Special Purpose Acquisition Companies (SPACs) have become a popular way to raise funds for public mergers and acquisitions in recent years. However, the directors and officers of a SPAC can face unique exposures. These liabilities can include direct risks to personal assets because the funds the SPAC raises through a public offering must be held in a trust. A SPAC’s trust funds cannot be used to cover its defense and settlement costs and its at-risk capital may not be sufficient to cover these kinds of costs.

The right insurance can offer valuable peace of mind, but there is often some confusion about how it all works. This article will review two recent SPAC lawsuits and examine how an insurance policy—a Representations and Warranties (RWI) Policy or a Directors and Officers (D&O) Policy—would respond in each situation.

RWI Insurance and the Immunovant Case

Although SPACs are an exciting way of fundraising and going public, a SPAC is still, at heart, an M&A deal, making RWI insurance useful.

Let’s look at a recent case involving the biopharmaceutical company Immunovant. In Pitman v. Immunovant, Inc.,[1] a company developing a new drug to help with a common and debilitating disease connected with a SPAC looking for such a company. The two merged and went public.

However, when Immunovant announced it had “become aware of a potential problem” and “out of an abundance of caution” was placing a voluntary hold on its ongoing clinical trials, its stock price plunged 42%.

Shareholder Plaintiffs’ attorneys multiplied the 42% stock drop by the number of shares in open circulation and felt that the resulting amount was a large enough “pot of gold” to be worth the trouble of bringing a lawsuit. They united enough shareholders for a securities class action lawsuit with multiple allegations, including:

- The SPAC failed to perform adequate due diligence.

- The SPAC failed to disclose safety issues associated with the drug.

- Because of either of these two factors, the prospects for approval, viability and profitability were diminished.

- As a result, the company’s public statements were materially false and misleading.

Let’s first focus on the allegations of inadequate due diligence. These kinds of allegations typically assert that the SPAC team was incentivized to close a deal by a specific deadline and did not take the time or the effort to perform sufficient due diligence. The first implication here is that if the SPAC had made a proper effort to diligence the business and operations of the target company, it would have uncovered the problems being called out by the plaintiffs and would have been able to disclose them. The second implication is that if the SPAC’s diligence had been thorough, but had not uncovered problems, those problems were so well and intentionally hidden by the target company that they amounted to fraud on the part of the target company.

Putting aside the fraud implication for a moment, how does a SPAC refute the first implication of inadequate due diligence? The SPAC is responsible for establishing that it did, in fact, perform adequate diligence. To do so, an RWI policy, similar to the one used in the Immunovant deal, could be of great use. The process the buyer of the RWI policy (in this case, the SPAC) undertakes to secure the policy includes an intensive review by the insurer of the diligence the buyer conducted. The insurer usually engages specialized counsel from big law firms to review the diligence and probe areas that the insurer and its counsel (who see dozens of similar kinds of deals in the same industry on a weekly basis) believe to be particularly risky. In a way, this process serves as a safety net for anything the SPAC’s diligence team could have missed while reviewing the target’s business and operations. The insurer is incentivized to be extremely thorough because it will be the one paying the bills if diligence is patchy.

So in the Immunovant case, if—hypothetically—there were representations given as to the accuracy of Immunovant’s records of previous clinical drug trials, the RWI policy defenses would include:

- The assertion that since the company has gone through the process of acquiring an RWI policy, which requires third parties to review the diligence and probe the adequacy of the work done. Thus the Plaintiffs have a much more difficult argument that that diligence was inadequate.

- The argument that RWI speaks very clearly to what was known and not known by the SPAC. In essence, RWI provides the Immunovant parties with a third-party paper trail showing how much Defendants knew, how hard they worked to get to the information, and how innocent they were.

Coming back to the second implication of fraud, a RWI policy covers seller’s fraud. So if the diligence efforts fail in the face of fraud by the target company, the RWI policy would step in to cover losses resulting from such fraud. This means that the SPAC could potentially recoup some lost money and return it to the SPAC investors (Plaintiffs), which would diminish their losses and consequently the amount claimed by Plaintiffs’ attorneys in their lawsuit against the SPAC.

