimum requirements. The crisis also revealed fundamental weaknesses in the U.S. regulatory community’s tools to deal promptly with emerging issues. As detailed in the Government Accountability Office’s (GAO) June 2011 study on the effectiveness of the prompt corrective action (PCA) regime, the PCA regime’s triggers, based primarily on regulatory capital ratios, limited its ability to promptly address problems at insured depository intuitions. The study also concluded that the PCA regime failed to prevent widespread losses to the deposit insurance fund, and that while supervisors had the discretion to act more quickly, they did not consistently do so. Section 166 of the Dodd-Frank Act was designed to address these problems by directing the Board to promulgate regulations providing for the early remediation of financial weaknesses at covered companies.[10]

The FRB’s proposal would have required a series of early remediation triggers and requirements cascading in stringency, from level one through level four.[11] Level one, or heightened supervisory review, would have been triggered when a firm first shows signs of financial distress such that the firm is likely to experience further decline.[12] Level two, or initial remediation, would have imposed limits on capital distributions, acquisitions, and asset growth for those banks.[13] Of note, at level two, a firm’s assets would have been limited to growing by no more than 5 percent quarter-over-quarter and year-over-year. Level three, or recovery-level remediation, would have required, among other things, development of a capital restoration plan; broad limits on the ability to conduct business as usual; and, importantly, a written agreement with the FRB prohibiting capital distributions, asset growth, and material acquisitions. Furthermore, for level three, a firm would have been subject to a prohibition on discretionary bonus payments and restrictions on pay increases, and supervisors would have had the ability to remove culpable senior management and limit transactions between affiliates.[14] At level four, the FRB would have considered whether to recommend resolution for the firm.[15]

Although these measures ultimately went unadopted, when the FRB implemented the DFA’s enhanced prudential standards in 2014, the FRB said that early remediation requirements would be adopted at a later date following further study.[16] It is not clear whether such a study occurred and, if so, what it concluded.

2013: Basel III Final Rule

When the federal banking agencies began to implement the Basel III capital standards in 2012, they proposed that all banking organizations be required to include certain aspects of accumulated other comprehensive income (“AOCI”) in regulatory capital.[17] AOCI “generally includes accumulated unrealized gains and losses on certain assets and liabilities that have not been included in net income, yet are included in equity under U.S. generally accepted accounting principles (GAAP) (for example, unrealized gains and losses on securities designated as available-for-sale (AFS)).”[18] AOCI is recorded in the equity section of the balance sheet, and, therefore, unrealized losses recorded in AOCI reduce equity.[19] The agencies believed that this proposed AOCI treatment would result in “a regulatory capital measure that better reflects banking organizations’ actual loss absorption capacity at a specific point in time.”[20] In response to the proposed rule, however, the agencies received comments asserting that the proposed treatment would result in “volatility in regulatory capital” and “significant difficulties in capital planning and asset-liability management.”[21] Ultimately, the final rule allowed certain banks not subject to the Advanced Approaches capital standards (ultimately, SVB was among them) to opt out of having AOCI flow through to regulatory capital.[22]

In making this decision, the agencies noted that

while the agencies believe that the proposed AOCI treatment results in a regulatory capital measure that better reflects banking organizations’ actual loss absorption capacity at a specific point in time, the agencies recognize that for many banking organizations, the volatility in regulatory capital that could result from the proposals could lead to significant difficulties in capital planning and asset liability management. The agencies also recognize that the tools used by larger, more complex banking organizations for managing interest rate risk are not necessarily readily available for all banking organizations.[23]

2022: Financial Stability Oversight Council Annual Report

More recently, the Financial Stability Oversight Council (“FSOC”) highlighted these same risks that the agencies observed in 2013. Specifically, the FSOC cautioned in its 2022 annual report that “[i]nvestment portfolios are at risk as [interest] rates rise, . . . [and] a rapid increase in rates may decrease profitability for banks with larger shares of long duration holdings. . . .”[24]

