Stablecoins are cryptocurrencies designed to maintain a steady value by pegging themselves to a reserve asset, typically a fiat currency like the U.S. dollar. However, because many stablecoins have experienced market price fluctuation from their pegged value,[1] a number of foreign and domestic jurisdictions have passed laws regulating them.[2] While laws have been passed in the EU and elsewhere, the U.S. does not yet have a comprehensive federal law providing a clear legal framework specific to stablecoins. At the same time, some states have passed applicable laws and issued regulations.[3] Since stablecoins may be transacted across borders and overseas,[4] there is a strong interest in considering the interplay of regulation in foreign jurisdictions when formulating a domestic framework. Doing so may reduce regulatory arbitrage and help facilitate cross-border interoperability. This article will examine the existing state of global regulations and distill some common principles that may inform U.S. policymaking on the national level.

Overview of Stablecoins

Stablecoins are cryptocurrencies engineered to maintain a consistent value, typically by pegging themselves to a reserve asset. While many stablecoins are pegged to fiat currency like the U.S. dollar, they can also be linked to commodities or even other cryptocurrencies. The specific mechanism backing each stablecoin is stipulated by its smart contract—the computer code that created it.

Despite aiming to offer the benefits of digital assets without extreme volatility, many stablecoins have experienced market price fluctuations. Nevertheless, the stablecoin market has grown considerably, with fiat-backed stablecoin supply reaching approximately $159 billion in 2024.[5]

There are four main types of mechanisms aimed at maintaining stablecoin price stability:

- Fiat-backed stablecoins: Each stablecoin issued has a corresponding unit of currency or cash equivalent held in reserve, often U.S. T-bills, typically held in custody at a depository institution. This method ensures that the stablecoin can be redeemed for its fiat counterpart at a fixed rate. Measured in total market capitalization, fiat-backed stablecoins are by far the largest category of stablecoins.[6]

- Commodity-backed stablecoins: The value of each stablecoin is pegged to a specific value of a commodity (i.e., gold or silver), which is held in custody in secure vaults. The stablecoin issuer must hold enough of the commodity to fully back all circulating stablecoins.

- Crypto-backed stablecoins: Crypto-backed stablecoins are backed by other cryptocurrencies. They may be pegged to the price of the other cryptocurrencies or the price of a fiat currency. These stablecoins are often overcollateralized to account for the volatility of the reserve assets. This means that in order to provide a buffer against market fluctuations, the value of the cryptocurrencies held in reserve exceeds the value of the stablecoins issued.

- Algorithmic stablecoins: This type of stablecoin does not hold assets in reserve. Instead, an algorithm dynamically adjusts the supply by creating more stablecoins to reduce the price when demand falls or by destroying stablecoins to increase the price when demand rises. In theory, this “stabilizes” the value of the stablecoin relative to the target peg. In practice, these mechanisms have notoriously failed to maintain a stable peg.[7]

Stablecoins are used for several purposes, including trading and effectuating transactions. Because stablecoins aim to offer price stability, they may be used to facilitate payments, both in the U.S. and across borders. Stablecoins are also an actively traded component of the cryptocurrency markets because they can be readily exchanged for other cryptocurrencies. Since January 2020, the supply of fiat-backed stablecoins has grown from $5 billion to approximately $159 billion.[8]

European Union (EU)

