The Delaware Chancery Court has issued a notable opinion that confirms Delaware’s position as a pro-sandbagging jurisdiction and clarifies when damages may be computed using a transaction multiple. These are important points for parties to take into account when negotiating and drafting acquisition agreements.

In re Dura Medic Holdings, Inc. Consolidated Litigation[1] involved a private equity firm’s acquisition of a medical equipment supplier through a reverse triangular merger. As explained in more detail below, the buyer sought indemnification from the sellers for breaches of certain representations and warranties in the merger agreement.

Sandbagging

Background

The sellers represented and warranted that the target company had been in compliance with applicable healthcare laws and, except as otherwise disclosed, had not received written notice of alleged noncompliance from any government authority in the three years prior to closing. The disclosure schedules described one such notice, but soon after closing, the buyer discovered others, one of which resulted in further government review and significant expense to the buyer. The buyer sued the sellers for breach of the representation. In response, the sellers contended that the buyer’s claim failed because the sellers had informed the buyer about the relevant notices in a conference call during pre-closing due diligence.

Sandbagging Jurisprudence in Delaware

In M&A transactions, the term “sandbagging” refers to circumstances in which a buyer asserts a claim after the closing based on a breach of a representation or warranty despite having had reason to suspect it was inaccurate as of the closing. The term has a negative connotation,[2] suggesting that the buyer is seeking to entrap the seller by concealing what the buyer knows and feigning reliance on the representation.

Delaware courts will enforce provisions in M&A agreements that expressly allow sandbagging (“pro-sandbagging” provisions) or expressly prohibit it (“anti-sandbagging” provisions, which effectively require the buyer to prove that it did not have knowledge of the inaccuracy of a representation or warranty in order to bring a claim). In cases where the acquisition agreement is silent, Delaware’s default position was widely thought to be pro-sandbagging, based in part on Chancery Court holdings by then–Vice Chancellor Leo E. Strine, Jr. However, the Delaware Supreme Court’s 2018 opinion in Eagle Force Holdings, LLC v. Campbell included dicta that muddied the waters. In a footnote, the majority opinion seemed to support a pro-sandbagging position (citing a New York line of cases)[3] while a concurring opinion by then–Chief Justice Strine cited to a 1913 opinion for the proposition that “[v]enerable Delaware law casts doubt” on a buyer’s ability to engage in sandbagging.[4]

Since Eagle Force, Delaware courts have consistently adopted a pro-sandbagging default position. Two post-trial Chancery Court opinions held that a buyer could terminate an acquisition agreement when the seller’s representations were incorrect even though the buyer was aware of the inaccuracy at an earlier stage of the transaction.[5] In another post-trial opinion, the Chancery Court held that sandbagging was not implicated because the buyer lacked actual knowledge that the seller’s representations were false; however, then–Vice Chancellor Joseph R. Slights III wrote: “In my view, Delaware is, or should be, a pro-sandbagging jurisdiction.”[6] Despite this general pro-sandbagging trend, none of these opinions squarely addressed the question of whether a buyer’s pre-closing knowledge of the inaccuracy of a seller’s representation or warranty would prevent the buyer from bringing a post-closing contractual indemnification claim for breach of that representation or warranty. In re Dura Medic addresses this issue.

The Court’s Holdings

In his opinion, Vice Chancellor J. Travis Laster noted that representations and warranties in an acquisition agreement serve to allocate risk between the parties and, unlike fraud claims, do not require a buyer to prove that it justifiably relied on the representations. He reiterated his pro-sandbagging holding in Akorn, Inc. v. Fresenius Kabi AG, which in turn quoted extensively from a pre–Eagle Force Vice Chancellor Strine opinion:

A breach of contract claim is not dependent on a showing of justifiable reliance. . . . [R]epresentations like the ones made in the agreement serve an important risk allocation function. By obtaining the representations it did, the buyer placed the risk [of inaccuracies] on the seller. Its need then, as a practical business matter, to independently verify those things was lessened because it had the assurance of legal recourse against the seller in the event the representations turned out to be false. . . . Having contractually promised the buyer that it could rely on certain representations, the seller is in no position to contend that the buyer was unreasonable in relying on the seller’s own binding words.[7]

Vice Chancellor Laster emphasized that, by making a representation and warranty, a seller agrees to assume the risk that the facts and circumstances as represented are or may become incorrect, regardless of the foreknowledge of either the buyer or the seller. This approach not only holds the parties to the plain terms of their acquisition agreement, but it serves to reduce due diligence costs, especially when a buyer is confronted with circumstances that may be subject to change or otherwise difficult to determine at the time of contracting.

