I. A Primer on Purpose Trusts[1]

When one thinks about the dynamics of a trust created by agreement (at its most basic level) and the normal progression of its creation and administration, there typically are several parties that are thought to be integral to the entire structure. Most notably, these are the grantor (or settlor), the trustee, and the beneficiaries. Once the trust is created and funded by the grantor, the trustee is charged with managing the assets of the trust in accordance with the express provisions of the trust agreement for the benefit of the beneficiaries. If the trustee mismanages the trust assets or takes some action that is not in the interests of the beneficiaries, those beneficiaries (or someone acting on their behalves) may bring an action against the trustee to enforce the terms of the trust and seek a remedy. Under this traditional trust framework, a trust without a beneficiary would not be enforceable. As a consequence, courts historically refused to permit such arrangements unless the trustee was willing to carry out the purpose of the trust, thus honoring a trust-like relationship that otherwise would have failed as a traditional trust (this trust-like relationship commonly is referred to as an “honorary trust”).[2]

Given that honorary trusts do not have an identifiable beneficiary, they exist merely to further the purpose for which they were created. Accordingly, honorary trusts are closely related to a traditional charitable purpose trust, which generally is a trust created for the support of religious, educational, scientific, artistic, and similar endeavors. Charitable purpose trusts can be formed for a general charitable purpose or to support a specific beneficiary, which beneficiary could at times be subject to change so long as the charitable purpose of such trust is left intact.[3] Traditionally, the honorary trust and the charitable purpose trust were the only two avenues by which a grantor could advance a cause other than the support of an identifiable beneficiary.

Although the honorary trust doctrine was occasionally applied in England[4] and eventually in the United States,[5] honorary trusts were far less common historically than charitable purpose trusts. Typically, an honorary trust was created for the care of burial plots, the care and maintenance of animals, and the saying of masses.[6] Slowly, as honorary trusts for the pursuit of certain noncharitable purposes became more routine, various jurisdictions around the country, including Delaware, began to pass statutes to specifically allow for their creation as noncharitable purpose trusts.[7] However, it was not until the release by the Uniform Law Commission of the Uniform Trust Code (UTC) in 2000 (and its subsequent adoption in one form or another by 35 states) that a wider array of noncharitable purpose trusts became permissible as a matter of statutory law.

II. The Delaware Purpose Trust Statute

The two fundamental guideposts in Delaware’s law governing the creation and administration of common law trusts (Delaware Trust Law)[8] is that maximum deference will be afforded to the intent of the settlor, and that the settlor has contractual freedom to reflect this intent in the governing documents of the trust. Section 3303(a) of Title 12 of the Delaware Code provides that “[i]t is the policy of this section to give maximum effect to the principle of freedom of disposition and to the enforceability of governing instruments.” Similarly, that section also provides that “a governing instrument may expand, restrict, eliminate, or otherwise vary any laws of general application to fiduciaries, trusts, and trust administration.”

Governed by these two concepts, Delaware has a long history of providing settlors with the tools necessary to create the trusts that suit their needs. To this end, Delaware has adopted a robust noncharitable purpose trust statute. Delaware’s statute, 12 Del. C. § 3556 (the Delaware Purpose Trust Statute), gives greater freedom for settlors to customize their noncharitable purpose trusts. Unlike the more restrictive provisions of the UTC adopted by many states, the Delaware Purpose Trust Statute does not contain a limitation on the duration of noncharitable purpose trusts, and provides that such trusts are valid so long as they contain a declared purpose that is “not impossible of attainment.” By contrast, the noncharitable purpose trust provisions under section 409 of the UTC provide that such trusts are valid only for a period of 21 years. Furthermore, the official comment to section 404 of the UTC, discussing permissible purposes for all types of trusts, provides that a noncharitable purpose trust must have a purpose that is not frivolous or capricious. The Restatement (Third) of Trusts, referenced in the official comment to section 404 of the UTC, implies that a trust may be considered capricious if it does not satisfy “a desire that many (even if not most) people have with respect to the disposition of their property[,]” or if an “unreasonably large” amount of the property is devoted to the trust’ purpose.[9] According to this language, for example, a perfectly reasonable purpose could be invalidated simply for being over funded, or a reasonably funded trust could be invalidated because a purpose important to the settlor could be deemed frivolous by others.