The Importance of RWI to SPACs

Representations and warranties insurance can hedge the risk for both the buyer and the seller in SPACs. There’s a common misperception that RWI is not useful in a public company style deal because in a public company deal the seller typical provides very limited or no representations and warranties in the purchase agreement and no indemnification. This reasoning is flawed. When there is lack of indemnification from the seller, the buyer is saddled with all of the risk with no avenue for a recourse. That is exactly the situation where RWI coverage is even more critical. In these kinds of cases, synthetic representations and warranties can be put in place through the use of a RWI policy and at least some of the risk can be transferred to the insurer. The definition of loss in these situations essentially comes from the insurance policy and not from the indemnification section of the agreement, and the buyer is insured against that loss.

D&O Insurance and the Lucid Motors Case

D&O insurance is on everyone’s minds these days because of its rising cost. Naturally, many companies are asking about ways they can save on their D&O premiums by reducing coverage.

Clients often ask if they need D&O coverage at the time of the SPAC’s IPO and whether they can get away with buying the least possible amount. There’s a myth out in the SPAC market that SPACs are not really subject to risk between the time of their IPO and their de-SPAC. Unfortunately, the common belief that all litigation comes after the de-SPAC is just not true and can cause some serious problems for the SPAC and its team of directors and officers. In fact, it is crucial to have coverage between the IPO and the de-SPAC.

Now, let us examine a case study that illustrates the importance of D&O insurance: Churchill Capital Corporation IV Securities Litigation.[2] The Complaint alleges that Rumors spread that Churchill Capital Acquisition Corporation IV was going to acquire Lucid Motors, an electric vehicle company, which caused the price of the SPAC’s shares to jump from $10 to $22 per share. Then, the Lucid Motors CEO spoke to the media and mentioned a plan to deliver 6,000 vehicles in 2021. After several other statements to the media, the SPAC shares climbed to over $57 a share. The merger was finally announced on February 22, 2021, and on the same day the Lucid Motors CEO told the media that, in fact, the production of the vehicles would be delayed.

Documentation filed with merger announcement revealed that only 557 vehicles were planned versus the 6,000 that were previously mentioned and, not surprisingly, the price of the SPAC’s shares tanked. By the time the lawsuit was filed on April 18, 2021, the SPAC’s shares were trading at $18 per share.

What is interesting to note here is that this lawsuit is not your garden variety merger objection suit in which the plaintiffs allege insufficient disclosure and argue for the merger to be halted. These kinds of allegations and demands are typically addressed through additional SEC filings to close any gaps in the disclosure, and the plaintiff usually goes away for a few thousand dollars in mootness fees. These merger objections suits are not looked upon kindly by Delaware courts, which is why they are often filed in New York and have been commonly referred to as an M&A (and now a SPAC) “transaction tax.”

The Lucid Motors case, however, is a full-blown securities class-action lawsuit brought in federal court in Alabama against the SPAC, its CEO and CFO, and the target and its CEO. It alleges that these parties made or were involved in making false statements and omissions that drove the wild price fluctuations, which then resulted in losses for the SPAC’s shareholders. What’s even more interesting is that this lawsuit is being brought in advance of the merger for statements made prior to even the merger announcement.

When lawsuits of this type are brought, defendants’ thoughts automatically turn to insurance. The questions typically are:

- Is there an insurance policy in place to protect my SPAC and my directors and officers?

- Will the limits of that policy be sufficient to cover litigation defense and settlement costs?