Vice Chancellor Laster made the additional point that, for breach of contract claims (as opposed to fraud claims), a standard integration clause prevents information outside of the four corners of the agreement from operating to modify the agreement.[8] In the case of In re Dura Medic, this meant that, even if the sellers had disclosed other governmental notices to the buyer during the pre-closing due diligence process (the court ultimately found that they had not), such disclosures would only modify the representation if they appeared in the transaction documents.

Key Points for Buyers

As the latest installment in Delaware’s pro-sandbagging jurisprudence, In re Dura Medic should give buyers greater assurance that, unless sellers include an express anti-sandbagging provision in an acquisition agreement, their representations and warranties will be interpreted as they are written to shift risk to the sellers. While buyers can further strengthen their position through an express pro-sandbagging provision (at least perhaps until the Delaware Supreme Court speaks to the issue), In re Dura Medic holds that a standard integration clause will function essentially as a pro-sandbagging provision. As interpreted by Vice Chancellor Laster, such a clause will prevent sellers from claiming that information provided to buyers outside of the transaction documents (whether through due diligence, site visits, employee interviews, emails, or otherwise) operates to modify the sellers’ representations.

Key Points for Sellers

If sellers want anti-sandbagging protection, they should include an express anti-sandbagging provision in the acquisition agreement and, in a transaction that contemplates a bifurcated sign and close, a mechanism to update the disclosure schedules. In the absence of these protections, information provided to a buyer during pre-closing due diligence that does not appear in the transaction documents likely will not modify the sellers’ representations and warranties. Accordingly, sellers should take care to ensure that their representations and warranties are accurate and appropriately qualified and that disclosure schedules are complete.

Use of a Transaction Multiple to Calculate Damages

Background

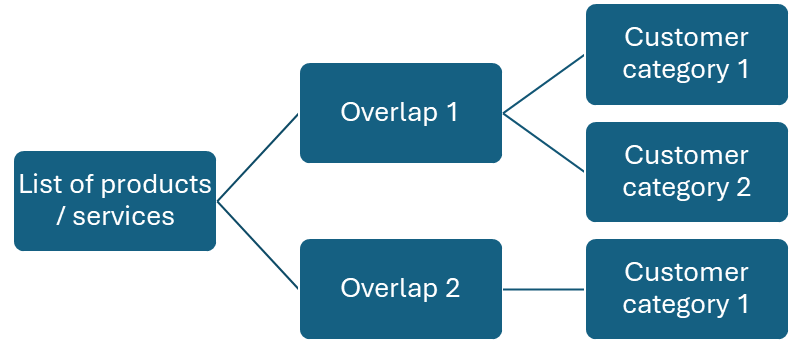

In the merger at issue in In re Dura Medic, the purchase price for the target company was calculated using its EBITDA for the twelve months ending April 30, 2018, multiplied by 6.7797. The merger agreement provided that the sellers would indemnify the buyer for “Losses” resulting from inaccurate representations, with “Losses” defined as “any and all damages,” including “damages based on a multiple of earnings, revenue or other metric.”[9] Despite expressly allowing for damages to be calculated using a transaction multiple, the agreement was silent as to when a multiple should or should not be used.

The sellers represented and warranted in the agreement that no significant customer had notified the target company of an intent to terminate or reduce its business. This representation proved to be false with respect to two customers. Vice Chancellor Laster calculated damages based on the loss of earnings that would have been received from those customers during the same twelve-month period used to calculate the purchase price. At issue was whether the Losses over this twelve-month period should be multiplied by 6.7797 to mirror the purchase price calculation. The sellers argued that no multiple should apply because the target company was not permanently impaired by the loss of the two customers and because the buyer had failed to mitigate the losses.