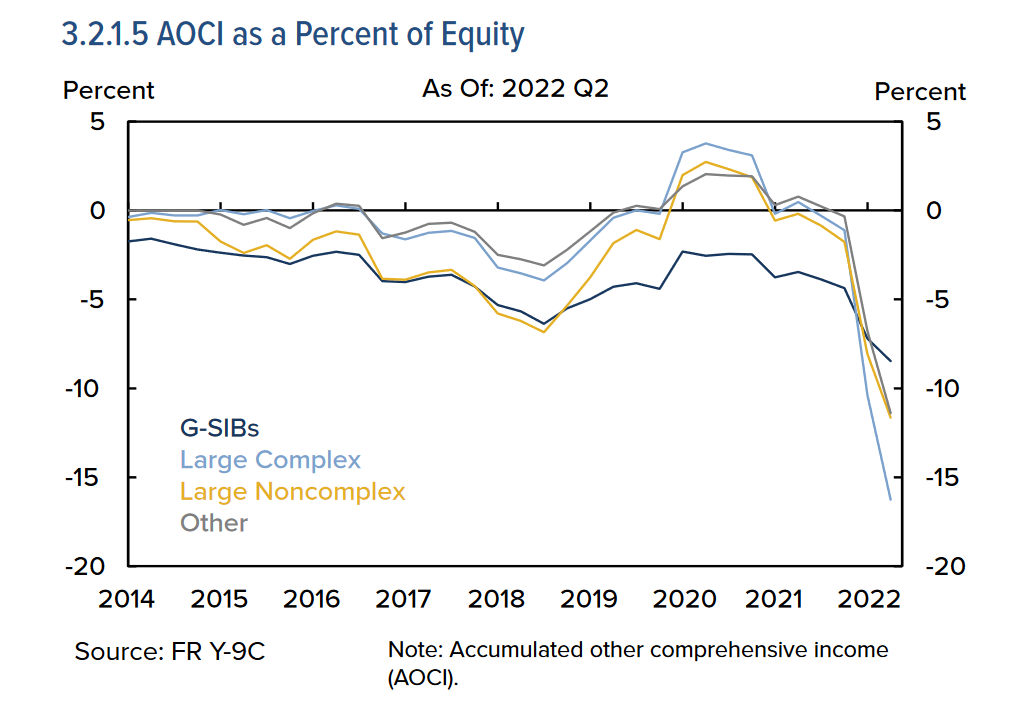

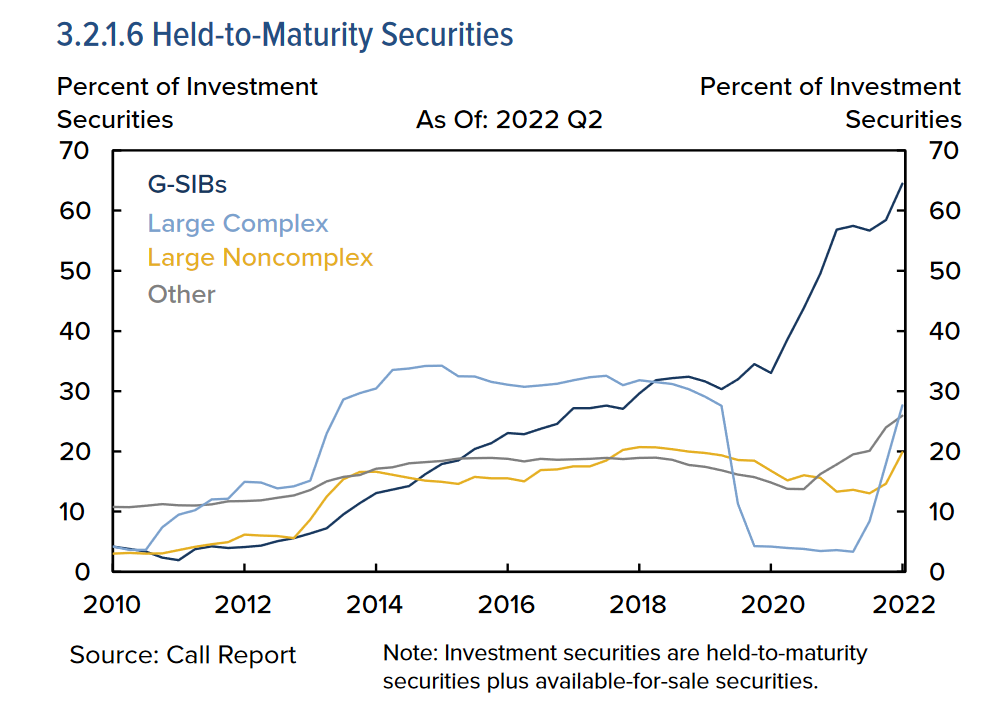

Two charts in the report, reproduced below, highlight the FSOC’s observations. First, the FSOC illustrated that AOCI at the end of 2021 and into 2022 represented negative 15 percent of equity for large complex bank holding companies, above negative 10 percent of equity for large noncomplex bank holding companies, and less than negative 10 percent of equity for U.S. global systemically important bank holding companies (“U.S. GSIBs”).[25] These levels of negative equity sharply increased from 2020 and early 2021. In addition, the FSOC illustrated, correspondingly, that into 2022, U.S. GSIBs held over 60 percent of investment securities as held-to-maturity (“HTM”), whereas large complex and large noncomplex bank holding companies held less than 30 percent and less than 20 percent, respectively, of investment securities as HTM.[26] This illustration is corresponding because HTM securities do not flow through to AOCI; therefore, as a firm holds more HTM securities in its investment portfolio, the investment portfolio will contribute less volatility to AOCI.

Chart A

This chart shows the extent to which unrealized losses on AFS securities resulted in negative equity balances across the banking industry in 2022. Source: FSOC 2022 Annual Report. See footnote 24.

Chart B

