As the M&A market breaks records, the pandemic wears on, and new market trends emerge, deal lawyers are likely to continue to confront a host of drafting challenges and reassess routine provisions in mergers and acquisitions contracts. From buzzwords to vaccines, here are some thoughts on what deal agreements might look like in 2022.

Pandemic Year Three

2022 will be the third year of the Covid-19 pandemic. Deal lawyers have adjusted quickly to the crisis, both in how they have conducted the deal process (see, for example, the discussion below on remote closings) and how they have addressed the complex collection of evolving pandemic-related issues that impact businesses and transactions in the body of their agreements.

As the pandemic continues to evolve, contract provisions will continue to do the same. One of the newer issues, which has only recently begun to show up in publicly available agreements, is Covid-19 vaccines. With government and corporate vaccine mandates increasing in prevalence, and the administration of Covid-19 booster shots just getting underway, agreements will increasingly need to address the vaccines—potentially in a wide range of provisions from representations and warranties to post-closing covenants. (By way of example, the definition of “fully vaccinated” could at some future time include the notion of booster shots or new health measures that protect workers against future variants, potentially impacting a variety of representations, covenants, and other provisions.)

With some pandemic issues, what we have seen is less evolution and more vacillation: the easing, then tightening, then easing again of health measures like masking and social distancing due to a variety of reasons, including the availability of new data and the emergence of new virus variants. Also, businesses are navigating a patchwork of conflicting guidance and best practices. This continuing state of change will undoubtedly impact how provisions, such as those regarding the ordinary course of business vis-à-vis Covid-19 and Covid-related exceptions to access-to-information covenants, are drafted. It could also impact how reasonableness is interpreted, as well as which, if any, reasonableness requirements parties elect to include in their references to Covid-19 responses.

On a related issue, will we get to a point where we are so deep into the pandemic that parties don’t feel the need to make qualifications to the definition of the ordinary course of business anymore, because pandemic ordinary course has already been in place for years?

There’s also a potential scenario none of us wants to consider, but given the events of the past year, it’s hard not to: What if, goodness forbid, the pandemic unexpectedly gets worse (again)? What if it gets really really bad? Right now, the pandemic market standard is to exclude pandemics generally, with it being very common to also explicitly exclude the current pandemic from the scope of the definition of “Material Adverse Effect” (MAE). Many of these exclusions go as far as to also exclude “worsening” and “future waves” of the pandemic. So with respect to these deals that exclude the pandemic from the MAE scope, especially those also explicitly excluding the worsening thereof, the answer would be that in such a doomsday scenario, those deal parties will most likely still be on the hook to close the deal, depending on the specifics of the agreement.

The pandemic has already caused legal scholars to take a more critical look at MAE definitions and MAE-related provisions. On one hand, changes in the severity of the pandemic could imaginably lead to shifts in the current MAE-exclusion trends. On the other hand, the legal scholarship and practitioner discourse that has been sparked by Covid-19 could introduce some new innovative approaches to MAEs with the potential to solve problems with the standard framework that long predate the pandemic.

