The governance bells are tolling for corporate, non-corporate, not-for-profit, governmental and other organizations. Investor and stakeholder demand, regulatory actions, and growing litigation risks are all increasing the focus on management and director responsibilities for effective governance. There is therefore the need to stress test governance structures and examine the viability of the existing checks and balances, to review the increased focus on board governance and oversight responsibilities, and to explore opportunities to create governance structures with a harder edge, while continuing to recognize governance’s often pivotal role in litigation. While exemplary corporate governance practices will never eliminate all occasions for suits, a sound governance structure will enhance the ability to successfully defend those suits to an early resolution through a motion to dismiss or for summary judgment.

The article introduces the importance of effective corporate governance, key points to consider in assessing governance, and resources—including many written by the expert co-authors—for gaining further understanding of these issues.

I. Stress Testing Governance Structures: An Introduction

Plan-Operate-Control Cycle

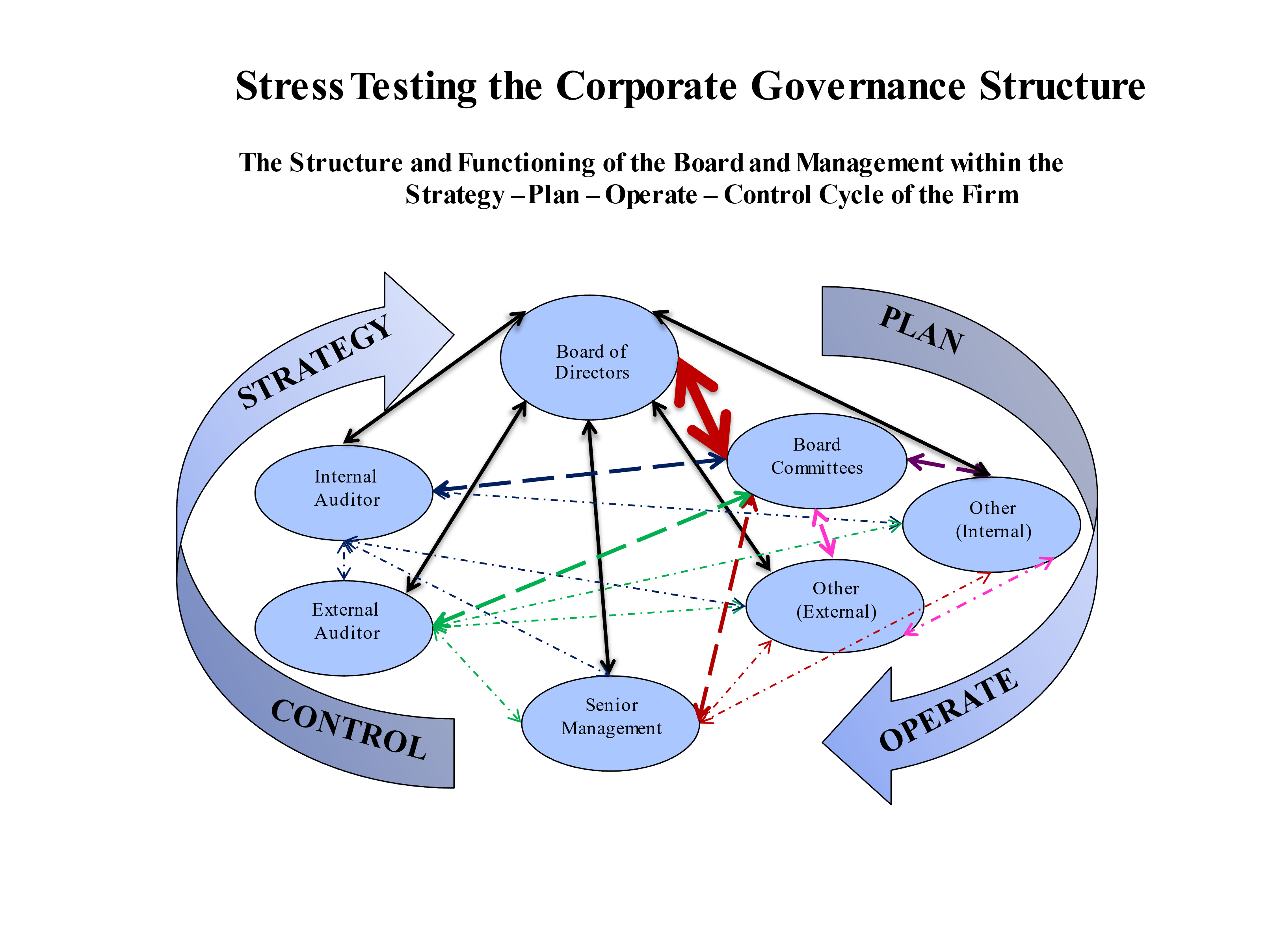

The diagram below sets out the basic governance structure of an organization. Stress testing determines the effectiveness of the governance structure in addressing the needs of the particular firm at that point in time. Stress testing examines how, and how well, an organization’s management and board are directing current operations and are prepared to react to specific risks and challenges, whether those challenges come from business competition, economic events and conditions, regulatory inquiries, changing shareowner expectations, litigation, or other causes.

This is not a middle market situation. The need for effective stress testing is exemplified by the recent breakdowns in the governance structures of Wells Fargo, Volkswagen, Credit Suisse, and Boeing, among others, with this focus on the governance structure going back to the well-known Walt Disney Shareholder Derivative Litigation involving the hiring and the subsequent termination of Michael Ovitz. In Disney, at that time referred to as “the corporate governance case of the century,” the Court made the board’s governance and oversight responsibilities clear, and examined the manner in which Disney management and its board addressed