This chart shows the percentage of investment securities classified as AFS and HTM and the stark differences in those classifications as between GSIBs, on the one hand, and large complex and large noncomplex bank holding companies, on the other. Source: FSOC 2022 Annual Report. See footnote 24.

Silicon Valley Bank

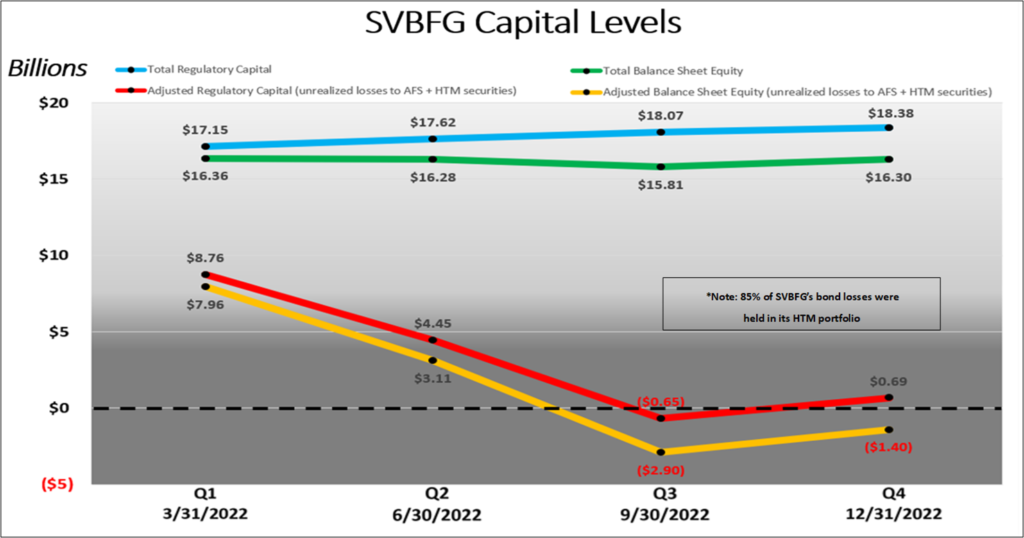

As of December 2022, just three months before SVB’s failure, SVB Financial Group (“SVBFG”), SVB’s parent holding company, had total assets of just over $200 billion and had invested nearly half those assets in HTM securities like Treasury bonds.[27] As the FRB raised interest rates, SVBFG experienced a dramatic loss in the value of its investment security portfolio; however, as noted above, under regulatory capital standards in effect at the time, this value leakage did not affect SVBFG’s regulatory capital ratios.[28] Indeed, if unrealized losses on SVBFG’s AFS and HTM portfolios had been subtracted from total balance sheet equity and total regulatory capital for accounting and regulatory capital purposes, SVBFG’s balance sheet equity and total regulatory capital would have reflected approximately negative $2.9 and negative $0.65 billion, respectively, in September 2022.[29] The chart below reflects this point.

Chart C

This chart, created by the author, shows the affect investment security losses would have had on SVBFG’s total regulatory capital and total balance sheet equity. See footnote 29.

