CURRENT MONTH (November 2022)

SPAC Mergers Are on the Rise

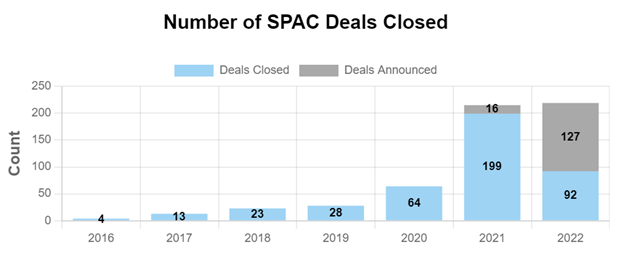

Over the past year, SPACs have been through market shifts, regulatory thrashing, economic issues, novel litigation theories, and SEC enforcement actions. But while new SPAC IPOs have slowed to a trickle, in the last three months, we saw an uptick in announced and completed SPAC mergers (deSPACs).

Source: SPAC Research

One deal that made headlines on November 18 and did fairly well out of the gate was the merger of Grindr, the world’s largest social networking app for the LGBTQ+ community, with Tiga Acquisition Corp. Is this one deal enough to turn the tide for SPACs and open the door for other successful business combinations in early 2023? Only time will tell. For now, according to SPAC Insider, 478 SPAC teams are still looking for a target as of November 28.

And some SPAC teams, thinking long and hard about the competitive market and their expiring clocks, are considering unusual alternatives. One of them is a merger with an already public company.

Public Company Merger

On the theory that some public companies may be more willing and able than private companies to enter into a merger with a SPAC, some SPAC teams are considering a merger with an already existing public company. An example of such a transaction is the merger of Coeptis Therapeutics Inc. with the SPAC Bull Horn Holdings Corp., which closed on October 31, 2022. The SPAC sponsor reportedly liked the idea because of greater transparency stemming from the publicly available performance record of the target.

For the public company, a merger with a SPAC provides a cash infusion from the SPAC’s trust account and access to the SPAC team’s expertise. For the SPAC, aside from the undeniable benefit of getting the deal done, the risk is presumably reduced.

There are several reasons. First, there are fewer issues with public company readiness, a problem that has plagued many newly de-SPACed companies. And second, there is the greater transparency of an already publicly filed business. I’ll leave it to the bankers to opine on whether the economics of these kinds of deals will benefit the investors in the SPAC and the target company.

From the insurance perspective, interesting questions come up as far as coverage of the original SPAC and its team prior to the merger. As with other unusual SPAC-related situations, the insurance coverage and costs need to be looked into thoroughly ahead of making any major budgeting decisions.

Mergers with already public companies arguably miss the point of the SPAC vehicle, which was designed as an alternative to a traditional IPO. However, in the current hostile market, I would not be surprised to see other similar transactions in the near future.