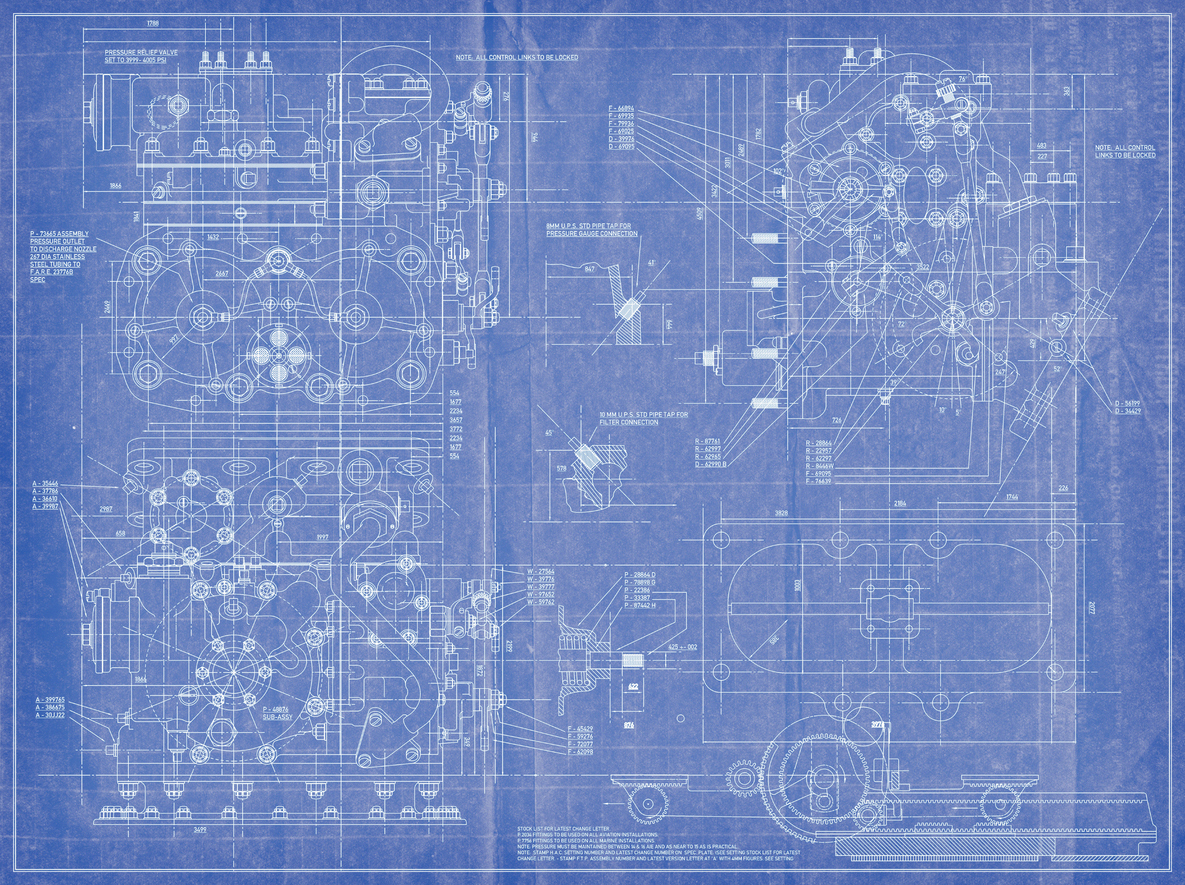

When the owners of a family business ask their attorney to advise them with business succession planning, counsel should begin with an outline that summarizes the entire process but that divides it into distinct projects that progress toward construction of a comprehensive succession plan. With the clients’ help, counsel can then refine the outline to more accurately reflect their circumstances, needs, expectations, and vision. This “blueprint” for the succession planning process will make the process more efficient, more effective, less stressful, and more rewarding for the clients.

The Case for Family Business Succession Planning

The most recent PWC U.S. Family Business Survey (2016) concludes that inattention to succession planning is a substantial problem for many family businesses in the United States. The authors of the PWC Survey found that owners of 69 percent of the family businesses surveyed expected ownership of the business to continue in the next generation, but only 23 percent had a robust, documented business succession plan.

The authors of the PWC survey call this finding “worrisome” and contend that serious problems such as the following can arise if a family business does not have a formal succession plan in place when owners cease to maintain control:

- next-generation family members may be reluctant, unprepared, or unable to lead;

- family members and other stakeholders may not support the choice for successor leadership; and

- the business may not have enough liquidity to support transition of ownership within the family.