However, given that the focus of Delaware Trust Law is on the subjective intent of the individual settlor with regard to the disposal of his or her property—not the objective standards of “many (even if not most) people”—the Delaware legislature saw these restrictions in the UTC as unnecessarily limiting. The intent behind the Delaware Purpose Trust Statute was to put all purpose trusts, charitable and noncharitable, on equal footing. Settlors of charitable purpose trusts have long enjoyed deference to their stated purposes and unrestricted timeframes in which to apply the assets of their trusts, and the Delaware Purpose Trust Statute affords settlors of noncharitable purpose trusts with these same benefits. An individual has an infinite number of creative ways to dispose of or apply his or her individually owned property, whether for charitable purposes or otherwise, and a settlor’s right to do so is a basic premise of Delaware Trust Law.

In addition, fiduciary responsibilities may be altered under Delaware Trust Law (and in some cases eliminated)[10] if necessary to promote the declared purpose in the trust agreement. The opportunity to divide roles and responsibilities among trustees provides flexibility to allow the trustees to handle the trust assets and carry out the stated purpose of the trust as intended by the settlor. This facet of trust administration, along with many others, can be uniquely tailored to fit the requirements of each situation.

The flexibility of the Delaware Purpose Trust Statute, coupled with the foundation of freedom of contract underlying Delaware Trust Law, provides a powerful platform for settlors to create trusts that may successfully carry out their unique, noncharitable purposes.

III. Facebook Is Utilizing Delaware Law to Support Its Unique Goals

Facebook, Inc. (Facebook), from its inception on the campus of Harvard and throughout its growth into a social media leader, has consistently striven to uphold the values of free speech and freedom of expression. However, Facebook also understands that “there are times when speech can be at odds with authenticity, safety, privacy and dignity.”[11] Realizing the need to balance the rights of all of its users, including users of Instagram, and in an effort to address these competing concerns head on, Facebook is using the Delaware Purpose Trust Statute (in conjunction with the Delaware Limited Liability Company Act (the Delaware LLC Act[12]) to create and operate a social media content review “Oversight Board.” Generally, it is Facebook’s intent that members of the Oversight Board will review appeals regarding user content decisions by Facebook. The decisions of the Oversight Board with respect to such appeals will be binding on Facebook and its users. In addition to conducting this content review, the Oversight Board will also issue policy advisory opinions regarding Facebook’s policies governing content on Facebook and Instagram.[13]

Although Facebook could easily create and operate the Oversight Board within its existing corporate framework, this approach likely would not provide the level of independence necessary to balance the interests of each party involved in a content dispute, including Facebook itself. As a result, Facebook sought an alternative approach that would allow the company to create a truly independent body to “ensure fair decision-making based on standards and values.”[14] Enter the Delaware Purpose Trust Statute.

Specifically, utilizing the Delaware Purpose Trust Statute, Facebook has created and funded a trust, known as the Oversight Board Trust (the Trust), with the following stated purpose:

to facilitate the creation, funding, management, and oversight of a structure that will permit and protect the operation of an Oversight Board for Content Decisions (the “Oversight Board” or “Board”), whose purpose is to protect free expression by making principled, independent decisions about important pieces of content and by issuing policy advisory opinions on Facebook’s content policies.[15]

Facebook’s intent is to create a lasting benefit for those in the worldwide community who engage with one another through Facebook’s platforms. Although there is a broad range of individuals and entities that will be impacted by and benefit from the stated purpose of the Trust, it would be impossible to consider all Facebook users as beneficiaries of the Trust, and a traditional trust structure would therefore not be appropriate. Although Facebook’s overarching goal is to improve social interaction for the collective good of all its users, providing independent review of appealed content for an entity such as Facebook would not be labeled as a traditional “charitable” purpose (i.e., a religious, educational, scientific, artistic, or similar purpose). As a result, a noncharitable purpose trust under the Delaware Purpose Trust Statute is the perfect tool to realize Facebook’s vision.

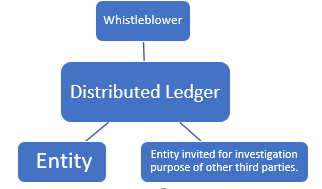

Before delving more deeply into the details of the creation and operation of the Oversight Board and the Trust, it is important to examine the basic overall structure employed by Facebook. The Trust is a Delaware purpose trust created and funded by Facebook pursuant to the Delaware Purpose Trust Statute, and the Trust will serve as the main source of funds needed to facilitate the operations of the Oversight Board. The Trust is irrevocable and is treated as a grantor trust for federal income tax purposes. Pursuant to the Delaware LLC Act, the trustees of the Trust (the Trustees) have formed and, collectively, on behalf of the Trust, will be the member of a single-member Delaware limited liability company (the LLC) that will be managed by a corporate manager (the Corporate Manager) and one or more individual managers (the Individual Managers, and together with the Corporate Manager, the Managers).