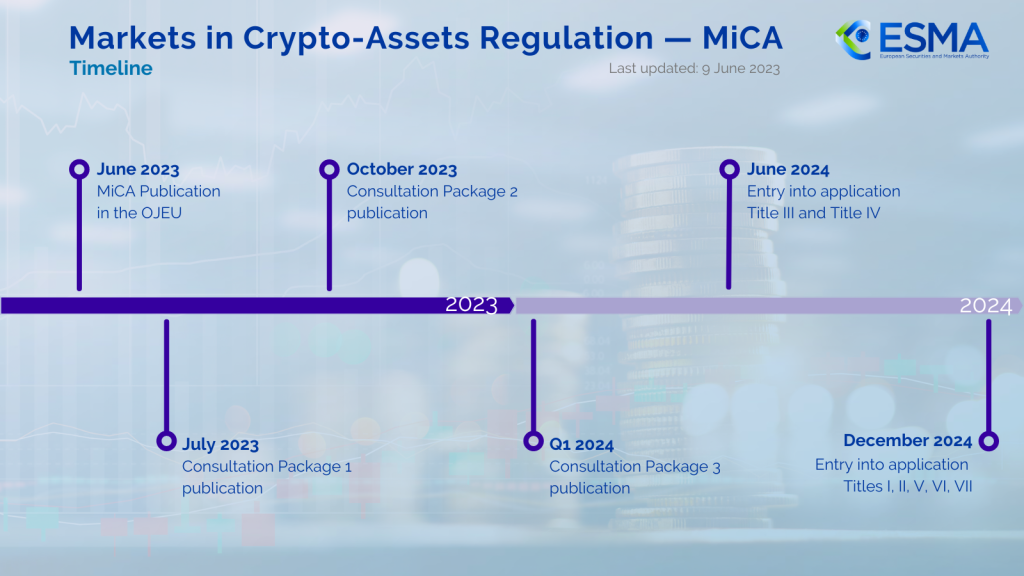

The EU Markets in Crypto-Assets Regulation (MiCA) was enacted in June 2023 and is slated for full implementation by December 2024 (see timeline below).[9]

The EU Markets in Crypto-Assets Regulation (MiCA) was enacted in June 2023 and is slated for full implementation by December 2024. Source: Markets in Crypto-Assets Regulation (MiCA), Eur. Sec. & Mkts. Auth. (last visited Sep. 18, 2024).

MiCA establishes a comprehensive regulatory framework to increase the safety and transparency of European digital asset markets.[10] The provisions of MiCA that are specific to stablecoins went into effect on June 30, 2024. The regulation encompasses several critical components such as licensing requirements for custodians and other crypto-asset service providers, enhanced consumer protections, specific stipulations for stablecoins, and provisions to prevent market abuse.[11]

MiCA categorizes stablecoins into two distinct types: electronic money tokens (EMTs) and asset-referenced tokens (ARTs).[12] EMTs are fiat-backed and intended to maintain a stable value relative to a single currency. They are treated similarly to electronic money under existing regulations. Conversely, ARTs are backed by several assets, potentially including multiple currencies, commodities, or financial instruments. This structure theoretically distributes risk but requires stringent oversight due to the varied underlying assets.

Specifically, MiCA designates fiat-backed EMTs as electronic money, requiring that issuers either have or obtain authorization as electronic money institutions (EMIs) or credit institutions (i.e., banks). To become authorized, an issuer must apply with the competent supervisory authority of its home member state. As EMIs, these issuers must adhere to the European Electronic Money Directive and MiCA-specific mandates.[13] These include the obligation to establish a legal entity within the EU, obtain authorization to operate, and publish a detailed crypto-asset white paper approved by a competent authority.[14] EMT issuers must maintain liquid reserves equal to the tokens in circulation, ensuring redemption at par value at any moment, even under market stress.[15] MiCA mandates that a minimum of 30 percent of these funds (or 60 percent in the case of “significant” EMTs)[16] be held in separate accounts at credit institutions, with the remainder invested in secure, low-risk, highly liquid financial instruments denominated in the same currency as the currency referenced by the EMT. Those liquid financial instruments must have minimal market, credit, and concentration risks.[17] Additionally, EMT issuers are not permitted to offer interest on these tokens and must implement robust measures for safeguarding reserves, handling customer complaints, and segregating reserve assets.

Issuers of ARTs face similar regulatory requirements, including obtaining authorization from their national competent authority unless the issuer is an authorized credit institution, issues tokens below a €5 million threshold over a twelve-month period, or restricts token sales to qualified investors. ARTs must give holders a perpetual redemption right, meaning that issuers must redeem tokens upon request.[18] MiCA also imposes strict rules concerning reserve composition, risk management, custody arrangements, governance, disclosure practices, complaints handling, and conflict of interest mitigation.

