What Exactly Is This Private Target Deal Points Study, Anyway?

The Private Target Deal Points Study is a publication of the Market Trends Subcommittee of the Business Law Section’s M&A Committee. It examines the prevalence of certain contract provisions in publicly available, private target M&A transactions during a specified time period. The Private Target Deal Points Study is the preeminent study of M&A transactions and is widely utilized by practitioners, investment bankers, corporate development teams, and other advisors.

What Time Period Will Be Covered by the Study?

The 2023 iteration of the Private Target Deal Points Study will analyze publicly available definitive acquisition agreements for transactions executed and/or completed either during calendar year 2022 or during the first quarter of calendar year 2023.

What Industries Will Be Covered by the Study?

The deals in the Private Target Deal Points Study reflect the broad array of industries of the deals that were conducted in our time period. In this year’s study, the technology, healthcare, and financial services sectors together make up approximately 45 percent of the deals.

What Is the Size of the Transactions in the Study?

The transactions analyzed in the Private Target Deal Points Study were in the “middle market,” with purchase prices ranging between $30 million and $750 million; purchase prices for most deals in the data pool were below $200 million.

Where Are You in the Process of Releasing the Study?

Almost all of our ten issue groups have turned in their data, and we are processing and analyzing it, running quality control checks, and finalizing the slides.

Can You Share Any Sneak Preview Data?

We shared a couple of sneak preview data points with attendees at the meeting of the Market Trends Subcommittee at the ABA Business Law Section’s M&A Committee meeting in September and encourage you to sign up for the M&A Committee and its various subcommittees if you haven’t already—at the following link: Join the BLS M&A Committee.

We can give you a peek ahead (understand, however, that our process is still ongoing, and thus these data points may not be final):

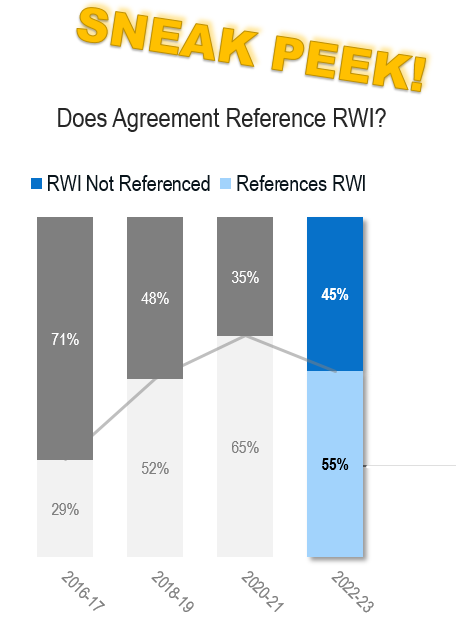

Number of deals referencing RWI has decreased for the first time

- The sneak peek: Representations and warranties insurance (RWI) has been a huge game changer in M&A deals. We measure whether a deal in our study pool utilized RWI by the closest proxy we can access: whether the purchase agreement references RWI. (Of course, RWI may have been obtained without such a reference in the purchase agreement.) The 2021 version of the Private Target Deal Points Study showed RWI references in nearly two-thirds of the deals referencing RWI. The 2023 version of the study will show a drop in RWI references, to 55%.

- What to watch for: Use of RWI in a deal impacts a variety of the negotiated provisions, as evidenced by our prior study data correlations. We are correlating even more data points with RWI references in the 2023 version of the Private Target Deal Points Study, so watch for those.

Please keep an eye out for our study and for an In the Know webinar to be scheduled, during which the chairs and issue group leaders will provide analysis and key takeaways from the results of the 2023 Private Target M&A Deal Points Study.