Further, as stated in FRB Vice Chair Michael Barr’s report on the supervision and regulation of the bank:

On March 9, SVB lost over $40 billion in deposits, and SVBFG management expected to lose over $100 billion more on March 10. This deposit outflow was remarkable in terms of scale and scope and represented roughly 85 percent of the bank’s deposit base. By comparison, estimates suggest that the failure of Wachovia in 2008 included about $10 billion in outflows over 8 days, while the failure of Washington Mutual in 2008 included $19 billion over 16 days. In response to these actual and expected deposit outflows, SVB failed on March 10, 2023, which in turn led to the later bankruptcy of SVBFG.[30]

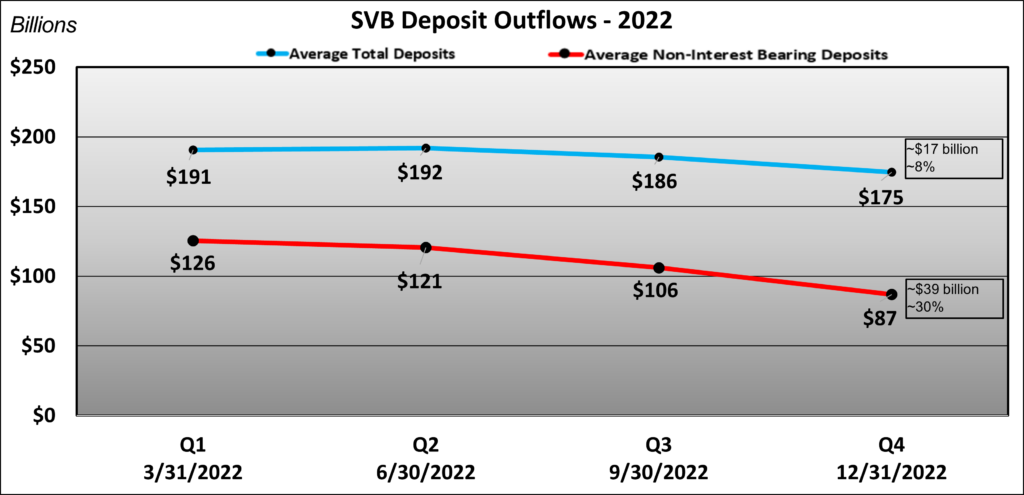

The deposit outflow on March 9, however, followed a longer, slower-motion outflow of deposits from SVB. Specifically, as reflected in the chart below, from March 31, 2022, until December 31, 2022, SVB’s average total deposits declined from approximately $191 billion to $175 billion, and SVB’s average noninterest-bearing deposits declined from $125.5 billion to $86.9 billion dollars—representing an approximately $17 billion, or 8 percent, and $38.6 billion, or 30 percent, outflow, respectively.[31] That is, the deposit outflow, particularly with respect to uninsured deposits observed in March 2023, in effect began one year prior. Said differently, it also may be possible to frame what occurred as a deposit outflow of approximately $56 billion and $80 billion dollars, respectively, over an approximately twelve-month period, rather than a $40 billion outflow in a single day.

Chart D

This chart, created by the author, shows the deposit outflows experienced by SVB over the year prior to the bank’s failure. See footnote 31.

According to congressional testimony from Federal Deposit Insurance Corporation (“FDIC”) Chairman Martin J. Gruenberg, the FDIC began developing a resolution strategy on the evening of March 9, 2023—just hours before the bank failed.[32] As has been documented rather extensively heretofore, in resolving SVB, the FDIC ultimately invoked the statutory systemic risk exception (“SRE”), which effectively allowed the FDIC to guarantee repayment of all of SVB’s deposits, whether insured or not.[33] The ability to invoke the SRE requires approval by two-thirds of both the FDIC board and the FRB, approval by the Treasury secretary, and consultation with the president.[34] Having successfully invoked this measure, on March 13, the Monday following SVB’s failure, the FDIC stated that “[d]epositors will have full access to their money beginning this morning [and] all depositors of the institution will be made whole . . . both insured and uninsured. . . .”[35] The FDIC has estimated that SVB’s failure will cost the deposit insurance fund $20 billion but noted that “[t]he exact cost will be determined when the FDIC terminates the receivership.”[36]