The authors of the PWC survey correctly suggest that many succession problems can be avoided or mitigated if family businesses plan for succession, rather than wait until “the last minute, when options may be more limited.” “Regardless of when a business thinks a changing of the guard will take place,” they conclude, “it’s important to always have a plan ready for that eventuality, since unforeseen circumstances can cause a sudden need for new leadership.”

The PWC survey results and its authors’ conclusions will ring true for attorneys who have experience working with family businesses. The chronic failure of family businesses to engage in formal succession planning is at odds with their tendency to focus on long-term performance better than businesses that are not family owned. In the 2012 Harvard Business Review article, “What You Can Learn from Family Business”, authors Kachaner, Stalk, Jr., and Bloch assert that “[e]xecutives of family businesses often invest with a 10- or 20-year horizon, concentrating on what they can do now to benefit the next generation.” These same family businesses, however, often have no real plan for how the next generation will realize those benefits as successor owners and leaders.

To be fair, one reason why so many family businesses do not engage in proper succession planning is because it is difficult and complex. Family business succession planning must take account of countless unknown future circumstances and current facts that are continuously changing and interacting, including business factors like the economy, the regulatory environment, and the state of the market in which the business operates, as well as family factors like family dynamics and the changing skills, maturity, career objectives, economic needs, and health status of individual family members.

Under these circumstances of pervasive uncertainty and complexity, it is understandably difficult for family business owners to comprehend how they could construct a proper business succession plan. However, if their attorney can provide them with an organized, logical, step-by-step outline for succession planning, they may be much more likely to begin the process and eventually develop the kind of “robust, written” succession plan that the authors of the PWC survey and other family business advisors advocate.

The Blueprint for Family Business Succession Planning

Attorneys can use much of the text of this article to create their own outline for family business succession planning. The section on each project includes commentary that provides a description of the project and an explanation of legal concepts and other substantive factors that may affect how the clients make decisions about the project. Although the projects are arranged in sequential order, they should be considered concurrently. The substance of the projects are interrelated; therefore, the clients should make decisions about each project with a solid understanding of how they intend to address projects that appear later in the outline.

One important prefatory piece of business: For the purpose of this article, the term “clients” is used broadly to include collective decision makers for the business and family. However, for each family business succession planning engagement, it is important to establish an understanding, in writing, about which parties counsel represents (and which parties counsel does not represent). For example, the attorney might choose to represent the business (or more accurately, some or all of the companies owned by the family) and/or the senior generation of owners (or some of them). If the attorney represents more than one party, he or she should obtain conflict waivers and joint representation agreements as necessary. The attorney should also ensure that the parties the attorney does not represent understand that the attorney does not represent them and that they should consider obtaining the advice of independent counsel before signing documents that the attorney has drafted as part of the business succession plan.

1. Collecting Information

Before counsel begins to design a family business succession plan, counsel should review copies of current business governing documents, related party contracts, and estate planning documents that might affect governance, ownership, or succession of the business. The clients and their other advisors should help the attorney collect these documents. This process also offers clients an opportunity to get their personal and business records organized and establish procedures for keeping them organized and current. For a list of information to request, see the sidebar entitled “Due Diligence for Family Business Succession Planning.”

2. Valuation

Proper family business succession planning requires a reliable valuation of the stock of the family’s primary business entities and other important business assets when planning commences and throughout the term of family ownership. If the clients do not already have current opinions of value, counsel should help the clients obtain them. This can help the attorney and the clients avoid major mistakes in the planning process that the attorney might otherwise make if working on faulty assumptions of value.

Obtaining a current valuation can help the clients in other ways as well. The evaluation process can reveal information about the strengths and weaknesses of the clients’ business that the clients can use to improve operations and profitability. The valuation professional can also help counsel draft the most appropriate purchase price language in the clients’ buy-sell agreements. Finally, the clients can maintain their relationship with the valuation professional to obtain updated opinions on a regular basis (such as every two years) for the purposes of the clients’ buy-sell agreements and for transfers of ownership interests within the family to implement the succession plan.