The LLC will enter into a service agreement to provide the above-discussed content review services to Facebook. These services ultimately will be performed by the Oversight Board pursuant to contracts between the LLC and the members of the Oversight Board. The Oversight Board will consist of a diverse set of members with a broad range of knowledge, competencies, diversity, and expertise.[16] In addition, the members of the Oversight Board must not have any actual or perceived conflicts of interest (such as being affiliated with Facebook or any of the Trustees) and should be familiar with “matters relating to digital content and governance, including free expression, civic discourse, safety, privacy and technology.”[17]

With respect to the funding and operation of the LLC, and ultimately the Oversight Board, the Individual Managers will serve as distribution direction advisers of the Trust pursuant to 12 Del C. § 3313 (and Facebook will additionally serve as an adviser pursuant to section 3313 by exercising consent rights in connection with certain actions of the Trustees, including regarding the investment of the Trust’s assets). The Individual Managers are also involved with the retention of the members of the Oversight Board and the facilitation of the Oversight Board’s content review process. As described in greater detail below, the Individual Managers will directly monitor and, when appropriate, replace the Oversight Board members, helping to ensure separation between Facebook and the Oversight Board and promote the independence of the Oversight Board’s decisions.

Currently, the Trustees are composed of a corporate Trustee (the Corporate Trustee) and one initial individual Trustee (the Individual Trustee). Facebook has the ability to appoint additional Individual Trustees, and once there are at least three serving, the number of Individual Trustees shall always be at least three and no more than 11. The Corporate Trustee may serve indefinitely, and each Individual Trustee will generally serve for a five-year term that will automatically be extended for an additional five years if such Trustee does not resign or is not removed. There is no limit to the number of terms an Individual Trustee may serve. The Individual Trustees have the ability to remove the Corporate Trustee by super-majority vote (greater than 66 percent), and the Corporate Trustee has the authority to remove any one or more of the Individual Trustees, provided that the other Individual Trustees consent to such removal by majority vote.

Although the Trustees generally have full authority to administer the Trust and carry out its stated purpose, as mentioned above, the Trust also takes advantage of section 3313 of the Delaware Trust Law, which permits the use of direction and consent advisors in connection with the administration of a Delaware trust.[18] For example, the Corporate Trustee has the responsibility under the Trust to invest the Trust’s assets in a manner that best facilitates the purpose of the Trust, but does so jointly with an investment committee (the Investment Committee) established under the Trust. The Investment Committee is composed of at least three Individual Trustees who are appointed by a majority vote of all of the Individual Trustees. In addition, distributions from the Trust shall be made only upon the direction of certain Managers of the LLC. Distributions that are necessary for the general administration of the LLC (such as to cover insurance premiums, attorney’s fees, accountant’s fees, investment counsel fees, tax payments, service provider fees, etc.) shall be made by the Corporate Trustee as directed by the Corporate Manager of the LLC. Distributions needed to cover expenses directly related to the operations of the Oversight Board, including compensation of Oversight Board members, reimbursement of Oversight Board member expenses, employment of staff to support the Oversight Board, and rent and other office-related expenses, shall be made by the Corporate Trustee as directed by the Individual Managers of the LLC.

In an effort to provide further clarity as to the roles and responsibilities that are allocated among the Trustees, the Trust incorporates the concept of an excluded trustee as permitted under 12 Del. C. § 3313A. Where the settlor of a trust wants to grant certain powers exclusively to only one of multiple co-trustees, the associated fiduciary responsibility rests solely on the trustee who has been exclusively granted the power in question. The nonauthorized excluded trustees are not liable for any loss or other claim stemming from the exercise of such power. Under the terms of the Trust, the Corporate Trustee shall also act as Individual Trustee for a limited period of four months from the effective date of the Trust. However, following the expiration of the four-month period, the Corporate Trustee will be an excluded trustee under 12 Del. C. § 3313A(a)(2) with respect to all matters requiring the action of the Individual Trustees, Investment Committee, Facebook as settlor, or other fiduciaries.

