We know it’s essential to keep as up to date as possible in the reps and warranties (RWI) market, which is both relatively small and rapidly developing.

This month we witnessed a very substantial drop in pricing as well as an equally substantial increase in the number of quotes and competitiveness of the market. In this article, we will update the data and look at emerging trends.

What New RWI Deal Activity in April Means Going Forward

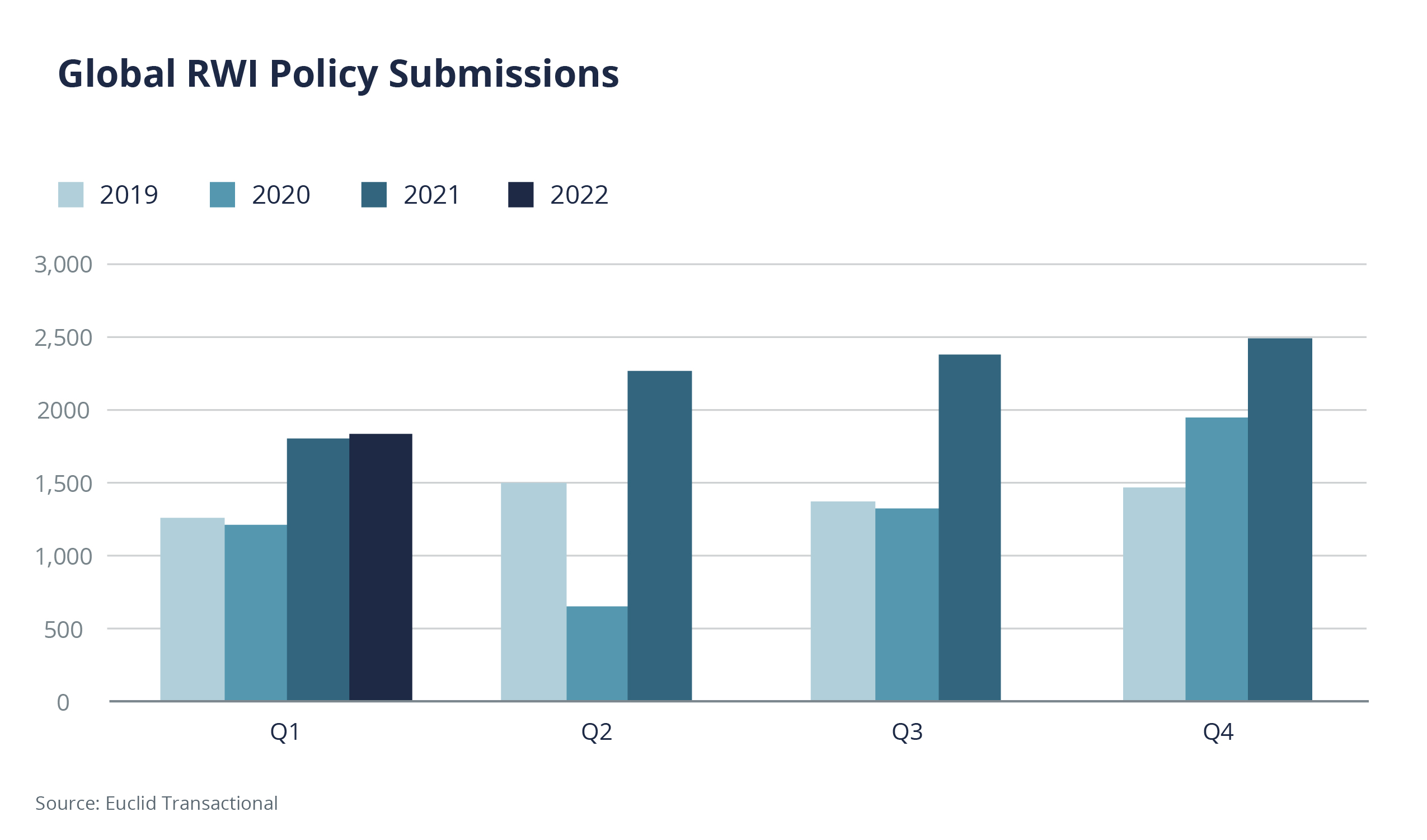

Although the M&A market continues to flourish, we saw a drop in activity in the first quarter. That is entirely common in the M&A cycle, with the first quarter traditionally being the slowest. You will see below the Euclid Transactional submission rate analysis for the first quarter. This shows a marked decrease from 2021 last quarter but slightly above par with 2021 first quarter.