3. Business Continuation Plan

If there are key family members who are particularly important to the operations or success of the family business, then early in the succession planning process, counsel should help the clients establish mechanisms to address the disruptions that would be caused by the sudden death or incapacity of one of those key family members. For example, the attorney should ensure that the controlling owner has updated powers of attorney appointing an appropriate person to vote clients’ interest if suddenly rendered incompetent; the attorney should ensure that the controlling owners’ stock designates an appropriate transfer-on-death beneficiary (such as their living trust) to avoid the delay of probate if they die during the succession planning process; and the attorney should ensure that the clients have a plan to replace the chief executive, at least on an interim basis, if he or she unexpectedly exits the business. These are temporary measures that will be replaced or supplemented by more permanent structures and procedures when the clients have made more progress on their succession plan.

4. Restructuring

After counsel reviews the existing business documents and obtains input regarding business valuation, counsel should work with the clients’ accountants to help the clients determine whether the business should be restructured or reorganized. It may be that making changes to the legal structure or tax treatment of the components of a clients’ business will facilitate succession planning. For example, it may be easier to plan transitions of ownership if the primary source of cash flow is taxed as a partnership rather than a C corporation, or if the real estate assets are held in entities that are separate from primary operations. The attorney should work with the clients’ accountants to ensure that any restructuring will be tax efficient (including income taxes and transfer taxes). Counsel must take into account other advantages of restructuring, such as limitations of liability, operational efficiencies, and diversifying ownership opportunities for family members. The attorney should include plans for how new ventures will be added to the structure in the future.

5. Governance and Buy-Sell Structures

Before updating the senior-generation owners’ estate plans with respect to the allocation of ownership among their beneficiaries, and before the senior-generation owners make additional lifetime transfers of ownership interests to members of the junior generation (or trusts for them), counsel should help the clients design the rules that will regulate governance, ownership, and owner exits after control has transitioned down from the senior generation. This includes four topics, which can be addressed in the business’s governing documents and agreements among the owners.

a. Unit Voting

The power to exercise owners’ voting rights primarily includes the power to appoint (or remove) board members and approve (or veto) major transactions. The clients should consider who should have the right to exercise owners’ voting rights. In some cases, voting units can be held in trust, to be voted by a fiduciary or a committee of fiduciaries, or the owners can sign agreements about how they will vote their units on particular issues. Governing documents can also be drafted to increase the scope of actions that require owner approval.

b. Governing Board

Members of a governing board, acting collectively, usually have the following powers: power to appoint and remove top executives and determine their compensation; power to issue dividends; and power to oversee budgets and long-range business planning, risk management, and strategic planning. The clients must decide how the board will be composed and how board members will be elected. Clients should consider the advantages of requiring an independent presence on the board, especially after members of the senior generation exit the business. Under most default rules, each board member is elected by plurality, but it may be desirable to “classify” the board so that each substantial owner can have one or two seats on the board. Governing documents can also be drafted to increase or decrease the amount of actions that the board can authorize without approval of the owners.

c. Executive Authority

Executives and officers have power and responsibility to run the day-to-day business, hire and terminate staff, develop budgets and plans for approval by the board, and sign checks and contracts, including loan agreements (within limits set by the board). While senior-generation owners are alive and competent, their status as patriarchs or matriarchs may naturally enable them to help their children and grandchildren make decisions about executive authority and compensation among family members, but after they are gone, the business’s owners and board must have a way to make decisions about the appointments, titles, duties, and compensation of family members that will be fair and will not disrupt family harmony.

d. Beneficial Ownership

Owners of business equity (which can be referred to as “beneficial owners” when considered apart from the power to vote the ownership interests (discussed above)) have the right to receive profits and appreciation from business operations. (Note: If the owners are also employees, they may receive most of their annual economic return in the form of compensation.) The clients should consider whether nonemployee family members should own shares and whether shares should be held in trust (primarily to protect them from estate taxes and claims of creditors or in the event of divorce). The clients should also decide upon mechanisms for owner exits that are fair to the exiting owners but are not disruptive to the business. The acquisition, ownership, and transfer of ownership interests, including redemptions triggered by retirement or other separation from employment at the business, should be drafted into updated governing documents.

It should be noted that although the business’s governing documents can provide the legal rules by which the business is governed and owned, the clients should also consider developing a family constitution, mission statements, and other policies that will guide decision makers when they apply the legal rules. The business’s legal documents cannot express the spirit and philosophy of the family as effectively as the principles that family members write in plain English and agree together to uphold.

6. Key Contracts

The attorney should help the clients negotiate restatements of key contracts with third parties that should (or must) be updated to be more consistent with business restructuring and anticipated changes of control or ownership. Such contracts include loan facilities and franchise/dealership agreements. The extent to which such contracts cannot be changed may affect decisions about how or when to implement other elements of the business succession plan.