The Future Arriving

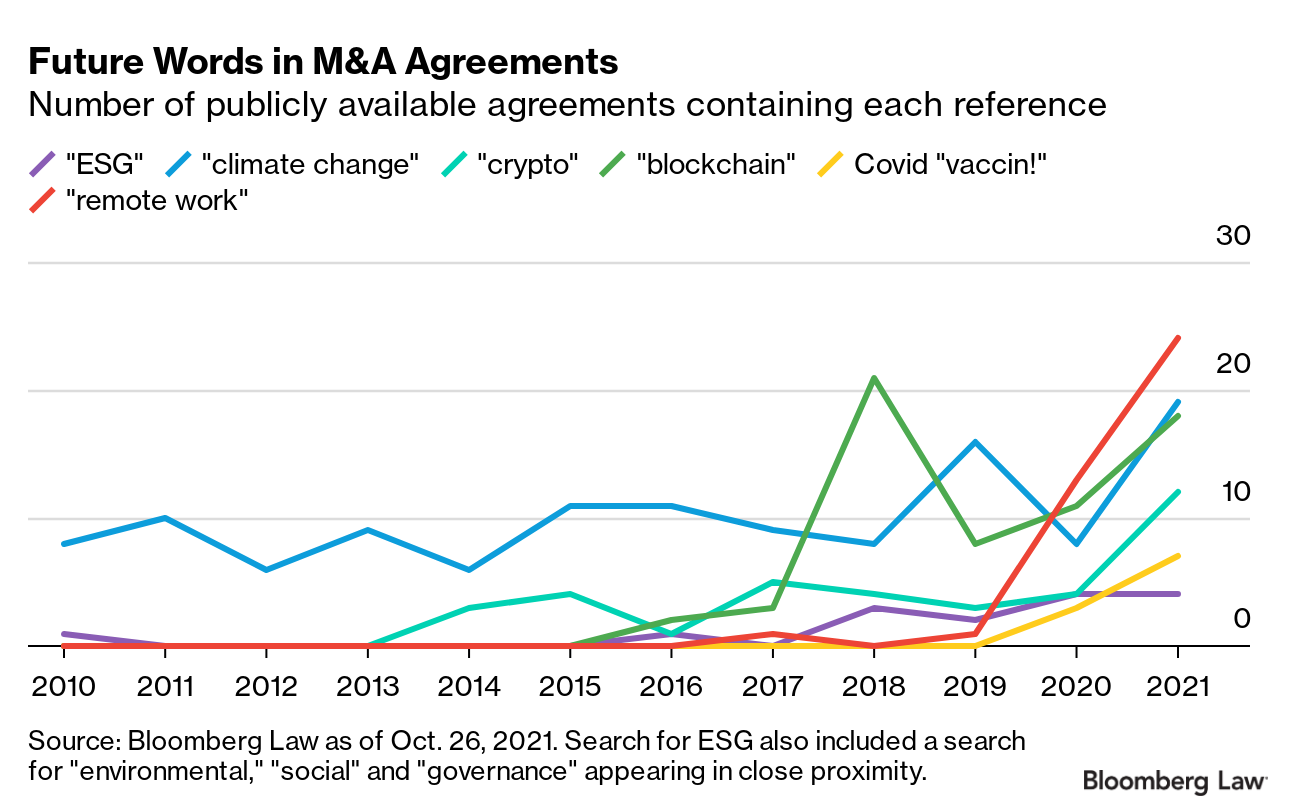

In the the world of M&A, everything is up this year. So are references in M&A agreements to certain emerging issues and trending market topics that make it feel like, in some areas, the future is already arriving. “Future words” feels like an appropriate label for these, though some might call them “buzzwords.”

According to Bloomberg Law Precedent Search, which is an advanced search of M&A agreements filed with the SEC via EDGAR, references to “remote work” in publicly available agreements first appeared in 2017. But the numbers clearly reflect that it didn’t become a thing until last year. Only one agreement containing the phrase appeared in 2017, and we found zero in 2018. References to “remote work” have jumped from only one agreement containing the exact phrase in 2019 to 13 agreements in 2020, and 24 agreements in 2021 thus far. Considering the slow pace of return to the office, we expect to continue to see “remote work” show up in deal agreements in 2022.

As discussed above, the issue of Covid-19 vaccines is an emerging one, and while our search yielded only three agreements containing a reference to Covid vaccines in 2020, we have found seven such agreements in 2021 as of October 26.

Corporate and market interest in cryptocurrency and blockchain are on the rise, and so are the number of agreements containing these exact phrases. “Crypto”—which, according to our search, has never appeared in more than five publicly available agreements in any prior year—has appeared in 12 M&A agreements this year, marking a significant leap in presence.

Corporations are incorporating sustainability, diversity, human rights, and other corporate social responsibilities (CSRs) into their contracts. Thus far, in M&A, references to “ESG” or “environmental, social, governance” are still found in very few publicly available agreements. Based on our search, 2020 and 2021 have had the highest number of agreements referencing ESG yet, and we expect to see more in 2022, especially if ESG is incorporated into regulatory frameworks and financial systems. Potentially a related indicator for ESG is “climate change,” which had a consistent level of references in agreements over the past decade before reaching an all-time high in 2021.