This division of investment and distribution powers among various advisors and fiduciaries is common in modern Delaware trusts for the benefit of individual beneficiaries. However, the unique approach described above utilizes the Managers of the LLC (who are tasked with the role of furthering the purpose of the Trust and are in the best position to determine the capital needs to fund such purpose on a daily basis) to direct contributions from the Trust in a manner similar to a capital call. In order to ensure the availability of assets for continued operations of the LLC, Facebook has included an initial conservative investment mandate regarding the Trust assets. The investments may be changed by the Corporate Trustee and Investment Committee provided that Facebook gives consent. Although a prudent investor rule normally applies to investment decisions by trustees, which may prompt a less conservative approach under other circumstances, this standard is waived under the Trust.[19] The ability to craft these unique provisions derives, in part, from the freedom of contract principle that is integral to both Delaware Trust Law and the Delaware LLC Act.[20]

As mentioned, the LLC (formally known as Oversight Board LLC) is managed by one Corporate Manager and one or more Individual Managers. Each Individual Trustee shall serve as an Individual Manager of the LLC. The Corporate Manager may be the Corporate Trustee but also may be another individual or corporate entity as selected by the Corporate Trustee. In addition, the Corporate Manager may appoint a “Director of LLC Administration” to assist in carrying out its duties. Other positions may be created and filled by the Managers to effectuate the purpose of the LLC as the Managers deem fit.

The Corporate Manager and the Director of LLC Administration shall undertake the following tasks:

- Management of Finances. The Corporate Manager shall manage all finances of the LLC.

- Payment of Service Providers. The Corporate Manager, or the Director of LLC Administration if one is appointed, may engage the services of accountants, payroll providers, investment counsel, travel service providers, insurance providers, and other professional advisors as necessary to facilitate the ongoing operations of the LLC. Each Manager is also authorized to hire agents, advisors, attorneys, or other counsel to assist the Manager in carrying out the business of the Company or the duties of the Manager, and such costs shall be paid by the LLC as directed by the Corporate Manager.

As discussed above, the main responsibility of the LLC is to support the Oversight Board in furtherance of the purpose of the Trust. The “Director of the Oversight Board” is appointed by the Individual Managers and may be removed, with or without cause, by majority vote of the Individual Managers. This is a required position and must be filled at all times. The Director of the Oversight Board shall have authority to take action on behalf of the Individual Managers as such authority is delegated from the Individual Managers. With respect to the operations of the Oversight Board, the Individual Managers and the Director of the Oversight Board shall undertake the following tasks:

- Enter into Oversight Board Member Contracts. After the selection of the individual Oversight Board members, the Director of Oversight Board may enter into a contract with each such individual to provide services as an Oversight Board member according to terms that are suggested by the Individual Managers and the Oversight Board. However, the ultimate contract provisions must be approved by the Director of Oversight Board (subject to the consent of Facebook solely with respect to provisions dealing with Facebook data). These Oversight Board member contracts shall be for a three-year term, with two potential renewals for a maximum term of nine years.

- Enter into Service Agreements with Facebook. The Individual Managers may authorize the LLC to enter into agreements with Facebook to provide content review and moderation services, which shall be negotiated and executed by the Director of Oversight Board based on recommendations from the Individual Managers and the Oversight Board.

- Annually Certify Oversight Board Member Activities. The Individual Managers shall annually certify to the Corporate Manager that each Oversight Board member has satisfactorily performed the obligations under his or her contract, or proceed with removal if warranted.

- Remove Oversight Board Members. The Individual Managers, with the consent of the Individual Trustees, may terminate any contract of an Oversight Board member, or decide not to retain such member, if it is determined that he or she has not satisfactorily performed his or her obligations.

- Direct Compensation and Other Payments for Oversight Board Members. As discussed previously, the Individual Managers may direct the Corporate Trustee to make contributions to the LLC for the purpose of compensating the Oversight Board members or reimbursing Oversight Board members for expenses under the terms of their contracts.

- Provide for Miscellaneous LLC and Oversight Board Member Expenses. The Individual Managers and the Director of Oversight Board have the authority to direct the Corporate Manager to pay on behalf of the LLC other miscellaneous LLC and Oversight Board member expenses not otherwise covered under a service contract.

- Employ Staff. The Director of Oversight Board may employ staff to provide general support to the Oversight Board. The Individual Managers shall direct the Corporate Manager to make payments on behalf of the LLC to cover the costs associated with such employees.

