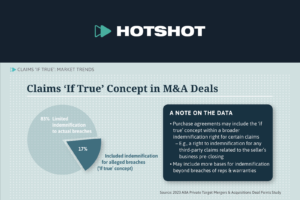

This is a summary of the Hotshot course “Claims ‘If True,’” an explanation of the claims “if true” concept in private M&A deals, including an analysis of the implications to the parties if an acquisition agreement does or does not contain this concept. View the course here.

Explaining Claims ‘If True’

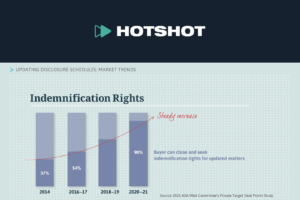

- An essential part of a private purchase agreement is that the buyer can seek indemnification from the seller for breaches of the seller’s reps and warranties and other negotiated indemnification rights.

- That’s why the parties spend so much time negotiating:

- The scope of the reps and warranties; and

- The amount and type of damages that can be sought if there’s a breach or other indemnity claim.

- That’s why the parties spend so much time negotiating:

- Buyers want the seller’s indemnification obligation to be as broad as possible.

- They want sellers to be responsible for anything that relates to the pre-closing period.

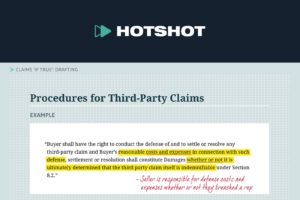

- They want to be made whole for all of their costs related to any third-party claims, including the costs of defending claims whether or not those claims later turn out to be true.

- That’s why buyers often want to include an indemnification right based on the ‘if true’ concept for third-party claims.

- The ‘if true’ concept is commonly referred to as “claims if true” or “facts if true.”

- It means that the seller has to indemnify the buyer for costs the seller would be responsible for if the facts alleged in the third-party claim were true.

- This issue typically relates to indemnification for breaches of reps and warranties.

- But it can relate to other indemnified areas as well.

Impact on the Parties

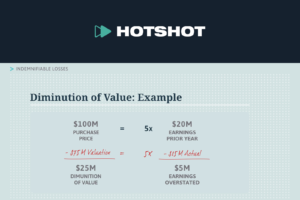

- To illustrate the impact this issue has on the parties, let’s look at what can happen if, after closing, there’s a third-party claim against the buyer for a matter that’s covered by a seller representation.

- If the third party prevails, the ‘if true’ issue is moot.

- This is because under most purchase agreements, the buyer’s costs and expenses in defending against third-party claims are indemnifiable under the purchase agreement because there has been a breach of a seller representation.

- If the buyer prevails (because it won the case) or neither party prevails (because the case was settled or the claim is never finally determined), the ‘if true’ issue comes into play.

- In these cases, the buyer can’t show a breach of the related seller representation, so the ‘if true’ concept becomes important.

- If the purchase agreement does not contain the ‘if true’ concept, the buyer is responsible for the costs and expenses of defending against the claim and cannot recover those amounts from the seller.

- Unless the buyer is able to prove in the indemnification claim against the seller that the underlying facts of the claim are true.

- It’s hard for a buyer to do this, as they have already defended the claim from the third party by taking the position that the facts underlying the claim were not true.

- If the agreement does include claims ‘if true’ language, the buyer can recover its costs and expenses of defending the claim.

- The buyer is covered whether or not the third-party claim demonstrates a breach of the related seller representation.

The rest of the video includes interviews with ABA M&A Committee members Joanna Lin from McDermott Will & Emery and Jessica Pearlman from K&L Gates.