There are limits on how many ARTs and EMTs denominated in a non-EU currency can be used for exchange within the EU. These limits are expressed as trading volume caps.[19] This is part of MiCA’s broader aim “to address risks that the wide use of crypto-assets which aim to stabilise their price in relation to a specific asset or a basket of assets (such as ARTs) could pose to financial stability, the smooth operation of payment systems, monetary policy transmission or monetary sovereignty.”[20]

The European Banking Authority (EBA) is tasked with developing more detailed regulations for both EMTs and ARTs, further refining the governance framework established by MiCA.[21]

United Kingdom (UK)

In November 2023, the UK’s financial regulatory authorities—the Bank of England, the Financial Conduct Authority (FCA), and the Prudential Regulation Authorit—unveiled proposals for the first phase of a comprehensive regulatory framework for digital assets. This initial phase of the framework addresses fiat-backed stablecoins, defined as those intended to hold a stable value by reference to one or more specific fiat currencies.[22]

Under this proposed framework, any entity issuing or providing custodial services for fiat-backed stablecoins within the UK must obtain authorization from the FCA and adhere to stringent regulatory standards. These standards include segregating client assets, maintaining robust governance controls, and maintaining meticulous records. Additionally, issuers would be required to back the issued stablecoins with stable and liquid reserves to enable swift customer redemptions, and they would be prohibited from offering interest on these stablecoins.

The framework also categorizes stablecoin-based payments into two types: hybrid and pure. Hybrid transactions involve using a regulated stablecoin to enter or exit a transaction, while pure transactions are conducted entirely on-chain with a single stablecoin. Both types of transactions are subject to at least some aspects of the existing Payment Service Regulations, which will be expanded to encompass features unique to stablecoin transactions. This inclusion ensures that stablecoin users enjoy protections similar to those afforded to traditional payment service users, such as specific disclosures, execution time limits, and a structured process for resolving complaints.[23]

Phase 1 of the framework does not cover commodity-backed or algorithmic stablecoins, which are slated for consideration under Phase 2 regulations. Additionally, the UK is assessing how to appropriately regulate foreign stablecoins that participate in UK payment systems. The current proposals require that a UK-authorized firm approve such stablecoins as meeting standards equivalent to regulated (i.e., UK-issued) stablecoins. This can be contrasted with the EU approach of requiring stablecoins offered to the EU public to be issued by EU-incorporated entities and subject to local reserve requirements.

United States

While the U.S. lacks comprehensive stablecoin legislation, certain existing regulations apply. At the federal level, stablecoins would be considered convertible virtual currency (CVC) by the Financial Crimes Enforcement Network (FinCEN),[24] and thus obligations under the Bank Secrecy Act apply. Notably, the issue of whether stablecoins are securities or not is being actively litigated, such as in Securities & Exchange Commission v. Binance Holdings Ltd.[25]

Significant variation exists in state-level regulation of stablecoins. Across the country, money transmission laws apply to stablecoin-related activities. However, some states, such as New York, offer specific guidance or entire regulatory regimes tailored for stablecoins. New York pioneered the BitLicense in 2015, which operates as a license and charter-based system for digital assets.[26] Such a license is required to conduct a digital asset business in New York. In June 2022, New York’s Department of Financial Services (NYDFS) released guidance on issuing U.S. dollar–backed stablecoins.[27] The guidance applies to U.S. dollar–backed stablecoin issuers licensed under a BitLicense or chartered as limited-purpose trust companies under New York banking law. The guidance creates “recommendations or principles” related to redeemability, reserves, and attestation (confirmation of accounting statements). Stablecoin issuers must hold at least a 1:1 ratio of reserves segregated from other assets, and the reserves must be highly liquid.[28]

Common Principles

Although there are many differences in jurisdictional approaches to stablecoin regulation, some common regulatory principles emerge:

- Stablecoin issuances require explicit regulatory approval by the appropriate regulator.