However, we do believe that around mid-March an air of hesitancy entered the market, which we believe is due to interest rate–related financing concerns and geopolitical instability. As reported by Paul Weiss, “March was the second consecutive month of decline in the number of transactions.” M&A at a Glance (April 2021) | Paul, Weiss (paulweiss.com)

Comparing Year over Year and Quarter to Quarter: An Historical View of Trends

The RWI Statistics

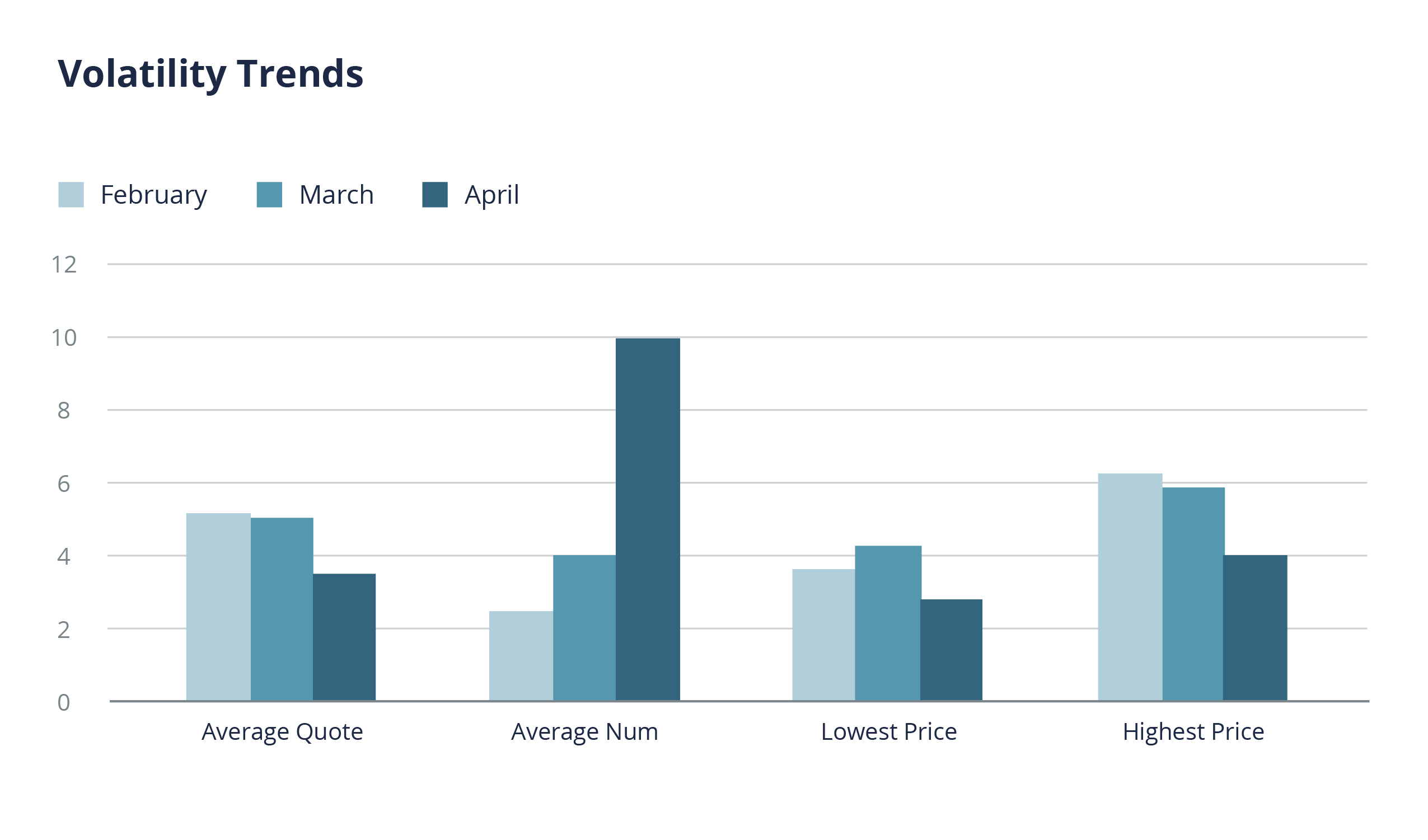

As we can see from the below data, the market has responded with alacrity to this change in conditions. While the activity may be on par with the first quarter of 2021, underwriters and markets ramped up in response to the growing activity last year and so face the level of activity in 2022 with more capacity and more staff.

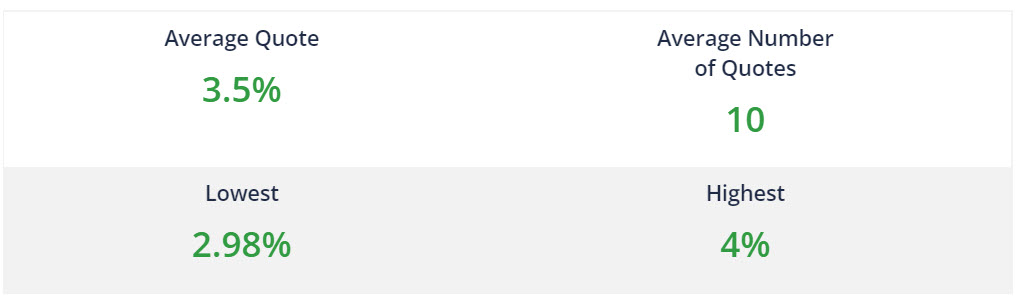

Overall, the news was very good for our clients and those needing reps and warranties insurance. The average number of quotes went through the roof and the premium prices we are seeing are on par with the beginning of 2021, if not slightly more competitive.