Remote Closings

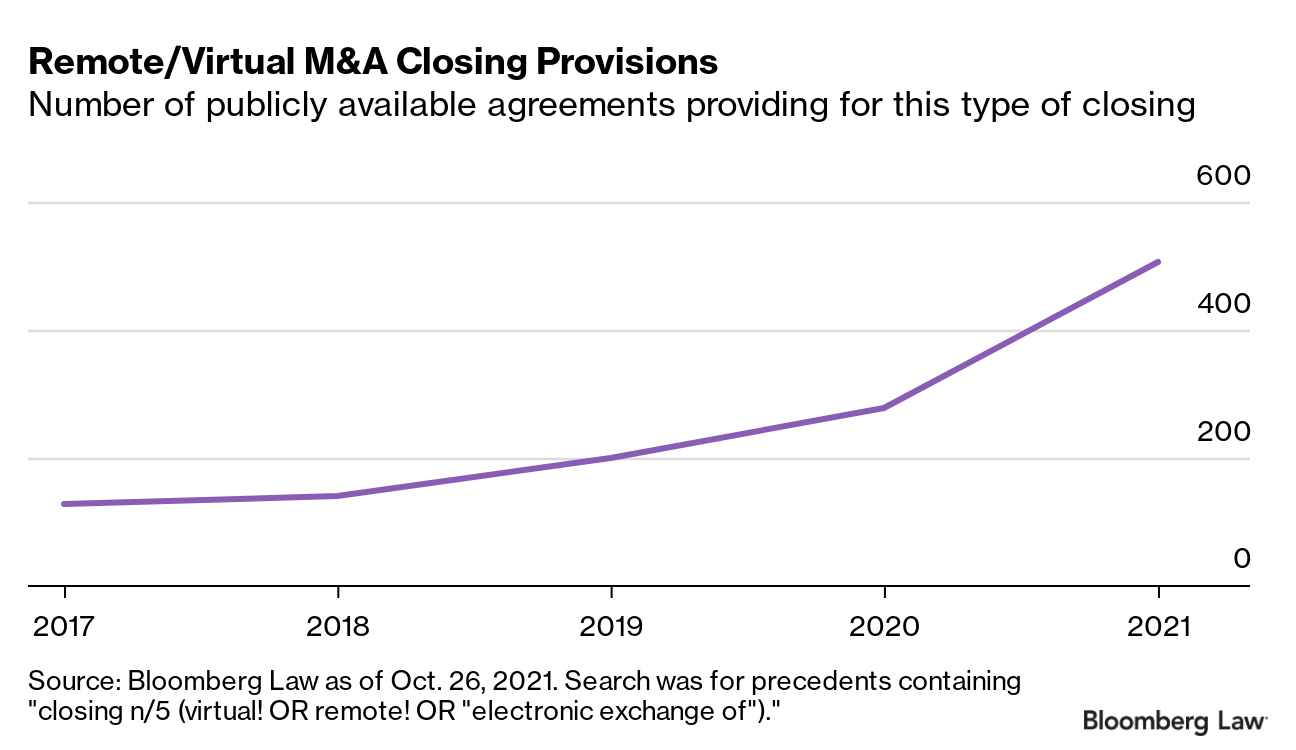

According to our search of publicly available M&A agreements, which was crafted to capture agreements that allow for “remote” or “virtual” closings, the number of agreements explicitly allowing this type of closing has surged this year.

In 2021, we found 506 agreements allowing for remote closings. This number is way up from 279 agreements in 2020 and 200 in 2019. Some are saying virtual dealmaking is here to stay, and these numbers make that stance hard to ignore.

PE Deal Drafting

There has been a massive amount of private equity M&A activity this year. When recently asked about the drafting trends he has been seeing in PE M&A deals, Andrew Nussbaum, corporate partner of Wachtell, Lipton, Rosen & Katz, noted that PE deals, both on the buy side and the sell side, “look more and more like a public company M&A transaction.” Nussbaum also noted that when the pandemic caused some deals to be renegotiated or terminated, it reminded sellers that “the boilerplate never matters until it does.” (The full discussion from August 2021 can be accessed here.) More public-style deal terms and closer attention to the boilerplate are trends to watch in PE deals into 2022.

This article was originally published on Bloomberg Law as “ANALYSIS: Predicting M&A Drafting Innovations in 2022” on Nov. 1, 2021.

Reproduced with permission. Bloomberg Law, Copyright 2021 by The Bureau of National Affairs, Inc. (800-372-1033) http://www.bloombergindustry.com