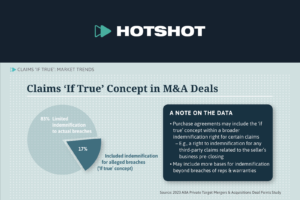

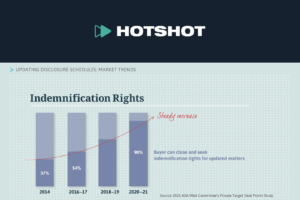

This is a summary of the Hotshot course “Claims ‘If True’: Buyer and Seller Perspectives,” a look at buyer and seller perspectives regarding claims “if true” language in acquisition agreements. View the course here.

Buyer and Seller Perspectives

- The parties’ positions on the concept of ‘if true’ claims in M&A agreements are straightforward:

- The buyer wants it in.

- The seller wants it out.

- One side usually wins the issue outright.

Buyer’s View

- If there’s a third-party claim that’s based on how the seller operated the business before closing, the buyer wants to be made whole regardless of whether the buyer ultimately prevails against the claimant.

- The buyer doesn’t want to take any of the risk for third-party claims that:

- Arise during the indemnification period; and

- Are based on facts that existed or occurred before the buyer acquired the business, whether or not the claim is proven.

- The buyer is worried that if the claim isn’t proven, it’ll cost them a lot of money to defend that claim.

- Without the ‘if true’ language in the agreement, the buyer won’t be able to recover that money from the seller.

- The buyer isn’t worried about claims that are proved to be true, since those would be protected under the indemnification provisions.

- Note this is different from:

- The risk the buyer knows it will assume after the indemnification period ends; and

- Claims based on facts that existed or occurred after the buyer acquired the business.

Seller’s View

- The seller’s typical response to proposed language making the seller responsible for the costs and expenses of defending unproven allegations is that the underlying third-party claim might be frivolous.

- The seller doesn’t think it should be responsible for the buyer’s costs and expenses of defending against a claim that arises after closing where the seller has not done anything wrong.

- This is particularly true if the seller believes the announcement of the deal or the identity of the buyer is more likely to attract frivolous claims.

- This might happen when the buyer is much better known than the seller and has greater ability to pay out on claims.

- In general, the seller’s view is that any unproven claim that arises after closing is a risk of owning and operating the business that the buyer should bear.

Buyer’s Response

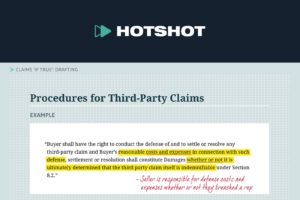

- The response the buyer might make to the seller is that refusing to allow the buyer recovery for the costs of unproven claims incentivizes the buyer to lose the case with the third party, costing the seller even more money.

- If the third party wins the claim, a breach of a rep would likely be proven.

- This puts the buyer in the position of being able to recover (under typical indemnification provisions):

- The damages the third party receives from the buyer; and

- The buyer’s costs and expenses related to the proceeding.

- This response assumes the buyer has the right to control the defense of third-party claims.

- This may not be the case under the given acquisition agreement.

Compromises

- One party usually wins outright, but there are some areas for potential compromise.

- The parties might consider handling the issue differently based upon the type of claim involved.

- Example:

- The seller might refuse to indemnify the buyer for unproven IP infringement claims but be willing to indemnify the buyer for its costs and expenses in defending against other unproven third-party claims.

- For example, for claims of employee discrimination or employee misclassification.

- The seller might refuse to indemnify the buyer for unproven IP infringement claims but be willing to indemnify the buyer for its costs and expenses in defending against other unproven third-party claims.

- Seller’s comfort with providing indemnity for various types of unproven claims will depend on the relative risk of the claims.

- This, in turn, will depend on:

- The nature and history of the business; and

- The industry in question.

- This, in turn, will depend on:

- Example:

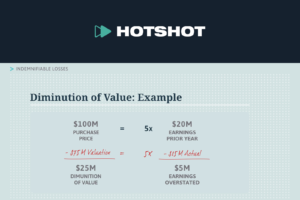

- Another area for compromise could be in the amount of cost and expenses that are recoverable.

- The parties could agree to share the burden in some manner, giving both parties “skin in the game.”

- This could be accomplished by:

- Splitting the burden equally, for example with language indicating that “only 50% of losses are recoverable”;

- Splitting it in some other proportion; or

- Having the seller bear only an initial capped amount of the costs and expenses, to ensure that the buyer isn’t motivated to run up the fees but instead settle as inexpensively as possible.

The rest of the video includes interviews with ABA M&A Committee members Joanna Lin from McDermott Will & Emery and Jessica Pearlman from K&L Gates.