Select Commentary

The commentary from regulators in the wake of the March 2023 turmoil has included a diverse collection of thoughts, empirical reporting, and proposed solutions for a path forward. Some, including Barr, have focused on the need for stronger capital requirements, saying, “[B]anks with inadequate levels of capital are vulnerable, and that vulnerability can cause contagion.”[37] Others, like FDIC Director Jonathan McKernan, have focused on the idea that “an effective resolution framework [is part of] our best hope for eventually ending our country’s bailout culture that privatizes gains while socializing losses.”[38] And while the Treasury Department’s Assistant Secretary for Financial Institutions Graham Steele approves of the current focus “on the unrealized losses in banks’ available-for-sale and held-to-maturity securities as important metrics to assess a bank’s solvency,”[39] FRB Governor Michelle Bowman has observed that the recent failures rest squarely on “poor risk management and deficient supervision, not . . . a lack of capital.”[40]

Dan Tarullo, a professor at Harvard Law School and a former FRB governor, framed it this way:

I think the agencies need to be especially careful here not to overreact to the events of this spring. It’s of course critical to address the vulnerabilities that were exposed and, as I said earlier, to make sure banks that are undershooting their profit targets do not take excessive risks. But the agencies need to think through whether some ideas for increased regulation would just exacerbate the competitive problems of these banks while not efficiently containing those vulnerabilities.[41]

In the spirit of Tarullo’s comments, the discussion below reviews potential policy tools that are available to address what the spring 2023 turmoil revealed, apart from the broader and more divisive debate about capital calibration and the appropriateness of tailoring the prudential regulatory framework based on the size of a banking organization.

Policy Considerations

Revising Early Remediation

On consideration is whether the FRB should promptly implement the DFA’s early remediation requirements.

Certainly, it should be possible to look back and evaluate how such requirements could have helped avoid the use of the SRE and the hectic resolution of SVB. For example, what triggers could have required swift action as SVB experienced a slow-motion run on 8 percent and 30 percent of its average total and average noninterest-bearing deposits, respectively? If those triggers had been in place, would the March 9 run have been avoided—or at least been less of a surprise? Could triggers be designed that would have prevented the accumulation of SVBFG’s negative equity balance, described above? Or required prompt action once it had accumulated?

Of course, picking the right triggers and remedial actions is no easy task, and it is also worthwhile to avoid fighting the last battle when designing policy. Moreover, remedial actions should be designed to avoid exacerbating a firm’s deteriorating financial condition. Nevertheless, the problems the FRB described when proposing early remediation rules in 2012 (“that the condition of large banking organizations can deteriorate rapidly even during periods when their reported capital ratios are well above minimum requirements”)[42] appear to still be present and to have been a part of the reason why the SRE needed to be used in resolving SVB. Moreover, it is not clear, for example, that given the problem that section 166 is designed to address, whether higher capital requirements would avoid a similar situation in the future.

Accordingly, DFA section 166 seems like a targeted tool that can be evaluated and used to fill the regulatory gaps that March 2023 revealed. In all events, the fact that designing rules involves complicated policy judgments, such as those described above, does not seem like a reason for the agencies to avoid faithfully implementing the laws on the books.[43]

Capitalizing Unrealized Losses on Investment Securities

As also reviewed above, the agencies previously said that having AOCI flow through to regulatory capital results in a capital measure that better reflects banking organizations’ actual loss absorption capacity at a specific point in time. This prior statement appears, in hindsight, to have been correct and worth revisiting, as the agencies recently have proposed.[44] Indeed, in this regard, the way unrealized losses were treated for SVB appears to show that, at least in this respect, capital did in fact play a role in its failure, given that the negative equity position likely caused depositors to have concern about the bank’s financial condition.

That said, the agencies naturally will have to grapple with the question that they previously noted, in particular, whether “tools used by larger, more complex banking organizations for managing interest rate risk are . . . readily available for all banking organizations” and, if not, the size threshold at which having AOCI flow through to capital is not necessary.[45] Making this judgment should involve considering the size above which resolution of an institution is likely to threaten financial stability. This question, however, should not be viewed in isolation. For example, if clear and strong early remediation requirements are in place, as discussed above, and the way in which the FDIC plans for resolution, as discussed below, is enhanced, then the likelihood that the failure of even a relatively large firm would threaten financial stability should be (perhaps materially) lower.