those responsibilities. The Disney litigation was eye-opening to many in the corporate sector because it was previously presumed that the business judgment rule defense would bring a quick end to the litigation. The Delaware Supreme Court did not quite see it that way and remanded the case to the lower court where the derivative suit would be tried on the merits. Ultimately, the Disney directors prevailed, but only after incurring significant legal defense expense. Our February 2019 Business Law Today article “Board Oversight and Governance: From Tone at the Top to Substantive Checks and Balances” examines the difficulties being experienced by the Wells Fargo board in addressing its responsibilities. We have authored four articles on our work in Disney, the first of which was “An Insider Revisits the ‘Disney Case’” (Directors Monthly, August 2008).

“Tone at the Top” vs. Checks and Balances

The long-revered concept of “tone at the top” as the guiding hand of an organization’s governance structure—where tone at the top took the form of a CEO/Chair essentially governing and managing the organization and the board being relegated to oversight—is still valued but now less emphasized. Today, there is broad-based recognition of the need for the appropriate “Checks and Balances” positioned in an environment characterized by transparency. The 2002 CPA Journal article “From Tone at the Top to Checks and Balances” authored by members of the Grace & Co. Board of Advisors, and the 2004 Wall Street Journal op-ed where Paul Volcker and Arthur Levitt Jr. point to the breakdown in checks and balances as the fundamental cause of major corporate collapses, both contributed to this evolving view of governance.

II. Board Governance: The Fed and Wells Fargo; Credit Suisse, Boeing and Volkswagen

One needs only to examine the 2018 Order to Cease and Desist between the Board of Governors of the Federal Reserve and the Board of Wells Fargo, and recent developments concerning Credit Suisse, Boeing and Volkswagen to gain a perspective on the current state of board, board committee and senior management “business” duties to govern, manage and oversee. Indeed, the troubles of Wells Fargo continue, with Senator Elizabeth Warren sending a letter on September 13, 2021, to Federal Reserve Chairman Jerome H. Powell urging a revocation of the bank’s operating license and forcing a break-up splitting the banking operations from Wells Fargo’s other financial and investment services.

