This is a summary of the Hotshot course “Sandbagging: Sample Provisions,” a look at typical sandbagging provisions, including pro-sandbagging and anti-sandbagging provisions, that also includes drafting tips and perspectives from ABA M&A Committee members. View the course here.

Sample Provisions

Sample Pro-Sandbagging Provision

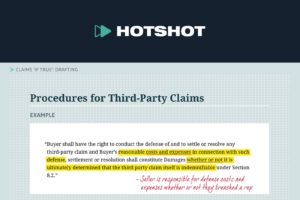

The right to indemnification, payment, reimbursement, or other remedy based upon any such representation, warranty, covenant, or obligation will not be affected by any investigation conducted or any Knowledge acquired at any time, whether before or after the execution and delivery of this Agreement or the Closing Date, with respect to the accuracy or inaccuracy of, or compliance with, such representation, warranty, covenant or obligation.

- This provision says that a party’s right to indemnification (and other costs and remedies) based on a “representation, warranty, covenant, or obligation” won’t be affected by “any investigation conducted or any Knowledge acquired at any time” regarding the accuracy or compliance with those provisions.

- It applies whether it’s before or after signing or closing.

- This language expressly disclaims investigation and knowledge as a basis for challenging a right to indemnification.

- Because of this, it allows the buyer who is aware (or should have been aware) of the inaccuracy of seller’s reps and warranties to close the deal and then recover damages even when the breaches were sufficiently material that the buyer could have refused to close.

Sample Anti-Sandbagging Provision

No party shall be liable under this Article for any Losses resulting from or relating to any inaccuracy in or breach of any representation or warranty in this Agreement if the party seeking indemnification for such Losses had Knowledge of such Breach before closing.

- This provision says that a party will not be liable under the indemnification section for losses that relate to “any inaccuracy in or breach of any representation or warranty” in the agreement if the other party had knowledge of the breach before closing.

- This language expressly disclaims a party’s ability to seek indemnification for damages resulting from a breach of which it had “Knowledge” (note this is a defined term) before closing.

- Because of this, it precludes the buyer from making a claim if it:

- Knew of the inaccuracy; and

- Depending on the definition of Knowledge, possibly even when the buyer didn’t have actual knowledge but only “should have known” of the breach. (This is often called “constructive knowledge.”)

- Because of this, it precludes the buyer from making a claim if it:

Definition of Knowledge

- This is an area where the agreement’s definition of knowledge can have a major impact.

- Sellers will want to define the term broadly, both in terms of:

- Whose knowledge is imputed to the buyer; and

- What qualifies as knowledge.

- They’ll want constructive as well as actual knowledge to count.

- Buyers will want the term to be as narrow as possible, wanting:

- A limited knowledge group; and

- Actual knowledge only.

Impact of Rep & Warranty Insurance

- Even when agreements are silent on sandbagging, there’s another provision that sellers sometimes try to include: a rep by the buyer that at the time of signing it had no actual knowledge of any inaccuracy in the seller’s representations and warranties.

- This rep won’t restrict a buyer with knowledge from bringing a claim post- closing in a pro-sandbagging jurisdiction.

- But it will allow the seller to assert a competing claim of breach of buyer’s rep.

- This rep is especially likely to be found in deals with rep & warranty insurance, where the buyer has to give the insurer a “no claims” certificate (which says that the buyer isn’t aware of any breaches other than those disclosed in the certificate).

- If the seller is responsible for claims that go beyond the policy limit or are excluded from the policy (referred to as “backstopping” the insurance), the seller may insist that the buyer make that same rep in the acquisition agreement.

- If the seller isn’t backstopping the insurance there’s no need for this protection.

This course also includes interviews with ABA M&A Committee members Nate Cartmell from Pillsbury LLP and Lisa Hedrick from Hirschler Fleischer LLP.