The lowest quote we saw was 2.98%, a return to early last year in terms of pricing. Unlike last month this low number was not as much of an outlier as previously seen. We are pretty much in the 3.5–4.5% range for most quotes right now.

The average quote was down from 5.1% to 3.5% which is a substantial decrease and shows the market’s ability to quickly adapt to changing circumstances. To put this in context, if you bought a $10 million policy in March, you would have paid roughly $510,000, and if you bought that same policy in April, it was more likely to cost $350,000.

The average number of quotes went from just over four to ten per risk, showing the continued excess supply of underwriting capacity either due to reduced deal flow, increases in human capital, or new entrants to the market.

As we saw above, the lowest price came in at 2.98%, which is a significant drop. What’s just as noteworthy is that the highest pricing has also dropped from 5.9% in March to 4% in April, again a substantial saving for deals priced this month as opposed to the previous month.

Trends in RWI “Heightened Risk” You Should Know

Anyone experienced in the process of placing an RWI policy should be familiar with the areas of heightened risk listed on every NBIL. These are the deal-specific areas on which underwriters will focus during their review of the diligence conducted by the buyer’s team of advisors. Should diligence be lacking in one of these areas, underwriters will likely seek to incorporate an exclusion in the policy for that portion of the risk.

Ukraine and Russia continue to be an area of heightened risk. However, we have seen underwriters drop the blanket approach and focus on those deals where it’s likely to be an actual issue rather than wanting to dig deep on every deal.

Three Cases of RWI Litigation

Arbitration as the first port of call is standard in RWI policies. Litigation around RWI has historically been difficult to find. There are currently three active cases in the court system right now. They have been around for a while, but we think it’s worth exploring them a little.

The three cases are:

Novolex Holdings, LLC v. Illinois Union Ins. Co, Index No. 656825

This dispute centers around the seller’s knowledge of the intention of its third-largest customer to significantly reduce business. This is currently pending a decision on the Insured’s summary judgment motion.

You can find a more thorough analysis here: Novolex Case Brings Lessons On R&W Insurance – Lexology

WPP Group USA, Inc. v. RB/TDM Investors, LLC, Index No. 656825

This case centers on whether financial projections were misrepresented and is currently in discovery. It’s interesting to note that in the WPP case the insured had the right to decide between arbitration and litigation and chose litigation.

You can find a more thorough analysis here: WPP Grp. U.S. v. RB/TDM Inv’rs , 2021 N.Y. Slip Op. 30160 | Casetext Search + Citator

pH Beauty Holdings III, inc. v. Certain underwriters at Lloyd’s, case no 21-1586 BLS

This case centers on the failure to account for millions of dollars in promotion expenses, which resulted in an inflation of the purchase price.

You may find more details of the case here: PH Beauty sues insurers to cover losses of ‘inflated’ deal | Reuters

None of these cases are resolved at this point, and extensive discovery is expected. We, therefore, anticipate that unless a settlement can be achieved quickly or through arbitration, long-term disputes are likely to be the norm.

All relate to claims of more than $10 million. We would expect to see litigation come into play for higher limit claims and don’t see this trend moving down to smaller claims. All three cases relate either to the accuracy of financial statements or material customers. We hear from the market that claims around material customers are much more prevalent and rising recently. While this is not relevant to the above, we expect this cause of conflict to continue. Material contract claims are where we see Covid issues materialize in the sense that Covid is often the inciting incident leading to a failure of a supplier or the customer to be able to maintain existing conditions.

What does this mean for you? While these go through the courts, it will be interesting to see how this impacts the buyer’s desire to maintain the right to litigate in court, whether expressly or by remaining silent on venue options. We imagine insurers will resist, because by and large they want to arbitrate as the first port of call. In some cases, arbitration is the only method of dispute resolution.

Going Forward: RWI Trends to Keep an Eye On

The market has returned to early 2021 levels in terms of pricing and competition. We imagine this will continue into the foreseeable future as the war in Ukraine and domestic economics play out, affecting the M&A market and the number of submissions.

The market has come to terms with the Ukrainian situation far more nimbly than it did COVID-19 and we also expect this to continue.

We anticipate more negotiation and pressure on dispute resolution clauses and more diligence on material contract reps going forward.

An earlier version of this article appeared in the Woodruff Sawyer M&A Notebook.