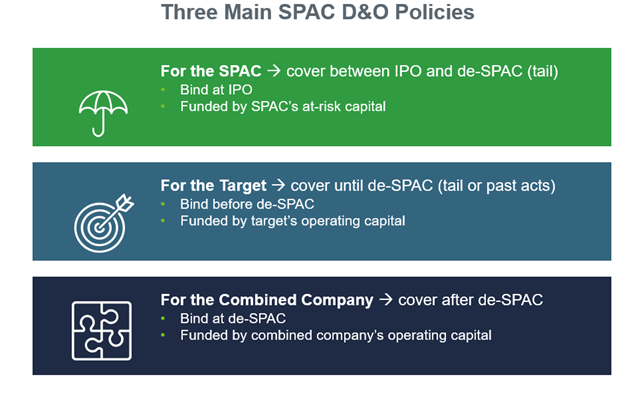

Here we should take a short detour and understand the kinds of policies that a SPAC team will encounter as it proceeds through the life cycle of the SPAC. There are three main types of D&O policies and it is essential to understand which D&O policies are in play before, during, and after the SPAC merger.

The first policy is the one that covers the SPAC and its directors and officers between the SPAC’s IPO and its business combination. This policy binds at the IPO and is funded by the SPAC’s at-risk capital. It typically has a tail component, which is essentially an extended reporting period for claims that come after the merger. Because a SPAC’s at-risk capital is usually very limited and the current SPAC D&O insurance pricing is quite high, these policies, if not planned and budgeted for properly, can cause a lot of aggravation to SPAC teams.

The second policy is the private company policy that covers the target company and its directors and officers until the company mergers with the SPAC. This policy can also have a tail component but is quite different from the public company D&O policy. It is a lot less complex and a lot less expensive than the public company D&O policy placed for a SPAC and for the combined company after the merger. This policy is typically in place ahead of the de-SPAC and is funded out of the target company’s operating capital.

The third policy covers the combined company and its directors and officers after the merger. It binds at the time of the merger and looks and feels very much like any traditional public company D&O policy. It is also considerably more expensive than the SPAC D&O policy and usually renews on an annual basis.

The Importance of Choosing the Right D&O Coverage

The first lesson we can learn from the Lucid Motors case is that serious, expensive lawsuits can and do occur before the de-SPAC and that the period between the SPAC IPO and its business combination is not risk-free. Consequently, the terms and limits of that first policy that covers the SPAC and its directors and officers between the IPO and the de-SPAC should be considered very carefully.

The second lesson is that lower limit of coverage may not be sufficient to cover defense and settlement costs and can put you at risk. Last year, SPAC teams usually considered $20 million in coverage limits for their SPACs because premium pricing was low and affordable. In recent months, however, increases in D&O premium pricing have forced SPAC teams to gravitate towards much lower limits. The majority now purchase between $5 million and $10 million in coverage, and some have even considered limits as low as $2.5 million. While D&O insurance costs are high and at-risk capital is restricted, going for the least expensive policy may not be the right decision for your SPAC and your team.

The importance of risk mitigation is another great lesson to take away from the Lucid Motors case. It is incredibly critical for all SPAC executives and the executives of the target company to pay very close attention to public messaging around deal time. They must be especially careful when making any statements on social or other media because getting sued for even inadvertent misrepresentations can be extremely painful, time consuming, and distracting in the midst of a deal and, without proper insurance coverage, can lead to serious financial losses.

Conclusion

The SPAC market is extremely dynamic and has grown dramatically in size and sophistication over the last few months. SPAC teams and teams aiming to merge with a SPAC must keep on top of the latest developments in the financial, regulatory, and legal aspects of this market.

Allegations and complaints in the lawsuits like the ones discussed above, while novel now, may become standard in the future. Having advisers who can steer you away from traps and anticipate risks and pitfalls, including guiding you through the most efficient and effective use of RWI and D&O policies is a must have for any SPAC team.

[1] Case No. 1:21-cv-00918, U.S. District Court for the Eastern District of New York.

[2] Case No. 21-cv-00539, U.S. District Court for the Northern District of Alabama, Eastern Division. See also, Arico v. Churchill Capital Corporation IV, Case No. 21-cv-12355, U.S. District Court for the District of New Jersey.