The Court’s Holdings

Vice Chancellor Laster applied the 6.7797 multiple to calculate damages. He held that when an acquisition agreement is silent as to when a multiple should be applied, the court must look to the common law, which allows a party to “recover reasonable expectation damages based on a multiple where the price was established with a market approach using a multiple.”[10] He cited evidence—namely, the buyer’s pre-closing investment committee memorandum and expert testimony—that proved that the buyer had derived the purchase price using a 6.7797 multiple of EBITDA during the applicable twelve-month period. He also rejected an argument by the sellers that losses must permanently affect a business in order for a transaction multiple to apply to the calculation of damages.[11] Instead, he found that “[w]hether a misrepresentation diminishes the value of the business sufficiently to warrant applying a multiple turns on the extent to which the misrepresentation affects future earning periods.”[12] Using that standard, he found that the undisclosed customer losses resulted in recurring declines in the target company’s revenue, which resulted in the buyer paying an inflated purchase price and caused damages that the buyer could not mitigate due to the sellers’ breach of its significant customer representation.

Key Points

Many acquisition agreements are silent as to whether and when a transaction multiple will be applied to calculate damages. In re Dura Medic stands for the proposition that, when the purchase price is calculated using a transaction multiple and the suffered loss would have impacted that price, the court may interpret such silence by looking to the common law, which allows the buyer to seek multiple-based damages. This holding may encourage some buyers to leave the acquisition agreement silent on multiple-based damages, but sellers should be aware of the risk this presents and consider drafting the agreement to expressly exclude multiple-based damages or otherwise limit the circumstances under which such damages may apply.

Buyers that wish to ensure that a transaction multiple is used to calculate damages for breaches of the sellers’ representations and warranties should expressly state in the acquisition agreement that multiple-based damages may be recovered. Buyers should also be prepared to support their position with evidence (e.g., pre-closing deal models, investment committee memoranda, or fact or expert witness testimony) that demonstrates that the purchase price was calculated using a transaction multiple and that a lower purchase price would have been paid (or that the buyer would not have closed on the transaction) if the seller made accurate representations and disclosures in the transaction documents.

The authors would like to thank Andrew J. Spadafora for his contributions to this article.

___ A.3d ___, Cons. C.A. No. 2019-0474-JTL (Del. Ch. Feb. 20, 2025) (Laster, V.C.). ↑

The term “sandbagging” has a criminal derivation: “In the 19th century, ruffians roamed the streets armed with cotton socks. These ostensibly harmless socks were filled with sand and used as weapons to rob innocent, unsuspecting victims. Sandbaggers, as they came to be known, were reviled for their deceitful treachery: representing themselves as harmless, until they have you where they want you. Then, revealing their true intentions, they spring their trap on the unwitting.” Arwood v. AW Site Servs., LLC, C.A. No. 2019-0904-JRS, slip op. at 71–72 (Del. Ch. Mar. 9, 2022) (Slights, V.C.) (quotations and citations omitted). ↑

Eagle Force Holdings, LLC v. Campbell, 187 A.3d 1209, 1236 n.185 (Del. 2018) (Valihura, J., majority opinion). ↑

Id. at 1247 (Strine, C.J., concurring in part and dissenting in part). ↑

Restanca, LLC v. House of Lithium, Ltd., C.A. No. 2022-0690-PAF (Del. Ch. June 30, 2023) (Fioravanti, V.C.), aff’d, 328 A.3d 328 (Del. 2024); Akorn, Inc. v. Fresenius Kabi AG, C.A. No. 2018-0300-JTL (Del Ch. Oct. 1, 2018) (Laster, V.C.), aff’d 198 A.3d 724 (Del. 2018). ↑

Arwood, slip op. at 6. ↑

In re Dura Medic Holdings, Inc. Consol. Litig., Cons. C.A. No. 2019-0474-JTL, slip op. at 32 (Del. Ch. Feb. 20, 2025) (Laster, V.C.) (quoting then–Vice Chancellor Strine’s holding in Cobalt Operating, LLC v. James Crystal Enters., LLC, C.A. 714-VCS (Del. Ch. July 20, 2007); textual revisions in the original not shown). ↑

An integration clause is a provision by which the parties agree that the transaction documents constitute the entire agreement and supersede all prior agreements and understandings, both written and oral, between the parties with respect to the subject matter. ↑

In re Dura Medic, slip op. at 17 (emphasis added). ↑

Id. at 47 (quotations and citations omitted). ↑

To support this argument, the sellers cited Zayo Group, LLC v. Latisys Holdings, LLC, C.A. No. 12874-VCS (Del. Ch. Nov. 26, 2018). However, Vice Chancellor Laster found Zayo Group to be factually distinguishable and held that it did not create a test for future cases requiring a permanent loss or diminution in business value for a transaction multiple to be applied. See In re Dura Medic, slip op. at 48–49. ↑

Id. at 49. ↑