Our 2019 article “Board Oversight and Governance: From Tone at the Top to Substantive Checks and Balances,” and the writings of former Delaware Supreme Court Chief Justice Norman Veasey and former Delaware Court of Chancery Chancellor William Chandler further contribute to that perspective that the board of directors will actually direct and monitor the management of the company, recognizing that Delaware law is clear that the business and affairs of a corporation are managed by or under the direction of its board of directors.

Chief Justice Veasey, in his May 2005 University of Pennsylvania Law Review article, stated “the board of directors will actually direct and monitor the management of the company, including strategic business and fundamental structural changes.” Chancellor Chandler, in his opinion in the Disney Shareholder Derivative Litigation, stated, “Delaware law is clear that the business and affairs of a corporation are managed by or under the direction of its Board of Directors.” The Federal Reserve website describes a board’s responsibility to create and enforce prudent policies and practices with the following statement: “Directors are placed in a position of trust by the bank’s shareholders, and both statutes and common law place responsibility for the affairs of a bank firmly and squarely on the board of directors. The board of directors of a bank should delegate the day-to-day routine of conducting the bank’s business to its officers and employees, but the board cannot delegate its responsibility for the consequences of unsound or imprudent policies and practices.”

A recent Delaware case involving Boeing is illustrative of a board’s oversight responsibilities. See In re The Boeing Company Derivative Litigation, 2021 WL 4059934 (Del. Ch. Sept. 7, 2021). This decision from the Delaware Chancery Court arose from the Boeing board’s conduct after two crashes of its 737 Max aircraft and serves as a cautionary tale for directors with regard to the importance of board and executive board committee level oversight and monitoring of “mission critical” product safety risks. Aircraft safety to a company such as Boeing would certainly be a mission critical area.

III. Governance with a Harder Edge

Governance with a harder edge merits consideration. By harder edge, we mean identifying opportunities to ensure board members are informed, involved and have skin in the game; and that the directors understand their responsibilities, are accountable to the organization—not the CEO, and bring an attitude of service and not entitlement to the position. The July 2020 BLT article “Why a Company Should Consider Using an Executive Committee of its Board of Directors” and January 2018 BLT article “Corporate Governance and Information Gaps: Importance of Internal Reporting for Board Oversight” examine the need to put in place governance structures with a harder edge, structures that ensure the voice of the General Counsel is heard. This improved governance positively impacts a firm’s operations; preparations for institutional investor visitations, activist inquiries, and plaintiff firm filings (often supported by litigation funding entities); and the availability and cost of liability insurance.

The current state of the D&O insurance marketplace is what is commonly called a “hard insurance market.” That means premiums for policies are at a relatively high level compared with earlier “soft market” years, and policy terms and conditions may be more restrictive. Also, and perhaps most important, insurance underwriters may look more critically at a risk’s corporate governance in order to select only the more desirable risks for acceptance. Because D&O insurance is frequently the sole or primary funding source in the settlement of securities class action or shareholder derivative litigation, the board and executive management must remain attuned to D&O insurer concerns.

The harder governance edge that exists in certain general partnerships merits examination, and contrasts with corporate governance. In these general partnerships, representatives of the general partners are informed—they understand the business of the partnership; they are involved in the operation of the partnership, and they have skin in the game. They understand their responsibilities, they are accountable back to the general partner they represent and not to the managing general partner, and they bring an attitude of service.

IV. Governance’s Often Pivotal Role in Litigation

Governance issues, which encompass plaintiffs and defendants, often occupy a pivotal role in litigation. The December 2016 BLT article “The Interplay between Corporate Governance issues and Litigation: What is Corporate Governance and How Does It Affect Litigation” and September 2011 BLT article “Governance Lessons from the Disney Litigation” demonstrate the importance of stress testing an entity’s governance structure as part of minimizing litigation. Actual cases, and the value of examining these cases under a business lens are explored in these articles and are commended to the reader in addition to the present article.