Preparing for Resolution and Developing an Effective Resolution Framework

Another lesson from SVB’s failure is perhaps one of the more obvious—beginning the process to resolve a $200 billion bank the evening before its failure does not provide sufficient runway to conduct an orderly resolution. Thus, the natural question that follows is this: When should the FDIC begin to actively plan for resolution?

For example, if there had been triggers for the FDIC to begin to prepare—such as SVB’s deposit outflows or the dramatically large unrealized losses on SVBFG’s balance sheet and the effective result that had on equity levels—would the SRE have been needed? If the FDIC had begun to prepare for SVB’s resolution, for example, in September 2022 (when the equity balance was negative ~$2.9 billion (see Chart C)) or after year-end 2022 (with average total and average noninterest-bearing deposits down ~8 percent and ~30 percent, respectively, in twelve months (see Chart D)), would the firm’s failure have been easier to manage? Perhaps the FDIC and other regulators would have been able to use this time to identify impediments to a sale, remedy them, and be ready to sell the firm to one or more buyers over a weekend. In addition, this time could have allowed the FDIC and other regulators to evaluate the type of resolution that was best suited to the circumstances. For example, was a resolution of the bank and bankruptcy of the holding company most appropriate, or would invocation of the DFA’s Title II orderly liquidation authority have been useful?

Further, would SVB’s management and board have been spurred to act more swiftly to address the firm’s deteriorating condition if they were advised by the FDIC that the agency was beginning plans for the resolution and sale of the firm? Experience suggests that hearing that message from the FDIC is sobering for management and a board and stiffens the spine to take difficult, and perhaps previously hard to imagine, actions.

Another adjacent question is whether clear and strong early remediation requirements could have worked in tandem with earlier resolution preparedness. Of course, important questions would need to be considered, such as: What are the appropriate triggers for resolution preparedness? Which agency should be responsible for calling in the FDIC to begin that preparation?

Conclusion

All of the above policy considerations, and the others being considered by policymakers, are complex, and different solutions have associated pros and cons. Financial regulatory policy is sufficiently complex that no one proposal is ever likely to provide a magic bullet. The above, however, shows that the DFA had provisions designed to address situations like the one that transpired earlier in 2023, but those provisions were never implemented. To that end, this article aims to put forward for consideration targeted proposals for using those tools in a way that would address the vulnerabilities revealed in the spring of 2023 and would help forge a more resilient financial system—and, in doing so, hopefully avoid, as Tarullo said, an overreaction that could exacerbate broader structural problems facing the banking sector.

This article represents the views of the author, not those of his firm or any client of the firm. The author gratefully acknowledges the assistance of Jeremy R. Lee, associate at Davis Polk, in the preparation of this article. The author also would like to acknowledge with gratitude the willingness of Alex LePore to take the time to challenge and help refine the author’s policy thoughts, whether we agree or disagree, including those thoughts presented in this article.

Press Release, Fed. Deposit Ins. Corp., FDIC Creates a Deposit Insurance National Bank of Santa Clara to Protect Insured Depositors of Silicon Valley Bank, Santa Clara, California (Mar. 10, 2023); Press Release, Fed. Deposit Ins. Corp., FDIC Establishes Signature Bridge Bank, N.A., as Successor to Signature Bank, New York, NY (Mar. 12, 2023); Press Release, Fed. Deposit Ins. Corp., JPMorgan Chase Bank, National Association, Columbus, Ohio Assumes All the Deposits of First Republic Bank, San Francisco, California (May 1, 2023). ↑

The Economic Growth, Regulatory Relief, and Consumer Protection Act, S. 2155, 115th Cong. (2018). ↑

See David Wessel, Talking to Dan Tarullo About Bank Mergers, Stress Tests, and Supervision, Brookings (Aug. 10, 2023) (“That’s changed, as so much in the country has changed. Issues that were formerly a little bit blurred have become increasingly partisan. It’s almost as if, when people from one party have a position, there’s a reflexive instinct on people from the other party to oppose that position.”). ↑

Dodd-Frank Wall Street Reform and Consumer Protection Act, H.R. 4173, 111th Cong. (2010) [hereinafter DFA]. ↑

See id. §§ 202(g), 166. ↑

Press Release, Fed. Deposit Ins. Corp., FDIC Adopts Final “Prompt Corrective Action” Rule (Sept. 15, 1992). ↑

