WHAT EXACTLY IS THIS PRIVATE TARGET DEAL POINTS STUDY, ANYWAY?

The Private Target Deal Points Study is a publication of the Market Trends Subcommittee of the Business Law Section’s M&A Committee. It examines the prevalence of certain contract provisions in publicly available, private target M&A transactions during a specified time period. The Private Target Deal Points Study is the preeminent study of M&A transactions and is widely utilized by practitioners, investment bankers, corporate development teams, and other advisors.

WHAT TIME PERIOD WILL BE COVERED BY THE STUDY?

The 2021 iteration of the Private Target Deal Points Study will analyze publicly available definitive acquisition agreements for transactions executed and/or completed either during calendar year 2020 or during the first quarter of 2021.

WHAT INDUSTRIES WILL BE COVERED BY THE STUDY?

The deals in the Private Target Deal Points Study reflect a broad array of industries. The healthcare, technology and industrial goods and services sectors together make up approximately 41% of the deals in this year’s study.

WHAT IS THE SIZE OF THE TRANSACTIONS OF THE STUDY?

The transactions analyzed in the Private Target Deal Points Study were in the “middle market,” with purchase prices ranging between $30 million and $750 million; purchase prices for most deals in the data pool were below $200 million.

WHERE ARE YOU IN THE PROCESS OF RELEASING THE STUDY?

Given the busier-than-ever M&A environment this year, our working group members had less than the usual amount of time to dedicate to their work on the study. The vast majority of our 10 issue groups have turned in their data, and the members are processing and analyzing it, and finalizing the slides.

CAN YOU SHARE ANY SNEAK PREVIEW DATA?

We shared a couple of sneak preview data points with attendees at the meeting of the Market Trends Subcommittee at the ABA’s M&A Committee meeting in September and encourage you to sign up for the M&A Committee and its various subcommittees if you haven’t already—at the following link on the ABA’s website.

We can give you a similar peek ahead (understand, however, that our process is still ongoing and thus these data points may not be final):

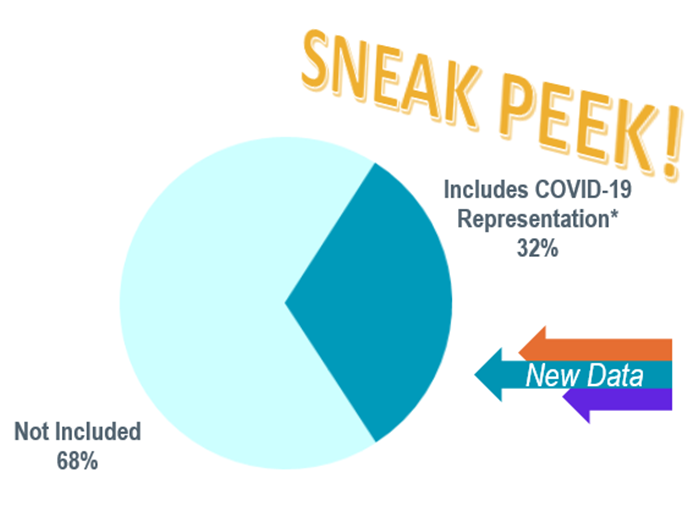

Consistently inconsistent COVID-19 representations

- The sneak peek: For obvious reasons, measuring representations related to COVID-19 is a new data point for the 2021 version of the Private Target Deal Points Study. What we learned is that the global pandemic impacted representations and warranties in our selected data set,[1] but not in a consistent way. Nearly one-third of our selected data set contained a representation related to COVID-19. However, these representations varied dramatically, covering matters such as the Paycheck Protection Program, furloughs, and supply chain matters.

- What to watch for: Given the broad range of approaches to representations related to COVID-19 in our selected data set, we will publish an addendum containing the specific representations when we release the 2021 version of the Private Target Deal Points Study.

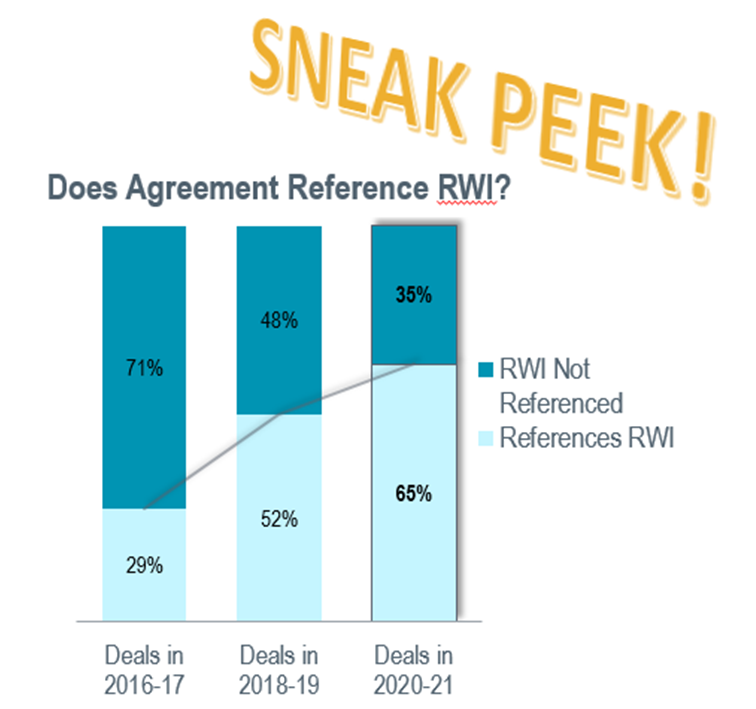

More RWI deals

- The sneak peek: Representations and warranties insurance (RWI) has been a huge game changer in M&A deals. We measure whether a deal in our study pool utilized RWI by the closest proxy we can access: whether the purchase agreement references RWI. (Of course, RWI may have been obtained without such a reference in the purchase agreement.) The 2017 version of the Private Target Deal Points Study showed RWI references in less than one-third of the deals. The 2019 version of the Private Target Deal Points Study marked the first time a majority of the deals referenced representations and warranties insurance (RWI). The 2021 version of the Private Target Deal Points Study shows even more growth, to nearly two-thirds of the deals referencing RWI.

- What to watch for: Use of RWI in a deal impacts a variety of the negotiated provisions, as evidenced by our prior study data correlations. We are correlating even more data points with RWI references in the 2021 version of the Private Target Deal Points Study, so watch for those.

Please keep an eye out for our study and for an In the Know webinar to be scheduled, during which the chairs and issue group leaders will provide analysis and key takeaways from the results of the 2021 Private Target M&A Deal Points Study.

[1] We recognize that it is not helpful to include in our denominator deals that were negotiated before the effects of the pandemic were understood in the United States. Thus, because our data set includes deals from 2020 and the first quarter of 2021, we excluded deals from this data point if the agreement was signed before March 11, 2020, which is the date the World Health Organization declared a global pandemic.