This is a summary of the Hotshot course “Updating Disclosure Schedules,” an introduction to disclosure schedules updates provisions, including why parties include a right or obligation to update disclosure schedules, the scope of permitted updates, and the updates’ effect on other rights and obligations of the parties under the acquisition agreement. View the course here.

Why Update Disclosure Schedules?

- The disclosure schedules to an M&A agreement, together with the reps and warranties they modify, provide a snapshot of the seller and the target as of the signing date.

- If the deal doesn’t close at signing, it’s possible that the disclosure schedules and the reps and warranties could be inaccurate or incomplete when the parties are ready to close.

- This could be due to:

- New facts discovered between signing and closing that the parties weren’t aware of before signing; or

- New developments, such as the target getting sued by a customer after the agreement is signed.

- Parties sometimes deal with this possibility by allowing, or even requiring, updates to the disclosure schedules.

- This could be due to:

- When parties agree to allow or require updates, they add a disclosure schedules updates provision in the interim covenants section of the agreement.

- Updating disclosure schedules is good for sellers, because the more accurate their disclosure is at closing, the lower the risk of a post-closing indemnification claim.

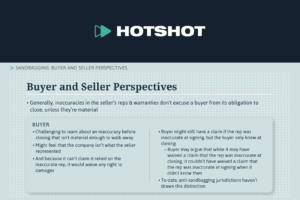

- And, in principle, buyers also like disclosure schedules to be as accurate as possible before closing so that they can negotiate changes to the deal or even walk away if new and adverse facts are disclosed.

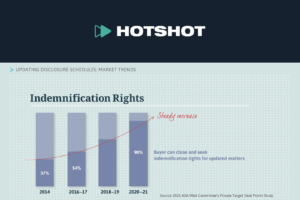

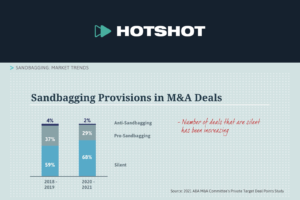

- But parties don’t often include the right to update the disclosure schedules because they can’t agree on:

- How the updated disclosure affects the rest of the agreement; or

- The scope of the permitted or required updates.

- When updates are not allowed, the parties are often taking the position that they’d rather not speculate on outcomes that aren’t certain when the agreement is signed. Instead they agree to deal with any issues as they arise.

Scope of Updates and Impact on the Acquisition Agreement

- Several areas of the acquisition agreement can be affected when parties allow updates to the disclosure schedules.

- The first is the closing conditions.

- An update to the disclosure schedules is essentially an amendment to the seller’s reps and warranties.

- Most M&A agreements include a condition that the seller’s reps and warranties have to be true and correct or true and correct in all material respects as of the closing. So if something happens after the deal is signed that would make the seller’s reps and warranties incorrect at closing, the buyer doesn’t have to close.

- But if disclosure schedule updates are allowed and the seller makes updates to reflect the new development, the buyer could be required to close even if the new disclosure materially amends the reps the seller made at signing.

- This dynamic leads parties to think carefully about another aspect of the agreement, the buyer’s termination rights. For example:

- Should the buyer have the right to terminate the acquisition agreement based on the new disclosure, especially when the buyer can no longer rely on the closing conditions to get out of the deal?

- What if the new disclosure is minor and doesn’t materially change the deal?

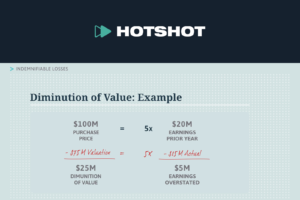

- A third issue the parties think about is the seller’s liability for a breach of the reps and warranties as they existed at signing. For example:

- Does an update to the disclosure schedules cure that breach and relieve the seller from its indemnification obligations for any resulting damages?

- The first is the closing conditions.

Scope of Updates

- If the parties are able to agree on those issues, they’ll include a provision that typically lays out:

- Whether the seller is required to update the schedules or if updates are simply permitted;

- The scope of updates that can be made; and

- How an update affects the rest of the agreement, like the closing conditions, termination rights, and indemnification provisions.

- Defining the parameters for updates can be tricky. The parties consider:

- The type of rep or warranty;

- When the new information arose; and

- The materiality of the new disclosure.

Type of Rep or Warranty

- Buyers might be more willing to allow updates to affirmative, rather than negative, disclosures.

- For example, both parties will want any new material contracts to be disclosed as part of the seller’s rep regarding material contracts.

- The buyer would expect this kind of update, since the seller agrees to continue operating the business in the ordinary course between signing and closing.

- But the buyer may be less willing to allow an update to a negative rep or warranty, like the “no liabilities” or “no litigation” reps.

- In those cases, the underlying facts are more likely to have a negative impact on the value of the business.

- And these types of updates usually relate to matters outside the ordinary course, so allowing them could expose the buyer to an unpredictable amount of additional risk.

- For example, both parties will want any new material contracts to be disclosed as part of the seller’s rep regarding material contracts.

When the New Info Arose

- The parties also may limit new disclosure based on when the underlying facts arose.

- A seller has a pretty compelling case for updating the disclosure schedules to include things that happen after signing.

- But should they also be able to add facts that were known or that should have been known before signing?

- What if those facts weren’t disclosed at signing because of an honest mistake or because the seller was genuinely unaware?

- On the other hand, if the seller is allowed to update the disclosure schedules with information that arose prior to signing, what’s preventing them from withholding material information at signing that would otherwise affect the deal?

Materiality

- The materiality of new information may also affect whether or not the seller can include it in a disclosure schedules update.

- Buyers are typically willing to allow updates relating to facts that arise in the ordinary course of business and that don’t affect the economics of the deal.

- But they often want to prohibit updates for new circumstances that are financially or operationally material to the business.

- Depending on how the buyer’s closing conditions and termination rights are drafted, the buyer could be forced to close despite the new material disclosure.

Rep and Warranty Insurance

- One other thing to consider is that if a deal has rep and warranty insurance, the policy is typically issued when the acquisition agreement is signed.

- The coverage will not extend to newly disclosed facts unless the insurer expressly agrees to an extension of the policy.

- So, if updates to the disclosure schedules are permitted or required, there may be a gap in the insurance coverage.

The rest of the video includes interviews with ABA M&A Committee members John F. Clifford from McMillan LLP and Ann Beth Stebbins from Skadden, Arps, Slate, Meagher & Flom LLP & Affiliates.