This is a summary of the Hotshot course “Materiality Scrapes,” an introduction to damages scrapes, breach scrapes, and double materiality scrapes. View the course here.

What Are Materiality Scrapes?

- When parties draft and negotiate reps and warranties in acquisition agreements, an important area of focus is the concept of materiality.

- Sellers try to qualify many of their reps and warranties with materiality to:

- Avoid being liable for immaterial claims or damages; and

- Reduce their disclosure burden.

- Buyers accept many of these materiality qualifiers, but often want them to be disregarded when it comes to indemnification.

- The way buyers try to do this is by using materiality scrapes.

- A materiality scrape is a provision in the indemnification section of an acquisition agreement that removes qualifiers like “material” or “material adverse effect” from the reps and warranties for purposes of indemnification.

- There are two concepts that can be included in a materiality scrape provision:

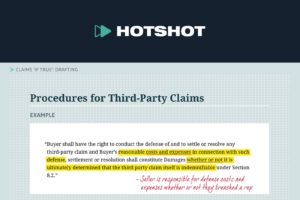

- A “breach scrape,” which removes materiality when determining if a rep has been breached; and

- A “damages scrape,” which removes materiality when calculating damages.

- A materiality scrape provision that includes both a breach scrape and a damages scrape is often referred to as a “double materiality scrape.”

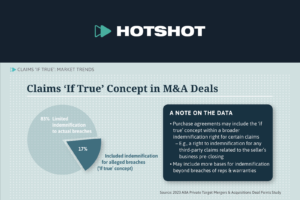

- It’s common for a materiality scrape provision to cover damages only (and not breaches), but you typically won’t see it the other way around (a breach scrape on its own).

- This is because buyers generally ask for both in first drafts of acquisition agreements and the sellers usually push back the strongest on the breach scrape.

- So when the parties agree on a compromise position that results in only one of the two types of scrapes being removed, it’s almost always the breach scrape that’s removed.

Relation to Other Provisions and Impact on a Deal

- Materiality scrape provisions effect several areas of an acquisition. These include:

- The seller’s reps and warranties and the indemnification provisions.

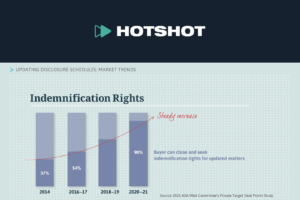

- In addition to removing materiality qualifiers from the reps, scrape provisions also relate to the baskets in the indemnification section.

- This is because sellers will often agree to materiality scrapes in exchange for increasing the size of the indemnification basket.

- The disclosure schedules.

- If an agreement has a breach scrape, the seller’s disclosure burden is greater because they will have to list out every exception to the reps and warranties, without regard to materiality.

- In other words, they’ll need to include disclosures that would have otherwise been immaterial because in the aggregate those issues may exceed the basket and result in indemnification liability.

- Rep and warranty insurance.

- Rep and Warranty insurance is an alternative to indemnification.

- It protects buyers against breaches of reps and warranties by the seller.

- When a deal has this insurance policy in place, the debate over scrapes is essentially moot.

- This is because the seller has no liability for breaches of most reps.

- Rep and Warranty insurance is an alternative to indemnification.

- The seller’s reps and warranties and the indemnification provisions.

- There can also be scrapes of knowledge qualifiers as well as scrapes of materiality qualifiers in covenants.

- These are less common though.

Example

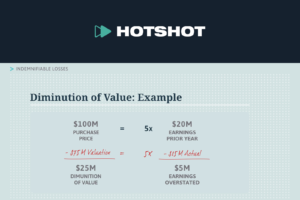

- Here’s an example of how the different types of scrape provisions can impact a deal and the financial risk for the parties.

- Say the seller’s litigation rep in an acquisition agreement for a $500 million company says that there’s “no material litigation outstanding”.

- When the agreement is signed, the seller has a pending $20,000 claim from an employee to collect a bonus the employee claims was promised.

- The seller disputes that the bonus was promised, and considers this an immaterial claim, so it’s not included in the disclosure schedule.

- After the deal, the claim is resolved for $10,000 and the buyer incurs $15,000 in legal fees, for total damages of $25,000.

- Assume that there’s no rep and warranty insurance in the deal.

- If the acquisition agreement does not contain any materiality scrape language:

- Then the seller’s litigation rep would be accurate – $20,000 isn’t material for a company worth half a billion dollars.

- The buyer wouldn’t be able to make an indemnity claim for any of its damages.

- Then the seller’s litigation rep would be accurate – $20,000 isn’t material for a company worth half a billion dollars.

- If the acquisition agreement contains both a damages scrape and a breach scrape:

- Then the materiality qualifier doesn’t apply and the rep would be interpreted to say there is no litigation outstanding at all.

- The rep therefore is not correct because the seller has this small employee litigation outstanding and didn’t disclose it.

- If the deductible is otherwise satisfied, the buyer would be entitled to recover for its $25,000 in damages.

- If the acquisition agreement includes a damages scrape only:

- Then the materiality qualifier applies when determining if there has been a breach.

- The rep would still be true.

- The buyer would not be able to make an indemnity claim for any of its damages.

The rest of the video includes interviews with ABA M&A Committee members Rita-Anne O’Neill from Sullivan & Cromwell LLP and Craig Menden from Willkie Farr & Gallagher LLP.