- Reserves must be liquid and stable, ensuring that they can cover all issued stablecoins on a 1:1 basis.

- Stablecoin payment services must align with existing financial regulations, offering protections akin to traditional currency-based payment systems.[29]

As interest in stablecoins grows, consideration of regulations in foreign jurisdictions is becoming increasingly crucial to prevent regulatory arbitrage and facilitate cross-border transactions. This will require careful analysis as well as collaboration between foreign jurisdictions and their regulators.

USDC and USDT, the two largest U.S. dollar–denominated stablecoins by market cap, have experienced temporary price deviation from their target price of US$1. On March 11, 2023, one day after Silicon Valley Bank failed, the market price of USDC dropped to $0.9715. Historical Snapshot—11 March 2023, CoinMarketCap (Mar. 11, 2023). In March 2020, during the initial COVID-19 pandemic wave, the market price of USDT dropped to $0.9742. Historical Snapshot—18 March 2020, CoinMarketCap (Mar. 18, 2020). ↑

Markets in Crypto-Assets Regulation (MiCA), Eur. Sec. & Mkts. Auth. (last visited Aug. 29, 2024). ↑

Joseph Jasperse, 50-State Review of Cryptocurrency and Blockchain Regulation, Stevens Ctr. for Innovation in Fin. (2024). ↑

Comm. on Payments & Mkt. Infrastructures, Bank for Int’l Settlements, Considerations for the Use of Stablecoin Arrangements in Cross-Border Payments (Oct. 2023). ↑

Global Live Cryptocurrency Charts & Market Data, CoinMarketCap (last visited Sep. 19, 2024). ↑

Top Stablecoin Tokens by Market Capitalization, CoinMarketCap (last visited Aug. 29, 2024). ↑

TerraUSD (UST) was an algorithmic stablecoin designed to maintain a stable price of US$1. It aimed to do so by dynamically adjusting supply in reference to its sister token, a cryptocurrency named LUNA. In May 2022, the price of UST and LUNA collapsed, wiping out $45 billion in value. The founder of UST, Do Kwon, has been found liable for securities fraud, see Sec. & Exch. Comm’n v. Terraform Labs PTE Ltd., and charged with multiple criminal fraud counts, see United States v. Do Hyeong Kwon. ↑

Global Live Cryptocurrency Charts & Market Data, supra note 5. ↑

Markets in Crypto-Assets Regulation (MiCA), supra note 2. This image may be obtained free of charge through the ESMA website. ESMA does not endorse this publication and in no way is liable for copyright or other intellectual property rights infringements nor for any damages caused to third parties through this publication. ↑

Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 on Markets in Crypto-Assets, and Amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EU and (EU) 2019/1937 (Document 32023R1114) [hereinafter MiCA]. ↑

Markets in Crypto-Assets Regulation (MiCA), supra note 2. ↑

“Tokens” are fungible digital assets that represent value or utility. ↑

Eur. Banking Auth., Draft Guidelines on Recovery Plans Under Articles 46 and 55 of the Regulation (EU) 2023/1114 (Nov. 8, 2023) (Consultation Paper EBA/CP/2023/30). ↑

Issam Hallak & Rasmus Salén, Eur. Parliamentary Rsch. Serv., Non-EU Countries’ Regulations on Crypto-Assets and Their Potential Implications for the EU (Sept. 2023). ↑

Eur. Banking Auth., Draft Regulatory Technical Standards to Specify the Minimum Contents of the Liquidity Management Policy and Procedures under Article 45(7)(b) of Regulation (EU) 2023/1114 (Nov. 8, 2023) (Consultation Paper EBA/CP/2023/26). ↑

Article 56(1) refers to the “significance” criteria for ARTs set out in Article 43(1):

The criteria for classifying asset-referenced tokens as significant asset-referenced tokens shall be the following, as further specified by the delegated acts adopted pursuant to paragraph 11:

- the number of holders of the asset-referenced token is larger than 10 million;

- the value of the asset-referenced token issued, its market capitalisation or the size of the reserve of assets of the issuer of the asset-referenced token is higher than EUR 5 000 000 000;

- the average number and average aggregate value of transactions in that asset-referenced token per day during the relevant period, is higher than 2,5 million transactions and EUR 500 000 000 respectively;

- the issuer of the asset-referenced token is a provider of core platform services designated as a gatekeeper in accordance with Regulation (EU) 2022/1925 of the European Parliament and of the Council;

- the significance of the activities of the issuer of the asset-referenced token on an international scale, including the use of the asset-referenced token for payments and remittances;

- the interconnectedness of the asset-referenced token or its issuers with the financial system;

- the fact that the same issuer issues at least one additional asset-referenced token or e-money token, and provides at least one crypto-asset service.

The 60 percent deposit requirement with credit institutions for significant EMTs is set out in Article 3(2) of the final draft of regulatory technical standards from the European Banking Authority. Eur. Banking Auth., Draft Regulatory Technical Standards to Further Specify the Liquidity Requirements of the Reserve of Assets Under Article 36(4) of Regulation (EU) 2023/1114 (June 13, 2024) (Final Report EBA/RTS/2024/10). ↑

Eur. Banking Auth., Draft Regulatory Technical Standards to Specify the Minimum Contents of the Liquidity Management Policy and Procedures, supra note 15. ↑

MiCA, supra note 10, art. 16(2). ↑

The European Banking Authority published the final draft of its regulatory technical standards in relation to this concept on June 19, 2024. Eur. Banking Auth., Draft Regulatory Technical Standards on the Methodology to Estimate the Number and Value of Transactions Associated to Uses of Asset-Referenced Tokens as a Means of Exchange Under Article 22(6) of Regulation (EU) No 2023/1114 (MiCAR) and of E-Money Tokens (Final Report EBA/RTS/2024/13). ↑

Id. at 5 (citing recital 5 of MiCA). ↑

Eur. Banking Auth., Markets in Crypto-Assets (last visited Aug. 31, 2024). ↑

Fin. Conduct Auth., Regulating Cryptoassets Phase 1: Stablecoins (Nov. 2023) (Discussion Paper DP23/4). ↑

Id. ↑

FinCEN issued guidance in 2019 and 2014 on how FinCEN’s regulations apply to certain business models involving convertible virtual currencies. See, e.g., FinCEN, Application of FinCEN’s Regulations to Certain Business Models Involving Convertible Virtual Currencies (May 9, 2019) (FIN-2019-G001). ↑

Sec. & Exch. Comm’n v. Binance Holdings Ltd., No. 1:23-cv-01599 (D.D.C. June 28, 2024), ECF No. 248. ↑

Industry Guidance, Adrienne A. Harris, Superintendent of Fin. Servs., N.Y. Dep’t of Fin. Servs., Guidance on the Issuance of U.S. Dollar–Backed Stablecoins (June 8, 2022). ↑

The reserves are subject to NYDFS approval and may only be comprised of “U.S. Treasury bills acquired by the Issuer three months or less from their respective maturities”; “Reverse repurchase agreements fully collateralized by U.S. Treasury bills, U.S. Treasury notes, and/or U.S. Treasury bonds on an overnight basis”; “Government money-market funds”; or “Deposit accounts at U.S. state or federally chartered depository institutions.” Id. Issuers must adopt clear redemption policies that allow for timely redemption (not more than two full business days) at par value. Moreover, stablecoin issuers must release public attestations monthly that a third-party accountant verifies. NYDFS issued these requirements as guidance, not rules. However, the guidance states that “[i]ssuers that currently issue U.S. dollar–backed stablecoins under DFS supervision are expected to come into compliance with this Guidance within three months of the date hereof.” Id. ↑

Cryptocurrency companies in the U.S. are already subject to all state-based money-service business laws and must register as a money services business (MSB) in any state in which they operate. ↑