See Enhanced Prudential Standards and Early Remediation Requirements for Covered Companies, 77 Fed. Reg. 634 (proposed Jan. 5, 2012) (to be codified at 12 C.F.R. pt. 252) (“The crisis also revealed fundamental weaknesses in the U.S. regulatory community’s tools to deal promptly with emerging issues.”) [hereinafter Early Remediation Reqs.]. ↑

U.S. Government Accountability Off., GAO-11-612, Bank Regulation: Modified Prompt Corrective Action Framework Would Improve Effectiveness (2011). ↑

DFA § 166. ↑

Early Remediation Reqs., 77 Fed. Reg. at 634. ↑

Id. ↑

Id. at 637. ↑

Id. ↑

Id. at 638. ↑

Id. ↑

Press Release, Fed. Rsrv., Federal Reserve Board Approves Final Rule Strengthening Supervision and Regulation of Large U.S. Bank Holding Companies and Foreign Banking Organizations (Feb. 18, 2014). ↑

Regulatory Capital Rules, 78 Fed. Reg. 62,020, 62,022 (Oct. 11, 2013). ↑

Id. at 62,024. ↑

Id. ↑

Id. at 62,060. ↑

Id. ↑

Id. ↑

Id. at 62,027. ↑

Fin. Stability Oversight Council, Annual Report 36–39 (2022). ↑

Id. ↑

Id. ↑

See Michael S. Barr, Bd. of Governors of the Fed. Rsrv. Sys., Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank 22–23 (2023). ↑

Id. at 87. ↑

SVB Fin. Grp., Quarterly Report (Form 10-Q) (May 6, 2022); SVB Fin. Grp., Quarterly Report (Form 10-Q) (Aug. 8, 2022); SVB Fin. Grp., Quarterly Report (Form 10-Q) (Nov. 7, 2022); SVB Fin. Grp., Annual Report (Form 10-K) (Feb. 2, 2023). ↑

Barr, supra note 29, at 4. ↑

SVB Fin. Grp., Annual Report (Form 10-K). ↑

Recent Bank Failures and the Federal Regulatory Response: Hearing Before the S. Comm. on Banking, Hous., & Urb. Affs., 118th Cong. 7 (Mar. 28, 2023) (statement of Martin J. Gruenberg, Chairman, Federal Deposit Insurance Corporation). ↑

Press Release, Fed. Deposit Ins. Corp., FDIC Acts to Protect All Depositors of the Former Silicon Valley Bank, Santa Clara, California (Mar. 13, 2023). ↑

Cong. Rsch. Serv., IF12378, Bank Failures: The FDIC’s Systemic Risk Exception (Apr. 11, 2023). ↑

Press Release, supra note 37. ↑

Press Release, Fed. Deposit Ins. Corp., First–Citizens Bank & Trust Company, Raleigh, NC, to Assume All Deposits and Loans of Silicon Valley Bridge Bank, N.A., from the FDIC (Mar. 26, 2023). ↑

Press Release, Fed. Rsrv. & Fed. Deposit Ins. Corp., Statement by Vice Chair for Supervision Michael S. Barr (July 27, 2023). ↑

Jonathan McKernan, Member, Fed. Deposit Ins. Corp. Bd. of Dirs., Statement on Resolution of First Republic Bank (May 1, 2023). ↑

Graham Steele, Assistant Sec’y for Fin. Insts., U.S. Dep’t of the Treasury, Remarks at the Americans for Financial Reform Education Fund (July 25, 2023). ↑

Press Release, Fed. Rsrv., Statement by Governor Michelle W. Bowman (July 27, 2023). ↑

Wessel, supra note 3. ↑

Early Remediation Reqs., supra note 7, at 601. ↑

To this end, another of DFA’s requirements that merits revisiting is the unfulfilled obligation of the federal banking agencies to adopt rules regarding the requirement for a bank holding company or savings and loan holding company to act as a source of financial strength for any subsidiary depository institutions. See 12 U.S.C. § 1831o-1. ↑

See Fed. Rsrv., Notice of Proposed Rulemaking: Regulatory Capital Rule: Amendments Applicable to Large Banking Organizations and to Banking Organizations with Significant Trading Activity (July 27, 2023). ↑

Regulatory Capital Rules, 78 Fed. Reg. 62,027 (Oct. 11, 2013). ↑