Last updated on September 1, 2024.

This is a summary of the Hotshot course “Sandbagging: Market Trends,” which features ABA M&A Committee members Lisa Hedrick from Hirschler Fleischer PC and Nate Cartmell from Pillsbury LLP discussing market trends for sandbagging provisions, drawing on data from the ABA’s Private Target M&A Deal Points Study. Lisa and Nate talk about why so many deals are silent on sandbagging, the risk of being silent, and where they think the trend is heading. View the course here.

Sandbagging: Market Trends

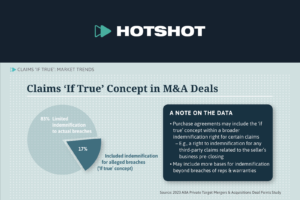

- The majority of deals covered by the ABA M&A Committee’s Private Target Deal Points Study are silent on the issue of sandbagging, thereby defaulting to state law.

- 76% of the deals in 2022 and the first quarter of 2023 were silent.

- Up from 68% in the 2020 and 2021 deals.

- 12% of the deals included pro-sandbagging provisions.

- Down from 29% in 2020 and 2021.

- Only 5% of them included anti-sandbagging provisions.

- Up from 2% in 2020 and 2021.

- 76% of the deals in 2022 and the first quarter of 2023 were silent.

- These numbers represent the general trend in this area since these figures were first tracked in the 2006 study.

- The number of deals that are silent on the issue has generally been increasing.

- The number of deals that include sandbagging provisions has correspondingly decreased.

- Several developments account for this trend.

- As a result of several Delaware Court of Chancery decisions since 2006, more lawyers consider Delaware a pro-sandbagging default jurisdiction.

- This means that when acting as buyer’s counsel, lawyers were increasingly willing to choose Delaware as the governing law for their agreements and be silent on the issue.

- However, the 2018 Delaware Supreme Court decision in Eagle Force Holdings v. Campbell has cast some doubt on the assumption.

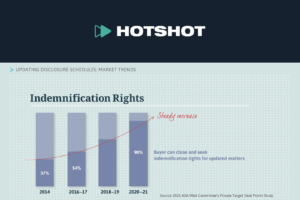

- The use of representation and warranty insurance in M&A deals has been increasing.

- These policies generally exclude from coverage any loss resulting from a breach of a representation or warranty known to the buyer at closing.

- So, if a buyer’s recourse post-closing is against the insurance policy and not the sellers, pro- or anti-sandbagging provisions become irrelevant.

- Particularly in a sellers’ market where a buyer may have limited or no recourse beyond a rep and warranty insurance policy, bargaining for a pro-sandbagging provision may provide little or no value.

- As lawyers have become more focused on these issues, they’re relying not on the representations themselves but on separate line-item indemnities (which are unaffected by knowledge) to protect buyers from losses associated with breaches of representations they suspect (or know) may not be true.

- As a result of several Delaware Court of Chancery decisions since 2006, more lawyers consider Delaware a pro-sandbagging default jurisdiction.

The rest of the course includes interviews with ABA M&A Committee members Nate Cartmell from Pillsbury LLP and Lisa Hedrick from Hirschler Fleischer LLP.