- Provide for an Office and Office Expenses. The Director of Oversight Board may secure reasonable office space and acquire office supplies and equipment to facilitate the ongoing operations of the LLC and the Oversight Board. The Individual Managers shall direct the Corporate Manager to make payments on behalf of the LLC to cover rent and other office-related expenses.

- Provide for Research or Related Services. The Director of Oversight Board may engage research and other related services to support the functions of the Oversight Board. The Individual Managers shall direct the Corporate Manager to make payments on behalf of the LLC to cover the costs of such services.

In an effort to create and fund an independent body to weigh the sometimes competing interests inherent in public discourse, Facebook has capitalized on Delaware’s policy of freedom of contract to craft the creative structure described above. The flexibility of Delaware Trust Law and the Delaware LLC Act has allowed Facebook to carry out its purpose to provide additional transparency and clarity to its users with respect to content decisions and policies.

[1] Vincent C. Thomas is a partner, and Justin P. Duda and Travis G. Maurer are associates, with the law firm of Young Conaway Stargatt & Taylor, LLP, in Wilmington, Delaware. The authors are grateful for the insights of Glenn G. Fox, Esq. and Rodney W. Read, Esq., both of the law firm of Baker & McKenzie LLP, as well as Elizabeth King, Aileen C. Denne-Bolton, and Edward Devine of Brown Brothers Harriman & Co.

[2] George G. Bogert et al., The Law of Trusts and Trustees § 166 (3d ed. Supp. 2019).

[3] A change of charitable beneficiary is accomplished through the doctrine of cy pres. For a further discussion of court modification of charitable beneficiaries under the doctrine of cy pres to achieve the settlor’s intent, see Restatement (Third) of Trusts § 67 cmt. e (Am. Law Inst. 2003).

[4] Bogert et al., supra note 2, § 166 (citing In re Dean, 1889, 41 Ch. D. 552 (care of animals); Mussett v. Bingle, W.N. (1876) 170 (building of monuments); Reichenbach v. Quinn, 21 L.R.Ir. 138 (for the saying of religious masses); In re Thompson, (1934) 1 Ch. 342 (to support fox hunting)).

[5] In re Searight’s Estate, 95 N.E.2d 779, 782 (Ohio Ct. App. 1950).

[6] Restatement (First) of Trusts § 124 (Am. Law Inst. 1935).

[7] For example, some states to adopt statutes allowing noncharitable purpose trusts include Wisconsin (Wis. Stat. § 701.11; honorary trusts, enacted in 1969 and repealed in 2014 with passage of UTC provisions), Montana (Mont. Code Ann. § 72-2-1017; honorary trusts and trusts for animals, enacted in 1993), Colorado (Colo. Rev. Stat. § 15-11-901; honorary trusts and trusts for animals, enacted in 1995), New York (N.Y. Est. Powers & Trusts Law § 7-8.1 (formerly § 7-6.1); trusts for pets, enacted in 1996) and Alaska (Ala. Stat. § 13.12.907; honorary trusts and trusts for pets, enacted in 1996).

[8] Generally, this refers to chapters 33 and 35 of title 12 of the Delaware Code and Delaware’s common law regarding the creation and administration of Delaware trusts.

[9] Restatement (Third) of Trusts § 47 cmt. e (Am. Law Inst. 2003).

[10] Although this is particularly helpful in the context of a purpose trust, Delaware Trust Law allows for altered fiduciary responsibilities in all trust instruments. It is possible to completely exclude a trustee from taking certain actions (and from the liability associated with those actions) under 12 Del. C. § 3313A.

[11] Facebook Oversight Board Charter 2 (Sept. 2019).

[12] 6 Del. C. §§ 18-101 to 18-1208.

[13] Facebook Oversight Board Charter, supra note 11, at 2.

[14] Id.

[15] Trust § 2.1.

[16] Facebook Oversight Board Charter, supra note 11, at 3.

[17] Id.

[18] 12 Del. C. § 3313.

[19] Altering the prudent investor rule is specifically authorized under 12 Del. C. § 3302(e).

[20] See 6 Del. C. § 18-1101. The Delaware LLC Act allows the Managers’ duties to be expanded, restricted, or altered as necessary under the LLC’s operating agreement, provided, however, that the covenant of good faith and fair dealing shall not be eliminated.