Last updated on December 31, 2024.

This is a summary of the Hotshot course “Fraud Carve-Outs: Market Trends,” in which ABA M&A Committee members Glenn West from Weil, Gotshal & Manges LLP and Tali Sealman from White & Case LLP discuss market trends for fraud carve-outs, drawing on data from the ABA M&A Committee’s Private Target Deal Points Study. View the course here.

Fraud Carve-Outs: Market Trends

- Market trends indicate that there’s increasing awareness of the importance of defining fraud in acquisition agreements.

- According to the 2023 ABA M&A Committee’s Private Target Deal Points Study, fraud was carved out of the Exclusive Remedy provision in 87% of deals in 2022 and the first quarter of 2023. Of these deals:

- 26% leave fraud undefined;

- 70% refer to “actual” or “intentional” fraud; and

- 30% of those refer to different types of fraud, like common law fraud or intentional misrepresentation.

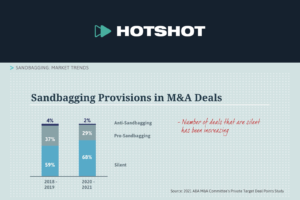

- The number of deals that leave fraud undefined has decreased over the years:

- 74% in 2014;

- 63% in 2016 to 2017;

- 39% in 2018 to 2019;

- 32% in 2020 to 2021; and

- 26% in 2022 to 2023.

- Because the Study only looked at material transactions between public companies and private parties, a substantial number of transactions were excluded.

- Anecdotal information is that the vast majority of private equity deals include defined fraud carve-outs that limit fraud to deliberate falsehoods, knowingly made in the written representations and warranties of the acquisition agreement.

- This supports the trend shown in the Study away from the use of undefined fraud carve-outs.

- Anecdotal information is that the vast majority of private equity deals include defined fraud carve-outs that limit fraud to deliberate falsehoods, knowingly made in the written representations and warranties of the acquisition agreement.

The rest of the video includes interviews with ABA M&A Committee members Glenn West from Weil, Gotshal & Manges LLP and Tali Sealman from White & Case LLP.