The clients should also consider whether written contracts for related-party transactions would make the succession plan more effective. Such contracts may include the following: leases between the operating business and family-owned entities that hold real estate or equipment used by the operating business; debt instruments for loans from owners to the business; reimbursement/contribution agreements among the business and the owners who have personally guaranteed business debt; and employment agreements for family members who work for the business.

7. Update Senior-Generation Owners’ Estate Plans

The attorney should update the senior-generation owners’ estate planning documents, including wills and revocable trusts, consistent with business restructuring and decisions that the clients have made about future governance structures and ownership rights. Updates should address the following: specific allocation of stock/unit voting rights; specific allocation of beneficial interest in business equity; disposition of other important business and personal assets; specific use of life insurance proceeds; the source of funds needed to pay estate taxes; and the structure, funding, and amount of charitable bequests.

8. Plan for Senior-Generation Owners’ Retirement

Before the senior-generation owners transfer control and substantial equity interests to the junior generation, counsel should work with the senior generation and their financial advisors to help ensure that senior-generation members will have sufficient economic means to support them indefinitely in retirement (or in the event of disability). In particular, counsel must seek means of support, cash flow, and assets for retirement that are not dependent on the success of the next generation of owners of the family business. Although plans like unfunded deferred compensation, private annuities, or seller-financed redemptions may look good on paper, they may place disproportionate risk on members of the senior generation when they are no longer in a position to affect business outcomes.

9. Lifetime Transfers to the Next Generation

Ideally, the senior-generation owners will be able to oversee the transition of leadership and ownership of the family business to the next generation through lifetime transfers, rather than rely on post-mortem contingency planning. Counsel should work with the clients’ accountants to design lifetime transfers that are tax efficient, but the attorney should not sacrifice the financial well-being of the senior generation in a blind rush to redistribute wealth to avoid estate taxes. In most cases, a combination of diverse approaches to estate tax planning can give the clients time to implement a family business succession plan at a pace that makes business sense and is more likely to meet the long-term economic needs of the senior-generation owners and their successors.

Conclusion

Family business succession planning is complicated because it requires the clients to make many difficult decisions out of context. However, by providing the clients with an outline or blueprint of the entire process at the beginning of the representation, and by keeping that outline updated as decisions are made and projects are completed, counsel can make the process more effective, more efficient, and ultimately more successful.

Further, like a blueprint for building a house, the outline provides direction for original construction, but it does not foreclose the possibility of future modification, renovations, or improvements. As the authors of the PWC survey advise, “[O]nce a plan has been put into place, it shouldn’t be treated as a one-time event. Good succession planning involves a series of intentional, well-coordinated, strategic efforts, sustained over time . . . .”

Due Diligence for Family Business Succession Planning

At the start of a new representation with respect to family business succession planning, counsel should identify the clients’ key advisors, including accountants, financial advisors, and insurance agents. The attorney must ask the clients and their advisors for the following documents and information:

- Business Governing Documents. For the primary business entity and each, other family-owned entity, the following documents (including amendments):

- Articles of Incorporation/Organization

- Bylaws

- Shareholders’ Agreement/Operating Agreement

- Voting Agreements or Voting Trusts

- Table of current ownership

- Related-Party Contracts.

- Leases or other agreements between the business and any other family entity

- Any employment contracts with family members

- Any deferred compensation or other nonqualified retirement benefit contract between the business and a family member

- Any personal guarantees of the business debt

- Estate Planning Documents. For the senior-generation owners, the following documents:

- Wills

- Revocable Trust or Trusts

- Irrevocable Trust or Trusts (if any)

- Marital Property Agreement (if any)

- Powers of Attorney for Health Care

- Powers of Attorney for Financial Matters

- Business/Asset Valuation.

- Most recent formal or informal valuation of the business

- Most recent indication of value of business assets (and statement of balance of any mortgage debt)

- All substantial loan facilities for business debt and related security documents

- Senior-Generation Owner Financials.

- Statement of assets and liabilities

- Summaries of retirement plan assets and benefits, including Social Security, deferred compensation, and any pensions

- All contracts of insurance on the life of any senior-generation owner, including policy owner, beneficiary designations, pledges or assignments, and in-force illustrations

- Family Governance Documents.

- Family constitution, family mission statement, family employment policy, family counsel charter

- Family (charitable) foundation documents, donor advised fund contracts, or other collective charitable giving information

- Business Governing Documents. For the primary business entity and each, other family-owned entity, the following documents (including amendments):